| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4811514000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the "Flexible plastic adhesive tape base material" product, based on the provided HS codes and tax details:

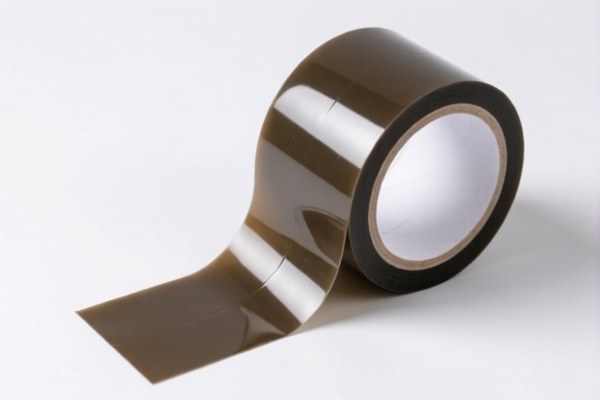

✅ HS CODE: 3920511000

Product Description: Acrylic flexible adhesive tape base material, made from acrylic polymers, classified under 3920.

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

- Notes: This is a high-tariff category, especially after April 11, 2025. Ensure the material is clearly identified as acrylic-based.

✅ HS CODE: 3921904010

Product Description: Flexible plastic tape material, classified under 3921904010, which includes flexible plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes: Lower base tariff, but still subject to the 30% additional tariff after April 11, 2025.

✅ HS CODE: 3920690000

Product Description: Polyester adhesive tape base material, classified under 3920.69.00.00, which includes plastic films made of polyester.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

- Notes: Similar to 3920511000, this category is also subject to the 30% additional tariff after April 11, 2025.

✅ HS CODE: 4811514000

Product Description: Plastic-coated paper adhesive tape base material, classified under 4811514000, which includes paper products coated with plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: No base tariff, but still subject to the 30% additional tariff after April 11, 2025. Confirm the product is indeed a paper-based material with a plastic coating.

✅ HS CODE: 3920620090

Product Description: PET plastic adhesive tape base material, classified under 3920.62.00.90, which includes PET (polyethylene terephthalate) plastic.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

- Notes: PET is a common material for adhesive tape base, and this category is subject to the 30% additional tariff after April 11, 2025.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm the exact material (e.g., acrylic, polyester, PET, or paper with plastic coating) to ensure correct HS code classification.

- Check Unit Price and Certification: Some materials may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all the above codes. If your shipment is scheduled after this date, the additional 30% tariff will apply.

- Consider Alternative Materials: If cost is a concern, explore alternative materials or coatings that may fall under lower-tariff HS codes.

Let me know if you need help with HS code selection or customs documentation. Here is the structured classification and tariff information for the "Flexible plastic adhesive tape base material" product, based on the provided HS codes and tax details:

✅ HS CODE: 3920511000

Product Description: Acrylic flexible adhesive tape base material, made from acrylic polymers, classified under 3920.

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

- Notes: This is a high-tariff category, especially after April 11, 2025. Ensure the material is clearly identified as acrylic-based.

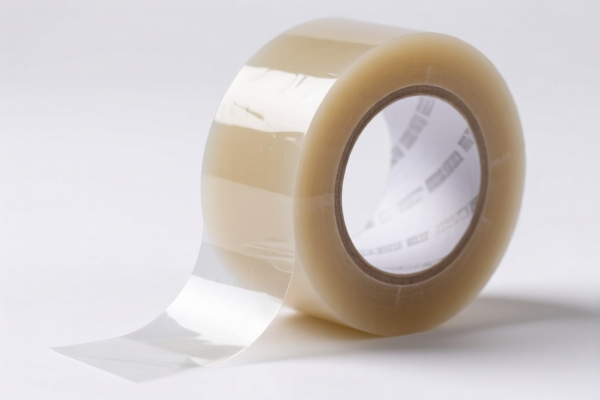

✅ HS CODE: 3921904010

Product Description: Flexible plastic tape material, classified under 3921904010, which includes flexible plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes: Lower base tariff, but still subject to the 30% additional tariff after April 11, 2025.

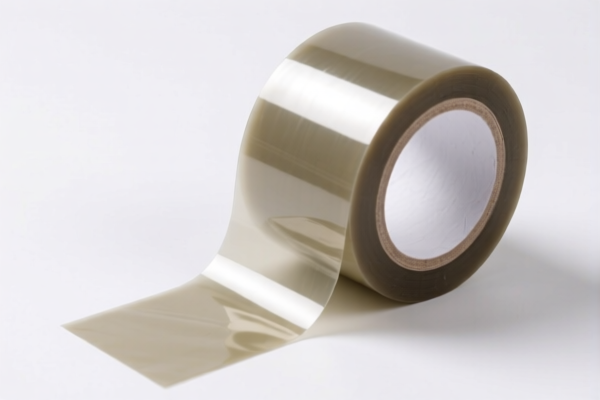

✅ HS CODE: 3920690000

Product Description: Polyester adhesive tape base material, classified under 3920.69.00.00, which includes plastic films made of polyester.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

- Notes: Similar to 3920511000, this category is also subject to the 30% additional tariff after April 11, 2025.

✅ HS CODE: 4811514000

Product Description: Plastic-coated paper adhesive tape base material, classified under 4811514000, which includes paper products coated with plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: No base tariff, but still subject to the 30% additional tariff after April 11, 2025. Confirm the product is indeed a paper-based material with a plastic coating.

✅ HS CODE: 3920620090

Product Description: PET plastic adhesive tape base material, classified under 3920.62.00.90, which includes PET (polyethylene terephthalate) plastic.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

- Notes: PET is a common material for adhesive tape base, and this category is subject to the 30% additional tariff after April 11, 2025.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm the exact material (e.g., acrylic, polyester, PET, or paper with plastic coating) to ensure correct HS code classification.

- Check Unit Price and Certification: Some materials may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all the above codes. If your shipment is scheduled after this date, the additional 30% tariff will apply.

- Consider Alternative Materials: If cost is a concern, explore alternative materials or coatings that may fall under lower-tariff HS codes.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.