| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4004000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3913901000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the Fluororubber Coating Raw Material and related products, based on the provided HS codes and tax details:

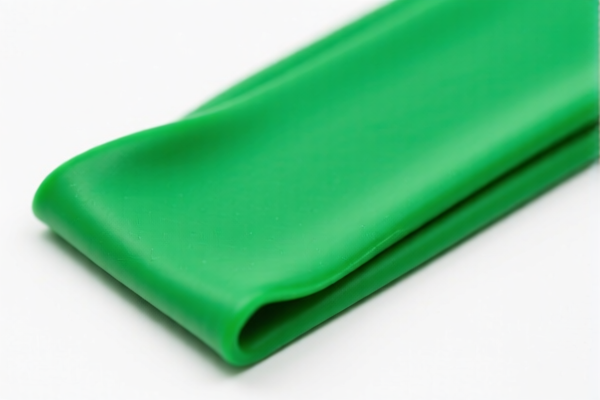

🔍 HS CODE: 3904691000 – Fluororubber Coating

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to fluororubber coatings, which are typically used in industrial or specialized applications.

- Ensure the product is correctly classified as a coating and not as raw fluororubber.

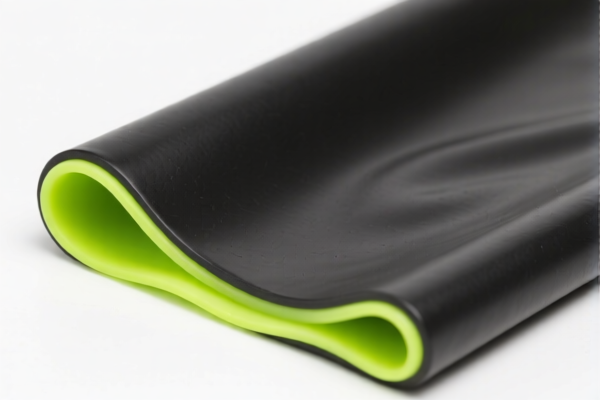

🔍 HS CODE: 4002600000 – Fluororubber Raw Material / Fluororubber Compound

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code covers both raw fluororubber and fluororubber compounds (mixtures).

- Be cautious to distinguish between raw material and compounded material, as they may have different regulatory requirements.

🔍 HS CODE: 4004000000 – Fluororubber Powder

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- Fluororubber in powder form is classified under this code.

- Confirm the physical form of the product to ensure correct classification.

🔍 HS CODE: 3913901000 – Rubber Coating Raw Material

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to raw materials used in rubber coatings.

- Ensure the product is not classified under a more specific code (e.g., fluororubber-specific codes).

📌 Important Reminders:

- April 11, 2025 Special Tariff:

- A 30% additional tariff will be applied to all the above products after April 11, 2025.

-

This is a time-sensitive policy—plan your import schedule accordingly.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for these products, but always verify with the latest customs notices or consult a customs broker for confirmation.

-

Certifications and Documentation:

- Verify the material composition and unit price to ensure compliance with customs regulations.

-

Check if certifications (e.g., REACH, RoHS, or specific import permits) are required for the product.

-

Classification Accuracy:

- Fluororubber and its derivatives can be classified under multiple HS codes depending on the form and use.

- Double-check with customs or a classification expert to avoid misclassification penalties.

If you need further clarification on any of these codes or their application, feel free to ask! Here is the structured classification and tariff information for the Fluororubber Coating Raw Material and related products, based on the provided HS codes and tax details:

🔍 HS CODE: 3904691000 – Fluororubber Coating

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to fluororubber coatings, which are typically used in industrial or specialized applications.

- Ensure the product is correctly classified as a coating and not as raw fluororubber.

🔍 HS CODE: 4002600000 – Fluororubber Raw Material / Fluororubber Compound

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code covers both raw fluororubber and fluororubber compounds (mixtures).

- Be cautious to distinguish between raw material and compounded material, as they may have different regulatory requirements.

🔍 HS CODE: 4004000000 – Fluororubber Powder

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- Fluororubber in powder form is classified under this code.

- Confirm the physical form of the product to ensure correct classification.

🔍 HS CODE: 3913901000 – Rubber Coating Raw Material

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to raw materials used in rubber coatings.

- Ensure the product is not classified under a more specific code (e.g., fluororubber-specific codes).

📌 Important Reminders:

- April 11, 2025 Special Tariff:

- A 30% additional tariff will be applied to all the above products after April 11, 2025.

-

This is a time-sensitive policy—plan your import schedule accordingly.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for these products, but always verify with the latest customs notices or consult a customs broker for confirmation.

-

Certifications and Documentation:

- Verify the material composition and unit price to ensure compliance with customs regulations.

-

Check if certifications (e.g., REACH, RoHS, or specific import permits) are required for the product.

-

Classification Accuracy:

- Fluororubber and its derivatives can be classified under multiple HS codes depending on the form and use.

- Double-check with customs or a classification expert to avoid misclassification penalties.

If you need further clarification on any of these codes or their application, feel free to ask!

Customer Reviews

No reviews yet.