Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tax information for Flexible plastic antistatic film, based on the provided HS codes and tariff details:

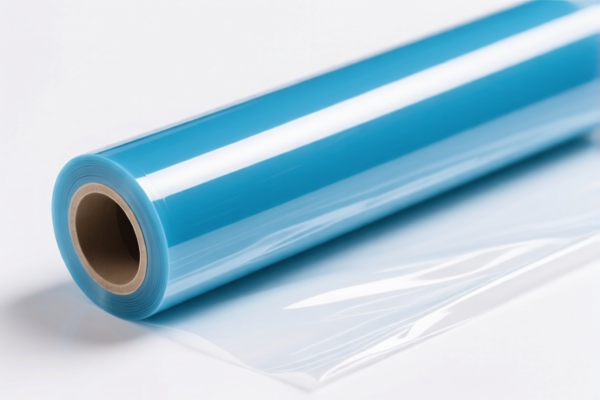

✅ Product Classification Overview: Flexible Plastic Antistatic Film

- Material Type: Plastic (polyester or other polymers)

- Function: Antistatic (prevents static electricity)

- Form: Flexible film

📦 HS Code Classification and Tax Details

1. HS CODE: 3920631000

- Description: Flexible polyester film (antistatic property does not affect classification)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code applies to flexible polyester film, including antistatic variants. The antistatic property does not change the classification.

2. HS CODE: 3921905050

- Description: Other plastic sheets, plates, films, foils, and strips (antistatic film falls under this category)

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code is for other plastic films, including antistatic films, provided they are not classified under more specific codes like 3920631000.

3. HS CODE: 3920992000

- Description: Other plastic sheets, plates, films, foils, and strips (non-cellular and non-reinforced)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code applies to other plastic films, including antistatic films, if they are not classified under more specific codes.

4. HS CODE: 3921904090

- Description: Flexible plastic sheets, plates, films, foils, and strips (not specially reinforced)

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code is for flexible plastic films, including antistatic films, if they are not reinforced or specially treated.

5. HS CODE: 3920631000 (Duplicate)

- Description: Conductive flexible polyester film (classified under the same code as non-conductive variants)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes: Conductive variants are still classified under this code.

⚠️ Important Notes and Alerts

- April 11, 2025 Tariff Increase: All listed codes will have an additional 30.0% tariff applied after April 11, 2025.

- No Anti-Dumping Duties: No specific anti-dumping duties are mentioned for this product category.

- No Special Tariffs on Iron/Aluminum: This product is plastic-based, so anti-dumping duties on metals do not apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm whether the film is made of polyester or another polymer, as this affects the correct HS code.

- Check Unit Price and Certification: Some countries may require certifications (e.g., RoHS, REACH) for plastic films, especially if used in electronics or sensitive environments.

- Review Tariff Changes: Be aware of the April 11, 2025 tariff increase and plan accordingly for cost management.

- Consult Local Customs: For the most accurate classification, always confirm with local customs or a qualified customs broker.

Let me know if you need help with a specific import scenario or documentation. Here is the structured classification and tax information for Flexible plastic antistatic film, based on the provided HS codes and tariff details:

✅ Product Classification Overview: Flexible Plastic Antistatic Film

- Material Type: Plastic (polyester or other polymers)

- Function: Antistatic (prevents static electricity)

- Form: Flexible film

📦 HS Code Classification and Tax Details

1. HS CODE: 3920631000

- Description: Flexible polyester film (antistatic property does not affect classification)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code applies to flexible polyester film, including antistatic variants. The antistatic property does not change the classification.

2. HS CODE: 3921905050

- Description: Other plastic sheets, plates, films, foils, and strips (antistatic film falls under this category)

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code is for other plastic films, including antistatic films, provided they are not classified under more specific codes like 3920631000.

3. HS CODE: 3920992000

- Description: Other plastic sheets, plates, films, foils, and strips (non-cellular and non-reinforced)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code applies to other plastic films, including antistatic films, if they are not classified under more specific codes.

4. HS CODE: 3921904090

- Description: Flexible plastic sheets, plates, films, foils, and strips (not specially reinforced)

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Notes: This code is for flexible plastic films, including antistatic films, if they are not reinforced or specially treated.

5. HS CODE: 3920631000 (Duplicate)

- Description: Conductive flexible polyester film (classified under the same code as non-conductive variants)

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes: Conductive variants are still classified under this code.

⚠️ Important Notes and Alerts

- April 11, 2025 Tariff Increase: All listed codes will have an additional 30.0% tariff applied after April 11, 2025.

- No Anti-Dumping Duties: No specific anti-dumping duties are mentioned for this product category.

- No Special Tariffs on Iron/Aluminum: This product is plastic-based, so anti-dumping duties on metals do not apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm whether the film is made of polyester or another polymer, as this affects the correct HS code.

- Check Unit Price and Certification: Some countries may require certifications (e.g., RoHS, REACH) for plastic films, especially if used in electronics or sensitive environments.

- Review Tariff Changes: Be aware of the April 11, 2025 tariff increase and plan accordingly for cost management.

- Consult Local Customs: For the most accurate classification, always confirm with local customs or a qualified customs broker.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.