| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

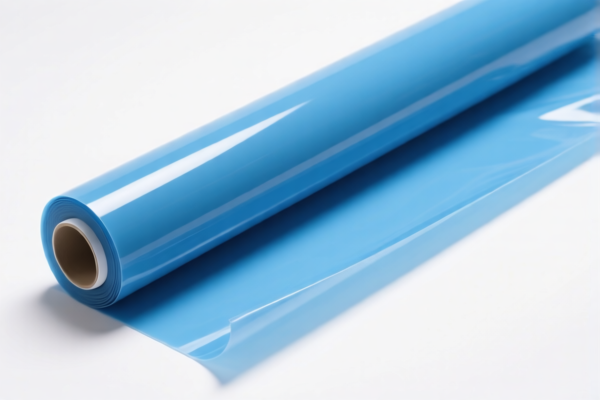

Product Classification and Tax Information for "Flexible Plastic Advertising Film"

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3920992000

Product Description: Plastic advertising film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3920631000

Product Description:

- Polyester flexible plastic film

- Label printed flexible film

- Advert printed flexible sheet

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921904010

Product Description: Flexible plastic sheet

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation. -

Material and Certification Requirements:

- Confirm the material composition (e.g., polyester, PVC, etc.) to ensure correct HS code classification.

- Check if certifications (e.g., RoHS, REACH, or environmental compliance) are required for import into the destination country.

-

Ensure accurate unit pricing is used for customs valuation purposes.

-

Tariff Variability:

The 3921904010 code has a lower total tax rate (34.2%) compared to the others, so if your product can be classified under this code, it may be more cost-effective.

🛑 Proactive Advice:

- Double-check the product description to ensure it aligns with the HS code used.

- Consult a customs expert if the product involves multiple materials or finishes (e.g., printed vs. non-printed).

- Monitor policy updates after April 11, 2025, as the special tariff may affect your import costs significantly.

Let me know if you need help with HS code verification or customs documentation! Product Classification and Tax Information for "Flexible Plastic Advertising Film"

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3920992000

Product Description: Plastic advertising film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3920631000

Product Description:

- Polyester flexible plastic film

- Label printed flexible film

- Advert printed flexible sheet

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921904010

Product Description: Flexible plastic sheet

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation. -

Material and Certification Requirements:

- Confirm the material composition (e.g., polyester, PVC, etc.) to ensure correct HS code classification.

- Check if certifications (e.g., RoHS, REACH, or environmental compliance) are required for import into the destination country.

-

Ensure accurate unit pricing is used for customs valuation purposes.

-

Tariff Variability:

The 3921904010 code has a lower total tax rate (34.2%) compared to the others, so if your product can be classified under this code, it may be more cost-effective.

🛑 Proactive Advice:

- Double-check the product description to ensure it aligns with the HS code used.

- Consult a customs expert if the product involves multiple materials or finishes (e.g., printed vs. non-printed).

- Monitor policy updates after April 11, 2025, as the special tariff may affect your import costs significantly.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.