| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

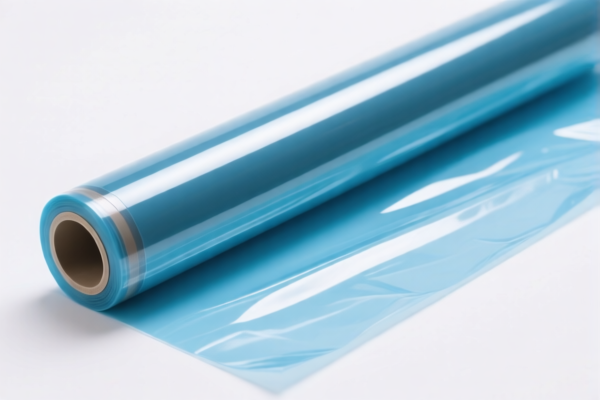

Here is the structured classification and tariff information for Flexible plastic covering film, based on the provided HS codes and tax details:

✅ HS CODE: 3919102055

Description: Self-adhesive sheets, plates, films, foils, strips, and other flat plastic products, whether or not wound in rolls: rolls of width not exceeding 20 cm: other: other

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code applies to self-adhesive plastic films with a width of ≤20 cm.

✅ HS CODE: 3921904010

Description: Other plates, sheets, films, foils, and strips made of plastics

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code applies to non-specific plastic films, not self-adhesive, and not covered by more specific codes.

✅ HS CODE: 3921904090

Description: Other plastic plates, sheets, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code is for other plastic films not covered by more specific categories.

✅ HS CODE: 3920632000

Description: Plastic plates, sheets, films, foils, and strips made of polycarbonate, alkyd resins, polyacrylates, or other polyesters, of unsaturated polyester type

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code applies to specific types of plastic (e.g., polycarbonate, unsaturated polyester), which may have higher tariffs due to material type.

✅ HS CODE: 3921905050

Description: Other plates, sheets, film, foil and strip, of plastics

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code is for other plastic films, possibly including those with specific properties not covered by other codes.

📌 Proactive Advice for Users:

- Verify the material composition of the plastic film (e.g., polycarbonate, polyethylene, etc.) to ensure correct classification.

- Check the width of the film if it is sold in rolls (≤20 cm may fall under 3919102055).

- Confirm the unit price and certifications required (e.g., RoHS, REACH, or specific import permits).

- Be aware of the April 11, 2025 tariff increase (30.0%) that applies to all the above codes.

- Review anti-dumping duties if the product is imported from countries under such measures (not specified here, but always verify).

Let me know if you need help determining which HS code best fits your specific product. Here is the structured classification and tariff information for Flexible plastic covering film, based on the provided HS codes and tax details:

✅ HS CODE: 3919102055

Description: Self-adhesive sheets, plates, films, foils, strips, and other flat plastic products, whether or not wound in rolls: rolls of width not exceeding 20 cm: other: other

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code applies to self-adhesive plastic films with a width of ≤20 cm.

✅ HS CODE: 3921904010

Description: Other plates, sheets, films, foils, and strips made of plastics

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code applies to non-specific plastic films, not self-adhesive, and not covered by more specific codes.

✅ HS CODE: 3921904090

Description: Other plastic plates, sheets, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code is for other plastic films not covered by more specific categories.

✅ HS CODE: 3920632000

Description: Plastic plates, sheets, films, foils, and strips made of polycarbonate, alkyd resins, polyacrylates, or other polyesters, of unsaturated polyester type

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code applies to specific types of plastic (e.g., polycarbonate, unsaturated polyester), which may have higher tariffs due to material type.

✅ HS CODE: 3921905050

Description: Other plates, sheets, film, foil and strip, of plastics

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not specified for this code

- Note: This code is for other plastic films, possibly including those with specific properties not covered by other codes.

📌 Proactive Advice for Users:

- Verify the material composition of the plastic film (e.g., polycarbonate, polyethylene, etc.) to ensure correct classification.

- Check the width of the film if it is sold in rolls (≤20 cm may fall under 3919102055).

- Confirm the unit price and certifications required (e.g., RoHS, REACH, or specific import permits).

- Be aware of the April 11, 2025 tariff increase (30.0%) that applies to all the above codes.

- Review anti-dumping duties if the product is imported from countries under such measures (not specified here, but always verify).

Let me know if you need help determining which HS code best fits your specific product.

Customer Reviews

No reviews yet.