| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904610010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904610090 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

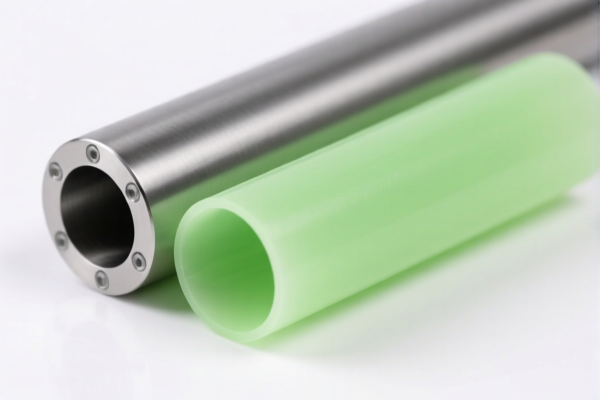

Here is the structured analysis and customs compliance information for the Fluoropolymer Reinforced Raw Material product classification:

🔍 HS CODE: 3904610010

Product Description: Polytetrafluoroethylene (PTFE) Film Raw Material

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code applies specifically to PTFE film raw material. - The April 11, 2025 special tariff is a significant increase, so monitor the import date to avoid unexpected costs.

🔍 HS CODE: 3904610090

Product Description: Other Forms of Poly Tetrafluoroethylene (PTFE) Raw Material

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code covers other forms of PTFE raw material, excluding film. - Same April 11, 2025 tariff applies. Ensure product form is clearly defined for accurate classification.

🔍 HS CODE: 3902900010

Product Description: Polybutene Resin Reinforced Material

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code applies to polybutene resin used as a reinforced material. - Check if the product is reinforced with other materials, as this may affect classification.

🔍 HS CODE: 3902900050

Product Description: Polypropylene Reinforced Composite Material

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code is for polypropylene-based reinforced composites. - Confirm the composite structure (e.g., fiber content, reinforcement type) to ensure correct classification.

🔍 HS CODE: 3907290000

Product Description: Polyether Resin Reinforced Material

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code applies to polyether resin used in reinforced applications. - Verify the resin type and reinforcement method to avoid misclassification.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm the exact chemical composition and form of the raw material (e.g., film, powder, composite).

- Check Unit Price and Certification: Some materials may require technical documentation or certifications (e.g., REACH, RoHS).

- Monitor Import Date: If importing after April 11, 2025, be prepared for the 30% special tariff.

- Consult Customs Broker: For complex classifications, especially if the product is a composite or reinforced material, seek professional advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for any of these HS codes. Here is the structured analysis and customs compliance information for the Fluoropolymer Reinforced Raw Material product classification:

🔍 HS CODE: 3904610010

Product Description: Polytetrafluoroethylene (PTFE) Film Raw Material

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code applies specifically to PTFE film raw material. - The April 11, 2025 special tariff is a significant increase, so monitor the import date to avoid unexpected costs.

🔍 HS CODE: 3904610090

Product Description: Other Forms of Poly Tetrafluoroethylene (PTFE) Raw Material

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code covers other forms of PTFE raw material, excluding film. - Same April 11, 2025 tariff applies. Ensure product form is clearly defined for accurate classification.

🔍 HS CODE: 3902900010

Product Description: Polybutene Resin Reinforced Material

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code applies to polybutene resin used as a reinforced material. - Check if the product is reinforced with other materials, as this may affect classification.

🔍 HS CODE: 3902900050

Product Description: Polypropylene Reinforced Composite Material

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code is for polypropylene-based reinforced composites. - Confirm the composite structure (e.g., fiber content, reinforcement type) to ensure correct classification.

🔍 HS CODE: 3907290000

Product Description: Polyether Resin Reinforced Material

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Notes: - This code applies to polyether resin used in reinforced applications. - Verify the resin type and reinforcement method to avoid misclassification.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm the exact chemical composition and form of the raw material (e.g., film, powder, composite).

- Check Unit Price and Certification: Some materials may require technical documentation or certifications (e.g., REACH, RoHS).

- Monitor Import Date: If importing after April 11, 2025, be prepared for the 30% special tariff.

- Consult Customs Broker: For complex classifications, especially if the product is a composite or reinforced material, seek professional advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for any of these HS codes.

Customer Reviews

No reviews yet.