| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4001290000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4005910000 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Classification and Customs Tariff Analysis for Fluororubber Film Raw Material

Based on the provided HS codes and tax details, here is a structured breakdown of the classification and tariff implications for fluororubber film raw material:

✅ HS CODE: 4002600000

Product Description: Fluororubber raw material (synthetic rubber raw material)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for fluororubber raw material, not finished products.

- No anti-dumping duties or special tariffs on iron/aluminum apply here.

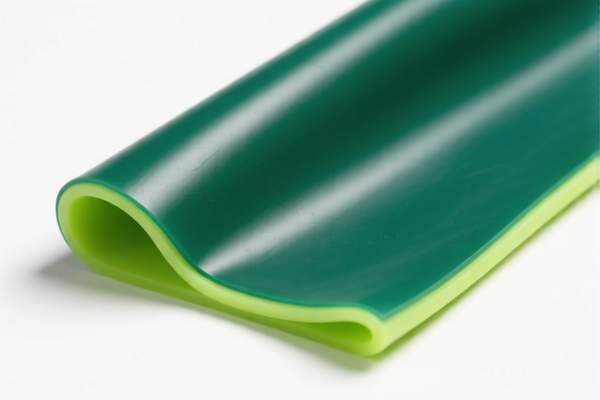

⚠️ HS CODE: 3904691000

Product Description: Fluororubber film (primary form of halogenated ethylene polymer)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to fluororubber film in its primary form.

- Ensure the product is not classified under a more specific code (e.g., 3904695000 for finished fluororubber membranes).

⚠️ HS CODE: 4001290000

Product Description: Natural rubber film raw material (primary form or sheet, strip)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is for natural rubber film, not fluororubber.

- If the product is fluororubber, this code is not applicable.

⚠️ HS CODE: 3904695000

Product Description: Fluororubber membrane (halogenated ethylene polymer)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for finished fluororubber membranes.

- Higher tax rate due to the base tariff of 6.5%.

- Ensure the product is not raw material (use 4002600000 instead).

⚠️ HS CODE: 4005910000

Product Description: Fluororubber sheet (composite rubber, in sheet, strip, or bar form)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to fluororubber sheets in composite form.

- Ensure the product is not raw material or finished membrane.

📌 Proactive Advice for Importers:

- Verify the exact product form: Is it raw material, film, membrane, or sheet? This determines the correct HS code.

- Check the unit price and material composition: This may affect classification and tax rates.

- Confirm required certifications: Some products may require specific documentation (e.g., technical specifications, origin certificates).

- Monitor the April 11, 2025, deadline: Additional tariffs will increase by 5% after this date.

- Avoid misclassification: Using the wrong HS code can lead to penalties or delays in customs clearance.

If you provide more details about the specific product form, composition, and origin, I can help you further refine the classification and tax calculation. Product Classification and Customs Tariff Analysis for Fluororubber Film Raw Material

Based on the provided HS codes and tax details, here is a structured breakdown of the classification and tariff implications for fluororubber film raw material:

✅ HS CODE: 4002600000

Product Description: Fluororubber raw material (synthetic rubber raw material)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for fluororubber raw material, not finished products.

- No anti-dumping duties or special tariffs on iron/aluminum apply here.

⚠️ HS CODE: 3904691000

Product Description: Fluororubber film (primary form of halogenated ethylene polymer)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to fluororubber film in its primary form.

- Ensure the product is not classified under a more specific code (e.g., 3904695000 for finished fluororubber membranes).

⚠️ HS CODE: 4001290000

Product Description: Natural rubber film raw material (primary form or sheet, strip)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is for natural rubber film, not fluororubber.

- If the product is fluororubber, this code is not applicable.

⚠️ HS CODE: 3904695000

Product Description: Fluororubber membrane (halogenated ethylene polymer)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for finished fluororubber membranes.

- Higher tax rate due to the base tariff of 6.5%.

- Ensure the product is not raw material (use 4002600000 instead).

⚠️ HS CODE: 4005910000

Product Description: Fluororubber sheet (composite rubber, in sheet, strip, or bar form)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to fluororubber sheets in composite form.

- Ensure the product is not raw material or finished membrane.

📌 Proactive Advice for Importers:

- Verify the exact product form: Is it raw material, film, membrane, or sheet? This determines the correct HS code.

- Check the unit price and material composition: This may affect classification and tax rates.

- Confirm required certifications: Some products may require specific documentation (e.g., technical specifications, origin certificates).

- Monitor the April 11, 2025, deadline: Additional tariffs will increase by 5% after this date.

- Avoid misclassification: Using the wrong HS code can lead to penalties or delays in customs clearance.

If you provide more details about the specific product form, composition, and origin, I can help you further refine the classification and tax calculation.

Customer Reviews

No reviews yet.