| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

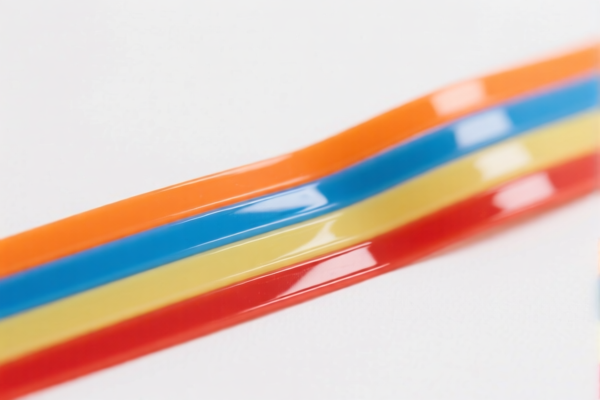

Here is the structured classification and tariff information for the flexible plastic strip material based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Note: This is a general category for flexible plastic strips, but it may not be the most specific classification for your product.

✅ HS CODE: 3920631000

Description: Flexible polyester plastic sheets, plates, films, foils, and strips

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This is a more specific code for polyester-based flexible plastic strips.

✅ HS CODE: 3920992000

Description: Other plastic flexible films, strips, and sheets

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This is a general category for non-polyester flexible plastic strips.

✅ HS CODE: 3921904010

Description: Flexible plastic sheets

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Note: This is for flexible plastic sheets, which may be similar to strips but not explicitly for strips.

✅ HS CODE: 3920591000

Description: Flexible acrylic plastic strips and tapes

- Base Tariff Rate: 6.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Note: This is a specific code for acrylic-based flexible strips and tapes.

📌 Important Notes and Recommendations:

- Time-sensitive policy: The special tariff of 30.0% applies after April 11, 2025. Ensure your import timeline aligns with this.

- Material verification: Confirm the exact material composition (e.g., polyester, acrylic, or other plastics) to select the most accurate HS code.

- Unit price and certification: Check if certifications (e.g., RoHS, REACH) or origin documentation are required for customs clearance.

- Anti-dumping duties: While not explicitly mentioned here, be aware that anti-dumping duties may apply to certain plastic products, especially if imported from specific countries.

- Consult a customs broker: For high-value or complex shipments, consider professional assistance to avoid classification errors.

Let me know if you need help determining the most accurate HS code based on your product’s material and dimensions. Here is the structured classification and tariff information for the flexible plastic strip material based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Note: This is a general category for flexible plastic strips, but it may not be the most specific classification for your product.

✅ HS CODE: 3920631000

Description: Flexible polyester plastic sheets, plates, films, foils, and strips

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This is a more specific code for polyester-based flexible plastic strips.

✅ HS CODE: 3920992000

Description: Other plastic flexible films, strips, and sheets

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Note: This is a general category for non-polyester flexible plastic strips.

✅ HS CODE: 3921904010

Description: Flexible plastic sheets

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Note: This is for flexible plastic sheets, which may be similar to strips but not explicitly for strips.

✅ HS CODE: 3920591000

Description: Flexible acrylic plastic strips and tapes

- Base Tariff Rate: 6.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Note: This is a specific code for acrylic-based flexible strips and tapes.

📌 Important Notes and Recommendations:

- Time-sensitive policy: The special tariff of 30.0% applies after April 11, 2025. Ensure your import timeline aligns with this.

- Material verification: Confirm the exact material composition (e.g., polyester, acrylic, or other plastics) to select the most accurate HS code.

- Unit price and certification: Check if certifications (e.g., RoHS, REACH) or origin documentation are required for customs clearance.

- Anti-dumping duties: While not explicitly mentioned here, be aware that anti-dumping duties may apply to certain plastic products, especially if imported from specific countries.

- Consult a customs broker: For high-value or complex shipments, consider professional assistance to avoid classification errors.

Let me know if you need help determining the most accurate HS code based on your product’s material and dimensions.

Customer Reviews

No reviews yet.