| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926909400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

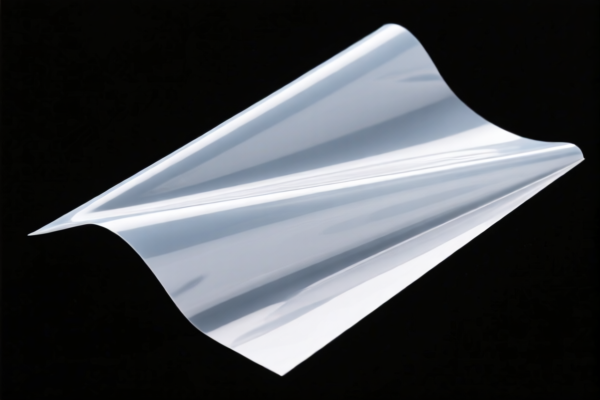

Here is the structured classification and tariff information for the "Flexible plastic thin sheet material" product, based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Description: Flexible polyester plastic sheets, films, foils, and strips

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product

- Note: This code is specific to polyester-based flexible plastic sheets and films.

✅ HS CODE: 3926909400

Product Description: Non-perforated cards for jacquard weaving; transparent plastic sheets containing 30% or more lead by weight

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code includes transparent plastic sheets with high lead content, which may require special handling due to environmental regulations.

✅ HS CODE: 3921904010

Product Description: Flexible plastic sheeting

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This is a general category for flexible plastic sheets, not specific to any material like PVC or polyester.

✅ HS CODE: 3920992000

Product Description: Other flexible plastic films, strips, and sheeting

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This is a catch-all category for flexible plastic films and sheets not covered by more specific codes.

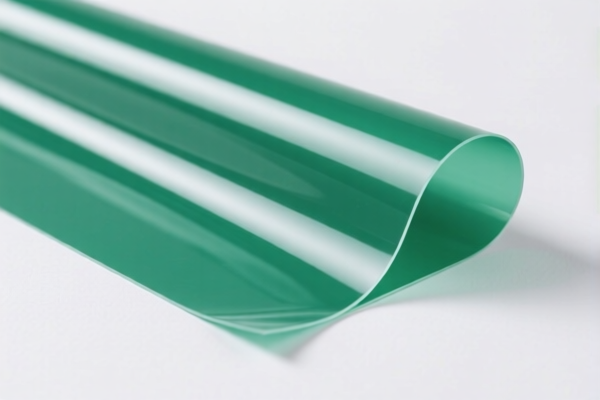

✅ HS CODE: 3920490000

Product Description: Flexible PVC plastic films

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is specific to PVC-based flexible films, which may have higher base tariffs due to material type.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm whether the product is made of PVC, polyester, or other materials, as this will determine the correct HS code.

- Check Unit Price and Certification: Some plastic products may require environmental or safety certifications (e.g., RoHS, REACH) depending on the destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so ensure your import plans are adjusted accordingly.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to the boundary of multiple HS codes.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured classification and tariff information for the "Flexible plastic thin sheet material" product, based on the provided HS codes and tax details:

✅ HS CODE: 3920631000

Product Description: Flexible polyester plastic sheets, films, foils, and strips

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product

- Note: This code is specific to polyester-based flexible plastic sheets and films.

✅ HS CODE: 3926909400

Product Description: Non-perforated cards for jacquard weaving; transparent plastic sheets containing 30% or more lead by weight

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code includes transparent plastic sheets with high lead content, which may require special handling due to environmental regulations.

✅ HS CODE: 3921904010

Product Description: Flexible plastic sheeting

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This is a general category for flexible plastic sheets, not specific to any material like PVC or polyester.

✅ HS CODE: 3920992000

Product Description: Other flexible plastic films, strips, and sheeting

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This is a catch-all category for flexible plastic films and sheets not covered by more specific codes.

✅ HS CODE: 3920490000

Product Description: Flexible PVC plastic films

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is specific to PVC-based flexible films, which may have higher base tariffs due to material type.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm whether the product is made of PVC, polyester, or other materials, as this will determine the correct HS code.

- Check Unit Price and Certification: Some plastic products may require environmental or safety certifications (e.g., RoHS, REACH) depending on the destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so ensure your import plans are adjusted accordingly.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to the boundary of multiple HS codes.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.