| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

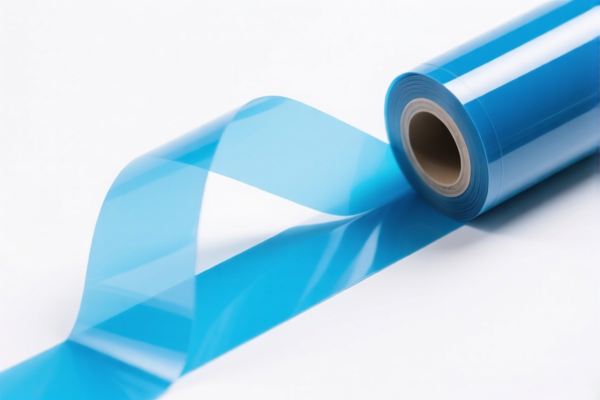

Here is the structured classification and tariff information for the "Flexible plastic strip film" product, based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is for a broader category of plastic films and strips, not specifically for flexible plastic strip film.

✅ HS CODE: 3920992000

Description: Other plastic-made flexible films, strips, and sheets

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is more specific to flexible plastic films, strips, and sheets, which aligns better with your product description.

✅ HS CODE: 3920631000

Description: Flexible polyester plastic sheets, plates, films, foils, and strips

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is specific to polyester flexible plastic strips and films. If your product is made of polyester, this may be the most accurate classification.

✅ HS CODE: 3920591000

Description: Flexible acrylic plastic strips and tapes

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is specific to acrylic plastic strips and tapes. If your product is made of acrylic, this would be the correct classification.

📌 Proactive Advice for You:

- Verify Material: Confirm the exact material (e.g., polyester, acrylic, or other plastics) to ensure the correct HS code is used.

- Check Unit Price: Tariff rates can vary based on the value of the product, especially if it falls under preferential trade agreements.

- Certifications Required: Some products may require specific certifications (e.g., RoHS, REACH) for customs clearance.

- April 11, 2025 Deadline: Be aware that additional tariffs of 30.0% will apply after this date. If your product is subject to these tariffs, consider adjusting your import strategy or seeking duty relief options.

- Consult a Customs Broker: For complex or high-value shipments, it's advisable to work with a customs broker or compliance expert to ensure accurate classification and avoid penalties.

Let me know if you need help determining the most accurate HS code based on your product's material and specifications. Here is the structured classification and tariff information for the "Flexible plastic strip film" product, based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is for a broader category of plastic films and strips, not specifically for flexible plastic strip film.

✅ HS CODE: 3920992000

Description: Other plastic-made flexible films, strips, and sheets

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is more specific to flexible plastic films, strips, and sheets, which aligns better with your product description.

✅ HS CODE: 3920631000

Description: Flexible polyester plastic sheets, plates, films, foils, and strips

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is specific to polyester flexible plastic strips and films. If your product is made of polyester, this may be the most accurate classification.

✅ HS CODE: 3920591000

Description: Flexible acrylic plastic strips and tapes

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this code

- Note: This code is specific to acrylic plastic strips and tapes. If your product is made of acrylic, this would be the correct classification.

📌 Proactive Advice for You:

- Verify Material: Confirm the exact material (e.g., polyester, acrylic, or other plastics) to ensure the correct HS code is used.

- Check Unit Price: Tariff rates can vary based on the value of the product, especially if it falls under preferential trade agreements.

- Certifications Required: Some products may require specific certifications (e.g., RoHS, REACH) for customs clearance.

- April 11, 2025 Deadline: Be aware that additional tariffs of 30.0% will apply after this date. If your product is subject to these tariffs, consider adjusting your import strategy or seeking duty relief options.

- Consult a Customs Broker: For complex or high-value shipments, it's advisable to work with a customs broker or compliance expert to ensure accurate classification and avoid penalties.

Let me know if you need help determining the most accurate HS code based on your product's material and specifications.

Customer Reviews

No reviews yet.