| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

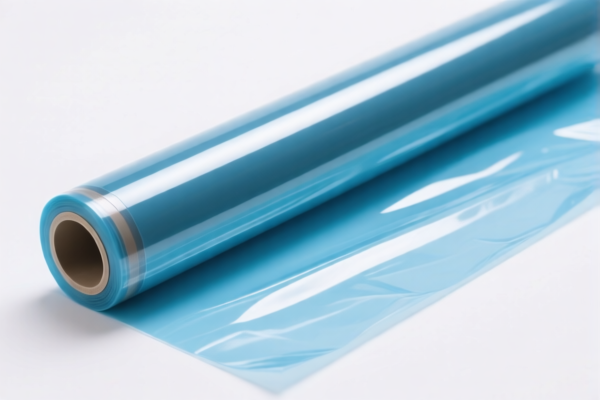

Here is the structured classification and tariff information for the Flexible Plastic Decorative Film product, based on the provided HS codes and tax details:

✅ HS CODE: 3920511000

Product Name: Acrylic Flexible Decorative Film

Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to the highest tax rate among the listed options.

✅ HS CODE: 3920631000

Product Name: Polyester Flexible Plastic Film (2 entries)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Two different product descriptions (e.g., "Polyester Flexible Plastic Film" and "Polyester Plastic Flexible Film") share the same HS code and tax rate.

✅ HS CODE: 3921904010

Product Name: Flexible Plastic Sheet

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product has the lowest base tax rate but is still subject to the 30% special tariff after April 11, 2025.

✅ HS CODE: 3920490000

Product Name: PVC Plastic Flexible Film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product has a slightly lower total tax rate than the acrylic film but still falls into the high-tax category.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed products are subject to an additional 30% tariff after this date. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact material composition (e.g., PVC, polyester, acrylic) to ensure correct HS code classification.

- Unit Price and Certification: Check if any certifications (e.g., RoHS, REACH) are required for import, especially for decorative films used in consumer or industrial applications.

- Tariff Calculation: Total tax is calculated as:

Base Tariff + Additional Tariff + Special Tariff (if applicable)

Example: 6.0% + 25.0% + 30.0% = 61.0% (for 3920511000)

If you are preparing for customs clearance, it is highly recommended to double-check the product description and material composition to ensure the correct HS code is applied. Here is the structured classification and tariff information for the Flexible Plastic Decorative Film product, based on the provided HS codes and tax details:

✅ HS CODE: 3920511000

Product Name: Acrylic Flexible Decorative Film

Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to the highest tax rate among the listed options.

✅ HS CODE: 3920631000

Product Name: Polyester Flexible Plastic Film (2 entries)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Two different product descriptions (e.g., "Polyester Flexible Plastic Film" and "Polyester Plastic Flexible Film") share the same HS code and tax rate.

✅ HS CODE: 3921904010

Product Name: Flexible Plastic Sheet

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product has the lowest base tax rate but is still subject to the 30% special tariff after April 11, 2025.

✅ HS CODE: 3920490000

Product Name: PVC Plastic Flexible Film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product has a slightly lower total tax rate than the acrylic film but still falls into the high-tax category.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed products are subject to an additional 30% tariff after this date. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact material composition (e.g., PVC, polyester, acrylic) to ensure correct HS code classification.

- Unit Price and Certification: Check if any certifications (e.g., RoHS, REACH) are required for import, especially for decorative films used in consumer or industrial applications.

- Tariff Calculation: Total tax is calculated as:

Base Tariff + Additional Tariff + Special Tariff (if applicable)

Example: 6.0% + 25.0% + 30.0% = 61.0% (for 3920511000)

If you are preparing for customs clearance, it is highly recommended to double-check the product description and material composition to ensure the correct HS code is applied.

Customer Reviews

No reviews yet.