| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

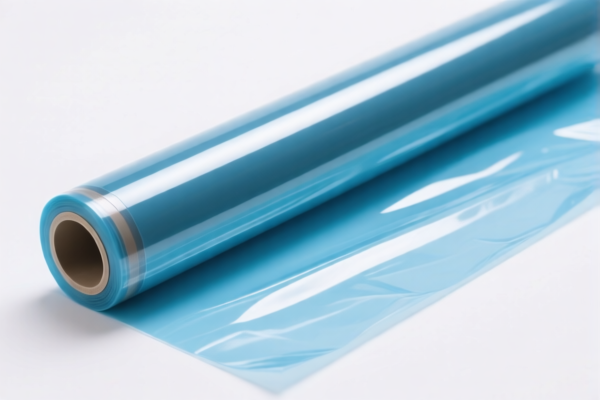

Here is the structured classification and tariff information for the flexible plastic film material based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Description: Polyester plastic flexible film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is subject to the April 11, 2025 special tariff increase.

✅ HS CODE: 3921904010

Product Description: Flexible plastic sheet

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is not subject to the additional 25% tariff, but will be affected by the April 11, 2025 special tariff increase.

✅ HS CODE: 3920490000

Product Description: PVC plastic flexible film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is subject to the April 11, 2025 special tariff increase.

✅ HS CODE: 3920992000

Product Description: Polyester flexible film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is subject to the April 11, 2025 special tariff increase.

✅ HS CODE: 3921904010

Product Description: Reinforced flexible plastic film

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is not subject to the additional 25% tariff, but will be affected by the April 11, 2025 special tariff increase.

📌 Proactive Advice for Users:

- Verify the exact material composition (e.g., whether it's PVC, polyester, or reinforced) to ensure correct HS code classification.

- Check the unit price to determine if the product falls under any preferential tariff schemes or exemptions.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Monitor the April 11, 2025 tariff change and plan accordingly for cost adjustments.

- Consult with customs brokers or legal advisors if the product is used in sensitive industries (e.g., electronics, automotive) where additional regulations may apply.

Let me know if you need help with HS code verification or tariff calculation for a specific product. Here is the structured classification and tariff information for the flexible plastic film material based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Description: Polyester plastic flexible film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is subject to the April 11, 2025 special tariff increase.

✅ HS CODE: 3921904010

Product Description: Flexible plastic sheet

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is not subject to the additional 25% tariff, but will be affected by the April 11, 2025 special tariff increase.

✅ HS CODE: 3920490000

Product Description: PVC plastic flexible film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is subject to the April 11, 2025 special tariff increase.

✅ HS CODE: 3920992000

Product Description: Polyester flexible film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is subject to the April 11, 2025 special tariff increase.

✅ HS CODE: 3921904010

Product Description: Reinforced flexible plastic film

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This product is not subject to the additional 25% tariff, but will be affected by the April 11, 2025 special tariff increase.

📌 Proactive Advice for Users:

- Verify the exact material composition (e.g., whether it's PVC, polyester, or reinforced) to ensure correct HS code classification.

- Check the unit price to determine if the product falls under any preferential tariff schemes or exemptions.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Monitor the April 11, 2025 tariff change and plan accordingly for cost adjustments.

- Consult with customs brokers or legal advisors if the product is used in sensitive industries (e.g., electronics, automotive) where additional regulations may apply.

Let me know if you need help with HS code verification or tariff calculation for a specific product.

Customer Reviews

No reviews yet.