| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4006905000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4005910000 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Classification: Fluororubber Extrusion Grade Raw Material

Below is the detailed breakdown of the HS codes and associated tariff rates for Fluororubber Extrusion Grade Raw Material, based on your input data:

✅ HS CODE: 3904691000

Description:

- Fluororubber extrusion material classified under HS Code 3904, which refers to halogenated olefins polymer (fluororubber) in its primary form, classified as an elastomer.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4002600000

Description:

- Fluororubber raw material falls under the category of synthetic rubber raw materials, classified under HS Code 4002600000.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4006905000

Description:

- Fluororubber extrusion profiles are classified under HS Code 4006905000, which refers to "Other forms (e.g., rods, tubes, and profiles) and articles (e.g., discs and rings), unvulcanized rubber: Other: Other."

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS CODE: 3902300000

Description:

- Polypropylene extrusion-grade raw material is classified under HS Code 3902, which refers to polypropylene in its primary form.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

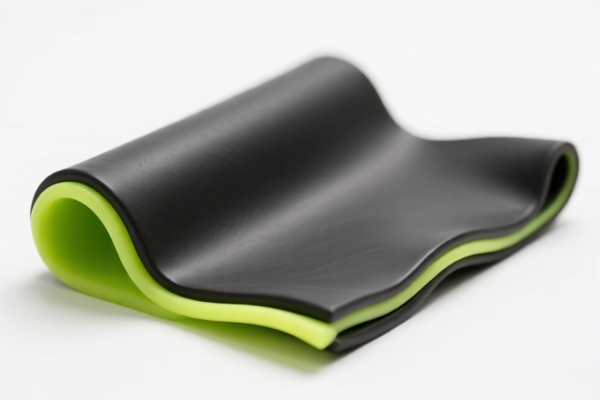

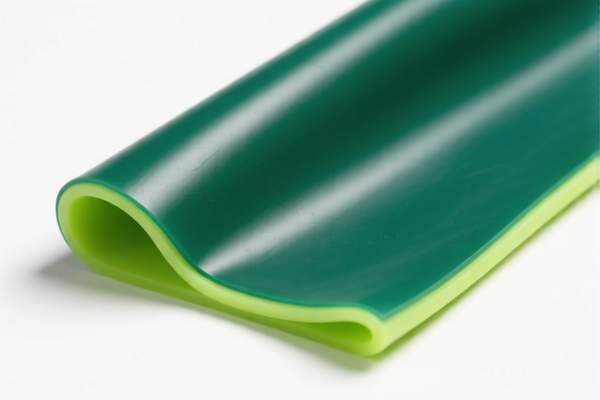

✅ HS CODE: 4005910000

Description:

- Fluororubber sheets are classified under HS Code 4005910000, which refers to fluororubber in sheet, plate, or strip form.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline aligns with this policy change. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for fluororubber in the provided data. However, always verify with customs or a compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

- Confirm the material composition and unit price to ensure correct classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for fluororubber in your destination country.

-

Customs Declaration:

- Use the correct HS code based on the product form (raw material vs. finished product).

- Maintain technical documentation (e.g., material safety data sheets, polymer type, and processing method) for customs inspection.

🛑 Action Required:

- Verify the exact product form (e.g., raw material, extrusion profile, sheet) to ensure the correct HS code is used.

- Consult a customs broker or compliance expert if the product is subject to any special trade agreements or regional tariff preferences.

- Monitor the April 11, 2025 deadline to avoid unexpected increases in import costs.

Product Classification: Fluororubber Extrusion Grade Raw Material

Below is the detailed breakdown of the HS codes and associated tariff rates for Fluororubber Extrusion Grade Raw Material, based on your input data:

✅ HS CODE: 3904691000

Description:

- Fluororubber extrusion material classified under HS Code 3904, which refers to halogenated olefins polymer (fluororubber) in its primary form, classified as an elastomer.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4002600000

Description:

- Fluororubber raw material falls under the category of synthetic rubber raw materials, classified under HS Code 4002600000.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4006905000

Description:

- Fluororubber extrusion profiles are classified under HS Code 4006905000, which refers to "Other forms (e.g., rods, tubes, and profiles) and articles (e.g., discs and rings), unvulcanized rubber: Other: Other."

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS CODE: 3902300000

Description:

- Polypropylene extrusion-grade raw material is classified under HS Code 3902, which refers to polypropylene in its primary form.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 4005910000

Description:

- Fluororubber sheets are classified under HS Code 4005910000, which refers to fluororubber in sheet, plate, or strip form.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline aligns with this policy change. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for fluororubber in the provided data. However, always verify with customs or a compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

- Confirm the material composition and unit price to ensure correct classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for fluororubber in your destination country.

-

Customs Declaration:

- Use the correct HS code based on the product form (raw material vs. finished product).

- Maintain technical documentation (e.g., material safety data sheets, polymer type, and processing method) for customs inspection.

🛑 Action Required:

- Verify the exact product form (e.g., raw material, extrusion profile, sheet) to ensure the correct HS code is used.

- Consult a customs broker or compliance expert if the product is subject to any special trade agreements or regional tariff preferences.

- Monitor the April 11, 2025 deadline to avoid unexpected increases in import costs.

Customer Reviews

No reviews yet.