| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 8534000080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8505192000 | Doc | 59.9% | CN | US | 2025-05-12 |

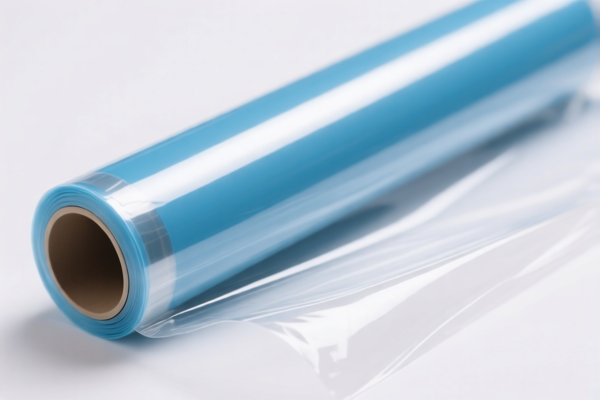

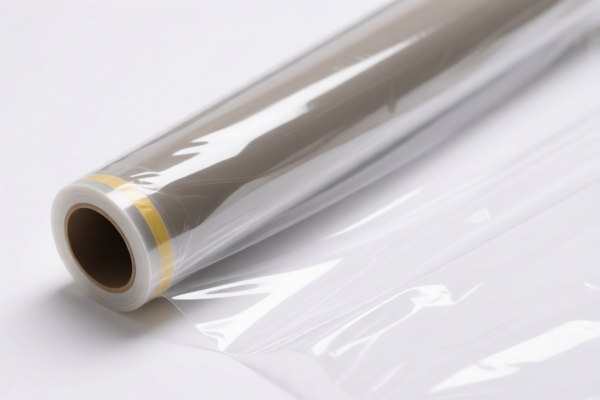

Here is the structured classification and tariff information for the Flexible Plastic Electronic Component Protection Film based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Description: Flexible polyester film for electronic components, flexible insulating plastic film, etc.

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is highly relevant for general-purpose flexible plastic films used in electronics.

- Proactive Advice: Confirm the material composition (e.g., polyester) and whether it is used for insulation or protection.

✅ HS CODE: 3920511000

Product Description: Flexible protective film made of acrylic (methyl methacrylate) for electronic components.

Total Tax Rate: 61.0%

Tax Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies specifically to acrylic-based flexible films.

- Proactive Advice: Verify if the film is made of methyl methacrylate and its intended use (e.g., protection, insulation).

✅ HS CODE: 8534000080

Product Description: Flexible printed circuit boards with protective film.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for flexible circuit boards that include a protective film.

- Proactive Advice: Ensure the product is classified as a circuit board with a film, not just a standalone film.

✅ HS CODE: 8505192000

Product Description: Flexible magnetic protective film.

Total Tax Rate: 59.9%

Tax Breakdown:

- Base Tariff: 4.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to magnetic films used for protection.

- Proactive Advice: Confirm the magnetic properties and whether it is used for shielding or protection.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for these HS codes (no mention of iron or aluminum).

- Certifications: Ensure compliance with any required certifications (e.g., RoHS, REACH) depending on the destination market.

- Material Verification: Confirm the exact material (e.g., polyester, acrylic) and intended use (e.g., insulation, protection) to ensure correct classification.

Let me know if you need help with customs documentation or further classification clarification. Here is the structured classification and tariff information for the Flexible Plastic Electronic Component Protection Film based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Description: Flexible polyester film for electronic components, flexible insulating plastic film, etc.

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is highly relevant for general-purpose flexible plastic films used in electronics.

- Proactive Advice: Confirm the material composition (e.g., polyester) and whether it is used for insulation or protection.

✅ HS CODE: 3920511000

Product Description: Flexible protective film made of acrylic (methyl methacrylate) for electronic components.

Total Tax Rate: 61.0%

Tax Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies specifically to acrylic-based flexible films.

- Proactive Advice: Verify if the film is made of methyl methacrylate and its intended use (e.g., protection, insulation).

✅ HS CODE: 8534000080

Product Description: Flexible printed circuit boards with protective film.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for flexible circuit boards that include a protective film.

- Proactive Advice: Ensure the product is classified as a circuit board with a film, not just a standalone film.

✅ HS CODE: 8505192000

Product Description: Flexible magnetic protective film.

Total Tax Rate: 59.9%

Tax Breakdown:

- Base Tariff: 4.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to magnetic films used for protection.

- Proactive Advice: Confirm the magnetic properties and whether it is used for shielding or protection.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for these HS codes (no mention of iron or aluminum).

- Certifications: Ensure compliance with any required certifications (e.g., RoHS, REACH) depending on the destination market.

- Material Verification: Confirm the exact material (e.g., polyester, acrylic) and intended use (e.g., insulation, protection) to ensure correct classification.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.