| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 8532250080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8532250060 | Doc | 55.0% | CN | US | 2025-05-12 |

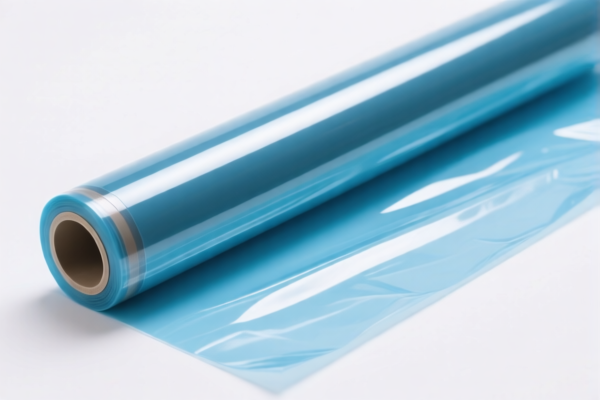

Here is the structured classification and tariff information for the "Flexible plastic dielectric film" product, based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Name: Flexible Polyester Film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to flexible polyester film, which is a common material used in dielectric applications.

✅ HS CODE: 3920490000

Product Name: PVC Plastic Flexible Film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC-based flexible plastic films, which may be used in various industrial and electrical applications.

✅ HS CODE: 3920992000

Product Name: Polystyrene Flexible Film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polystyrene-based flexible films, which may be used in dielectric or insulation applications.

✅ HS CODE: 8532250080

Product Name: Thin Film Plastic Dielectric Capacitor

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for dielectric capacitors made of thin plastic film, which are used in electronic circuits.

✅ HS CODE: 8532250060

Product Name: Plastic Dielectric Film Capacitor

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic dielectric film capacitors, which are commonly used in electronics and power systems.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy, so plan your import schedule accordingly. -

Material Verification:

Ensure the material composition of the product (e.g., polyester, PVC, polystyrene) is clearly defined to avoid misclassification. -

Certifications Required:

Depending on the end-use (e.g., electrical, industrial), certifications such as CE, RoHS, or UL may be required. Confirm with the importing country’s regulatory body. -

Unit Price and Classification:

The HS code classification may vary based on unit price, technical specifications, and intended use. Always verify with a customs broker or classification expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for the "Flexible plastic dielectric film" product, based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Name: Flexible Polyester Film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to flexible polyester film, which is a common material used in dielectric applications.

✅ HS CODE: 3920490000

Product Name: PVC Plastic Flexible Film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC-based flexible plastic films, which may be used in various industrial and electrical applications.

✅ HS CODE: 3920992000

Product Name: Polystyrene Flexible Film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polystyrene-based flexible films, which may be used in dielectric or insulation applications.

✅ HS CODE: 8532250080

Product Name: Thin Film Plastic Dielectric Capacitor

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for dielectric capacitors made of thin plastic film, which are used in electronic circuits.

✅ HS CODE: 8532250060

Product Name: Plastic Dielectric Film Capacitor

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic dielectric film capacitors, which are commonly used in electronics and power systems.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy, so plan your import schedule accordingly. -

Material Verification:

Ensure the material composition of the product (e.g., polyester, PVC, polystyrene) is clearly defined to avoid misclassification. -

Certifications Required:

Depending on the end-use (e.g., electrical, industrial), certifications such as CE, RoHS, or UL may be required. Confirm with the importing country’s regulatory body. -

Unit Price and Classification:

The HS code classification may vary based on unit price, technical specifications, and intended use. Always verify with a customs broker or classification expert if in doubt.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.