Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

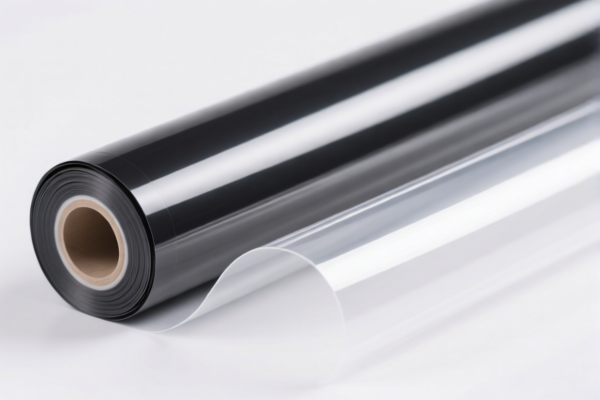

Product Classification: Flexible Plastic Composite Film

Based on the provided HS codes and descriptions, the product "Flexible Plastic Composite Film" can be classified under several HS codes depending on specific material composition and structure. Below is a structured breakdown of the applicable HS codes and their associated tax rates:

1. HS CODE: 3921904010

- Description: Flexible plastic composite film, flexible plastic composite foil, flexible plastic composite tape, reinforced flexible plastic film, etc.

- Total Tax Rate: 34.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is suitable for products explicitly described as "flexible" and "plastic composite."

2. HS CODE: 3921904090

- Description: Plastic composite film, fitting the description of "other plastic sheets, plates, films, foils, and strips."

- Total Tax Rate: 34.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is more general and applies to a wide range of plastic composite films not specifically described under 3921904010.

3. HS CODE: 3921905050

- Description: Plastic composite film, fitting the description of "plastic sheets, plates, films, etc."

- Total Tax Rate: 34.8%

- Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- Slightly higher base tariff compared to 3921904010 and 3921904090.

4. HS CODE: 3920992000

- Description: Composite plastic film, polyester flexible film, etc., fitting the description of "laminated, supported, or otherwise combined with other materials."

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code applies to layered or composite films with other materials.

- Higher total tax rate due to the additional 25% tariff.

5. HS CODE: 3920631000

- Description: Polyester plastic flexible film, flexible polyester plastic sheet, etc.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is specific to polyester-based flexible films.

- Same total tax rate as 3920992000 due to the 25% additional tariff.

Key Considerations for Customs Compliance:

- Material Composition: Confirm the exact composition of the film (e.g., polyester, polyethylene, etc.) to determine the correct HS code.

- Product Structure: Whether the film is layered, reinforced, or combined with other materials will influence the classification.

- Tariff Changes After April 11, 2025: A 30% additional tariff will apply to all the above codes after this date. This is a time-sensitive policy and must be accounted for in cost estimation and compliance planning.

- Certifications: Verify if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Unit Price and Material Verification: Ensure that the declared product matches the HS code description to avoid misclassification penalties.

Proactive Advice:

- Double-check the product's technical specifications (e.g., material, thickness, structure) to ensure accurate HS code selection.

- Consult with customs brokers or classification experts if the product involves multiple layers or composite materials.

- Plan for increased costs due to the 30% additional tariff after April 11, 2025.

Product Classification: Flexible Plastic Composite Film

Based on the provided HS codes and descriptions, the product "Flexible Plastic Composite Film" can be classified under several HS codes depending on specific material composition and structure. Below is a structured breakdown of the applicable HS codes and their associated tax rates:

1. HS CODE: 3921904010

- Description: Flexible plastic composite film, flexible plastic composite foil, flexible plastic composite tape, reinforced flexible plastic film, etc.

- Total Tax Rate: 34.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is suitable for products explicitly described as "flexible" and "plastic composite."

2. HS CODE: 3921904090

- Description: Plastic composite film, fitting the description of "other plastic sheets, plates, films, foils, and strips."

- Total Tax Rate: 34.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is more general and applies to a wide range of plastic composite films not specifically described under 3921904010.

3. HS CODE: 3921905050

- Description: Plastic composite film, fitting the description of "plastic sheets, plates, films, etc."

- Total Tax Rate: 34.8%

- Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- Slightly higher base tariff compared to 3921904010 and 3921904090.

4. HS CODE: 3920992000

- Description: Composite plastic film, polyester flexible film, etc., fitting the description of "laminated, supported, or otherwise combined with other materials."

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code applies to layered or composite films with other materials.

- Higher total tax rate due to the additional 25% tariff.

5. HS CODE: 3920631000

- Description: Polyester plastic flexible film, flexible polyester plastic sheet, etc.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is specific to polyester-based flexible films.

- Same total tax rate as 3920992000 due to the 25% additional tariff.

Key Considerations for Customs Compliance:

- Material Composition: Confirm the exact composition of the film (e.g., polyester, polyethylene, etc.) to determine the correct HS code.

- Product Structure: Whether the film is layered, reinforced, or combined with other materials will influence the classification.

- Tariff Changes After April 11, 2025: A 30% additional tariff will apply to all the above codes after this date. This is a time-sensitive policy and must be accounted for in cost estimation and compliance planning.

- Certifications: Verify if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Unit Price and Material Verification: Ensure that the declared product matches the HS code description to avoid misclassification penalties.

Proactive Advice:

- Double-check the product's technical specifications (e.g., material, thickness, structure) to ensure accurate HS code selection.

- Consult with customs brokers or classification experts if the product involves multiple layers or composite materials.

- Plan for increased costs due to the 30% additional tariff after April 11, 2025.

Customer Reviews

No reviews yet.