| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

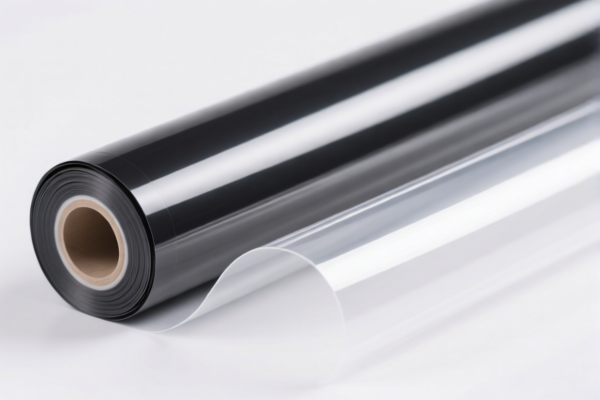

Product Classification: Flexible Plastic Composite Material

HS CODE: 3921904010 (10-digit code)

🔍 Classification Summary

- Product Type: Flexible plastic composite materials, including sheets, foils, tapes, and reinforced plastic sheets.

- HS Code: 3921904010 (classified under "Plastics and articles thereof" in Chapter 39).

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

⚠️ Important Notes on Tariffs

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

No Anti-Dumping Duties:

As of now, there are no specific anti-dumping duties reported for this product category (e.g., on iron or aluminum components).

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed classified under 3921904010 and not under a different HS code due to variations in composition or structure. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product. -

Plan for Tariff Changes:

If importing after April 11, 2025, be prepared for a 30% increase in tariffs, which could significantly impact your cost structure. -

Consult Customs Broker:

For complex or high-value shipments, consider engaging a customs broker to ensure compliance and optimize your import strategy.

Let me know if you need help with HS code verification or tariff impact analysis for your specific product.

Product Classification: Flexible Plastic Composite Material

HS CODE: 3921904010 (10-digit code)

🔍 Classification Summary

- Product Type: Flexible plastic composite materials, including sheets, foils, tapes, and reinforced plastic sheets.

- HS Code: 3921904010 (classified under "Plastics and articles thereof" in Chapter 39).

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

⚠️ Important Notes on Tariffs

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

No Anti-Dumping Duties:

As of now, there are no specific anti-dumping duties reported for this product category (e.g., on iron or aluminum components).

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed classified under 3921904010 and not under a different HS code due to variations in composition or structure. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product. -

Plan for Tariff Changes:

If importing after April 11, 2025, be prepared for a 30% increase in tariffs, which could significantly impact your cost structure. -

Consult Customs Broker:

For complex or high-value shipments, consider engaging a customs broker to ensure compliance and optimize your import strategy.

Let me know if you need help with HS code verification or tariff impact analysis for your specific product.

Customer Reviews

No reviews yet.