| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3913901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4005910000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4006905000 | Doc | 57.7% | CN | US | 2025-05-12 |

- HS CODE: 4002600000

- Product Classification: Fluororubber raw material (synthetic rubber raw material)

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification is suitable for fluororubber raw materials, and the description matches the product.

-

HS CODE: 3913901000

- Product Classification: Modified natural rubber raw material

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code aligns with modified natural rubber raw materials, and the description is consistent with the product.

-

HS CODE: 3904691000

- Product Classification: Fluororubber with high elasticity

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is appropriate for fluororubber with high elasticity, and the description matches the product.

-

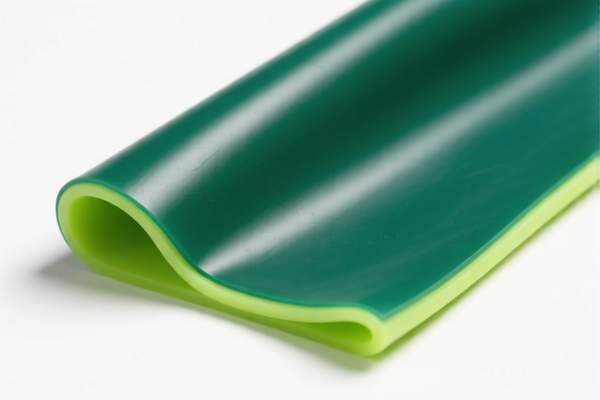

HS CODE: 4005910000

- Product Classification: Fluororubber sheet

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for fluororubber sheets, and the description is consistent with the product.

-

HS CODE: 4006905000

- Product Classification: Fluororubber profiles

- Total Tax Rate: 57.7%

- Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is appropriate for fluororubber profiles, and the description matches the product.

✅ Proactive Advice:

- Verify the material specifications (e.g., whether it is fluororubber, modified natural rubber, or other types) to ensure correct classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs.

- Confirm if any certifications (e.g., RoHS, REACH, or other compliance documents) are required for customs clearance.

- Be aware of the April 11, 2025, tariff adjustment and plan accordingly for import costs.

- HS CODE: 4002600000

- Product Classification: Fluororubber raw material (synthetic rubber raw material)

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification is suitable for fluororubber raw materials, and the description matches the product.

-

HS CODE: 3913901000

- Product Classification: Modified natural rubber raw material

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code aligns with modified natural rubber raw materials, and the description is consistent with the product.

-

HS CODE: 3904691000

- Product Classification: Fluororubber with high elasticity

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is appropriate for fluororubber with high elasticity, and the description matches the product.

-

HS CODE: 4005910000

- Product Classification: Fluororubber sheet

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for fluororubber sheets, and the description is consistent with the product.

-

HS CODE: 4006905000

- Product Classification: Fluororubber profiles

- Total Tax Rate: 57.7%

- Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is appropriate for fluororubber profiles, and the description matches the product.

✅ Proactive Advice:

- Verify the material specifications (e.g., whether it is fluororubber, modified natural rubber, or other types) to ensure correct classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs.

- Confirm if any certifications (e.g., RoHS, REACH, or other compliance documents) are required for customs clearance.

- Be aware of the April 11, 2025, tariff adjustment and plan accordingly for import costs.

Customer Reviews

No reviews yet.