| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

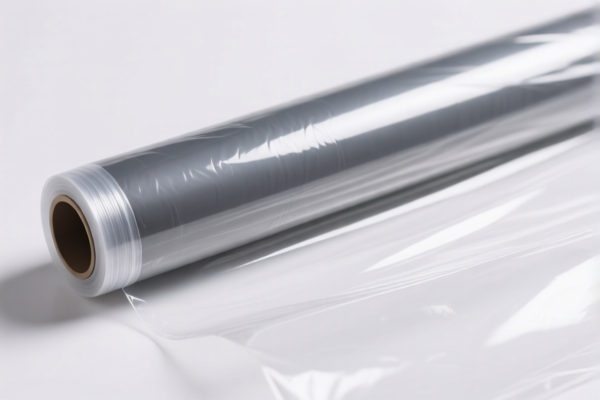

Product Classification: Flexible Plastic Anti-Cold Film

Based on the provided HS codes and descriptions, the flexible plastic anti-cold film can be classified under several HS codes depending on its specific composition and use. Below is a structured summary of the classification and associated tariff information:

1. HS Code: 3921.90.40.90

- Description: Flexible plastic sheets, films, etc., not reinforced with paper.

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies if the film is not reinforced with paper.

- Ensure the product is not reinforced with paper to qualify for this classification.

2. HS Code: 3921.90.40.10

- Description: Flexible plastic sheets, films, etc., reinforced with paper.

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies if the film is reinforced with paper.

- Confirm the material composition to determine if this classification is applicable.

3. HS Code: 3920.63.10.00

- Description: Flexible polyester plastic film (e.g., used for agricultural purposes).

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code is for polyester-based flexible films, including agricultural films.

- If the film is polyester-based and used for agricultural purposes, this classification is likely correct.

- Higher tax rate due to additional tariffs and special tariffs after April 11, 2025.

Key Considerations for Classification

- Material Composition: Confirm whether the film is polyester-based or non-polyester.

- Reinforcement: Determine if the film is reinforced with paper or not.

- Intended Use: If the film is used for agricultural purposes, it may fall under 3920.63.10.00.

- Certifications: Check if any certifications (e.g., for agricultural use, safety, or environmental compliance) are required for import.

Proactive Advice

- Verify Material and Unit Price: Confirm the exact material (e.g., polyester, polyethylene) and unit price to ensure correct classification.

- Check for Additional Tariffs: Be aware of the 30% special tariff imposed after April 11, 2025, which significantly increases the total tax rate.

- Consult Customs Authority: If in doubt, consult local customs or a customs broker for confirmation on the most accurate HS code and applicable duties.

Let me know if you need help determining the exact material composition or intended use of the product for further classification.

Product Classification: Flexible Plastic Anti-Cold Film

Based on the provided HS codes and descriptions, the flexible plastic anti-cold film can be classified under several HS codes depending on its specific composition and use. Below is a structured summary of the classification and associated tariff information:

1. HS Code: 3921.90.40.90

- Description: Flexible plastic sheets, films, etc., not reinforced with paper.

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies if the film is not reinforced with paper.

- Ensure the product is not reinforced with paper to qualify for this classification.

2. HS Code: 3921.90.40.10

- Description: Flexible plastic sheets, films, etc., reinforced with paper.

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies if the film is reinforced with paper.

- Confirm the material composition to determine if this classification is applicable.

3. HS Code: 3920.63.10.00

- Description: Flexible polyester plastic film (e.g., used for agricultural purposes).

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code is for polyester-based flexible films, including agricultural films.

- If the film is polyester-based and used for agricultural purposes, this classification is likely correct.

- Higher tax rate due to additional tariffs and special tariffs after April 11, 2025.

Key Considerations for Classification

- Material Composition: Confirm whether the film is polyester-based or non-polyester.

- Reinforcement: Determine if the film is reinforced with paper or not.

- Intended Use: If the film is used for agricultural purposes, it may fall under 3920.63.10.00.

- Certifications: Check if any certifications (e.g., for agricultural use, safety, or environmental compliance) are required for import.

Proactive Advice

- Verify Material and Unit Price: Confirm the exact material (e.g., polyester, polyethylene) and unit price to ensure correct classification.

- Check for Additional Tariffs: Be aware of the 30% special tariff imposed after April 11, 2025, which significantly increases the total tax rate.

- Consult Customs Authority: If in doubt, consult local customs or a customs broker for confirmation on the most accurate HS code and applicable duties.

Let me know if you need help determining the exact material composition or intended use of the product for further classification.

Customer Reviews

No reviews yet.