Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3923290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Flexible Plastic Greenhouse Film, based on the provided HS codes and tax details:

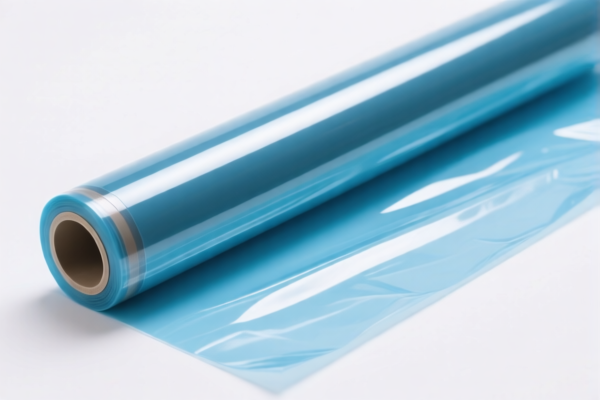

✅ Product Classification: Flexible Plastic Greenhouse Film

🔍 HS Code: 3920631000

- Description: Flexible plastic film made of polycarbonate, acrylic resin, polyacrylate, or other polyester (unsaturated polyester type), non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is suitable if the film is made of specific resins and is combined with other materials.

- Verify material composition and whether it is laminated or combined with other materials.

🔍 HS Code: 3920490000

- Description: Flexible PVC plastic film.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This is the most likely code for PVC-based greenhouse film.

- Check if the film is indeed made of PVC and not another type of plastic.

🔍 HS Code: 3923290000

- Description: Plastic articles for packing or wrapping goods, including bags and sacks.

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is for packaging-related plastic items, not specifically for greenhouse film.

- Not ideal for greenhouse film unless it is used as a packaging bag.

🔍 HS Code: 3921905050

- Description: Other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This is a general category for other plastic films.

- Lower tax rate but may not be the most accurate for greenhouse film unless it doesn't fit the more specific codes.

🔍 HS Code: 3921904090

- Description: Flexible plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This is a flexible plastic film category.

- Lower tax rate but may not be the most accurate unless the film is not made of PVC or other specific resins.

📌 Proactive Advice for Users

- Verify the material composition of the greenhouse film (e.g., PVC, polycarbonate, etc.).

- Check if the film is laminated or combined with other materials, which may affect the HS code.

- Confirm the intended use (e.g., for packaging or greenhouse use) to ensure correct classification.

- Review the April 11, 2025 special tariff and plan accordingly if importing after that date.

- Check if any certifications (e.g., RoHS, REACH) are required for the product in the destination market.

📊 Summary of Tax Rates (after April 11, 2025)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|

| 3920631000 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3920490000 | 60.8% | 5.8% | 25.0% | 30.0% |

| 3923290000 | 58.0% | 3.0% | 25.0% | 30.0% |

| 3921905050 | 34.8% | 4.8% | 0.0% | 30.0% |

| 3921904090 | 34.2% | 4.2% | 0.0% | 30.0% |

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Flexible Plastic Greenhouse Film, based on the provided HS codes and tax details:

✅ Product Classification: Flexible Plastic Greenhouse Film

🔍 HS Code: 3920631000

- Description: Flexible plastic film made of polycarbonate, acrylic resin, polyacrylate, or other polyester (unsaturated polyester type), non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is suitable if the film is made of specific resins and is combined with other materials.

- Verify material composition and whether it is laminated or combined with other materials.

🔍 HS Code: 3920490000

- Description: Flexible PVC plastic film.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This is the most likely code for PVC-based greenhouse film.

- Check if the film is indeed made of PVC and not another type of plastic.

🔍 HS Code: 3923290000

- Description: Plastic articles for packing or wrapping goods, including bags and sacks.

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This code is for packaging-related plastic items, not specifically for greenhouse film.

- Not ideal for greenhouse film unless it is used as a packaging bag.

🔍 HS Code: 3921905050

- Description: Other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This is a general category for other plastic films.

- Lower tax rate but may not be the most accurate for greenhouse film unless it doesn't fit the more specific codes.

🔍 HS Code: 3921904090

- Description: Flexible plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes:

- This is a flexible plastic film category.

- Lower tax rate but may not be the most accurate unless the film is not made of PVC or other specific resins.

📌 Proactive Advice for Users

- Verify the material composition of the greenhouse film (e.g., PVC, polycarbonate, etc.).

- Check if the film is laminated or combined with other materials, which may affect the HS code.

- Confirm the intended use (e.g., for packaging or greenhouse use) to ensure correct classification.

- Review the April 11, 2025 special tariff and plan accordingly if importing after that date.

- Check if any certifications (e.g., RoHS, REACH) are required for the product in the destination market.

📊 Summary of Tax Rates (after April 11, 2025)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|

| 3920631000 | 59.2% | 4.2% | 25.0% | 30.0% |

| 3920490000 | 60.8% | 5.8% | 25.0% | 30.0% |

| 3923290000 | 58.0% | 3.0% | 25.0% | 30.0% |

| 3921905050 | 34.8% | 4.8% | 0.0% | 30.0% |

| 3921904090 | 34.2% | 4.2% | 0.0% | 30.0% |

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.