| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4016935010 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4016935050 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4008292000 | Doc | 57.9% | CN | US | 2025-05-12 |

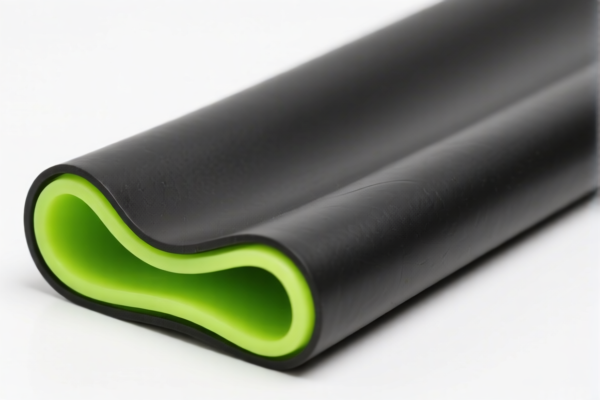

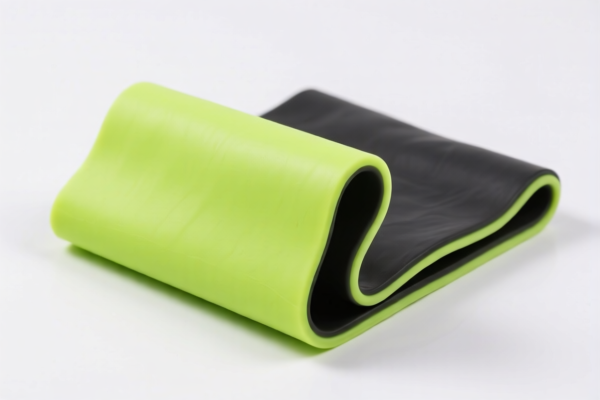

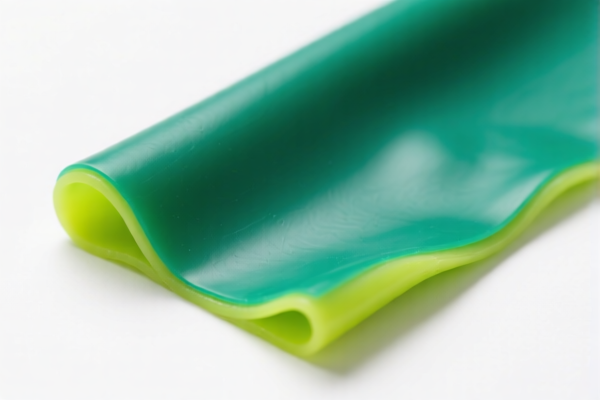

Product Classification: Fluororubber O Ring Raw Material

HS CODEs and Tax Information Overview

Below are the HS CODEs and corresponding tax details for fluororubber O rings based on their classification under the Harmonized System (HS):

1. HS CODE: 4016935010

- Description: Sulfurized rubber products, specifically fluororubber O rings.

- Total Tax Rate: 57.5%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for sulfurized rubber products.

2. HS CODE: 4008294000

- Description: Fluororubber O rings classified under non-cellular rubber profiles.

- Total Tax Rate: 57.9%

- Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for non-cellular rubber products.

3. HS CODE: 3904691000

- Description: Fluororubber O rings classified under fluoropolymer elastomers in their primary form (not sulfurized).

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw fluoropolymer materials, not finished products.

4. HS CODE: 4016935050

- Description: Sulfurized rubber products, specifically fluororubber O rings.

- Total Tax Rate: 57.5%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 4016935010, but may differ in specific product type or material composition.

5. HS CODE: 4008292000

- Description: Fluororubber O rings classified under non-cellular rubber profiles.

- Total Tax Rate: 57.9%

- Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for non-cellular rubber products, similar to 4008294000 but may differ in product form or application.

Key Observations and Recommendations

- Tariff Increase Alert:

- All codes are subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase import costs.

-

Material and Classification Clarification:

- Ensure the material form (raw fluoropolymer vs. sulfurized rubber) is clearly defined.

-

Confirm whether the product is a finished O ring or raw material for further processing.

-

Certifications and Documentation:

- Verify if customs certifications (e.g., material composition, origin, etc.) are required.

-

Maintain product specifications and technical data sheets for customs inspection.

-

Cost Implications:

- The base tariff varies between 0.0% and 2.9%, but the total tax rate is 55.0% to 57.9% due to additional tariffs.

- Consider alternative sourcing or tariff exemptions if applicable.

Proactive Advice

- Verify the exact product form (raw fluoropolymer, sulfurized rubber, or finished O ring).

- Check the HS CODE with customs or a classification expert to avoid misclassification penalties.

- Monitor the April 11, 2025 deadline for tariff changes and plan accordingly.

- Review import documentation to ensure compliance with all customs regulations.

Product Classification: Fluororubber O Ring Raw Material

HS CODEs and Tax Information Overview

Below are the HS CODEs and corresponding tax details for fluororubber O rings based on their classification under the Harmonized System (HS):

1. HS CODE: 4016935010

- Description: Sulfurized rubber products, specifically fluororubber O rings.

- Total Tax Rate: 57.5%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for sulfurized rubber products.

2. HS CODE: 4008294000

- Description: Fluororubber O rings classified under non-cellular rubber profiles.

- Total Tax Rate: 57.9%

- Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for non-cellular rubber products.

3. HS CODE: 3904691000

- Description: Fluororubber O rings classified under fluoropolymer elastomers in their primary form (not sulfurized).

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw fluoropolymer materials, not finished products.

4. HS CODE: 4016935050

- Description: Sulfurized rubber products, specifically fluororubber O rings.

- Total Tax Rate: 57.5%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 4016935010, but may differ in specific product type or material composition.

5. HS CODE: 4008292000

- Description: Fluororubber O rings classified under non-cellular rubber profiles.

- Total Tax Rate: 57.9%

- Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for non-cellular rubber products, similar to 4008294000 but may differ in product form or application.

Key Observations and Recommendations

- Tariff Increase Alert:

- All codes are subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase import costs.

-

Material and Classification Clarification:

- Ensure the material form (raw fluoropolymer vs. sulfurized rubber) is clearly defined.

-

Confirm whether the product is a finished O ring or raw material for further processing.

-

Certifications and Documentation:

- Verify if customs certifications (e.g., material composition, origin, etc.) are required.

-

Maintain product specifications and technical data sheets for customs inspection.

-

Cost Implications:

- The base tariff varies between 0.0% and 2.9%, but the total tax rate is 55.0% to 57.9% due to additional tariffs.

- Consider alternative sourcing or tariff exemptions if applicable.

Proactive Advice

- Verify the exact product form (raw fluoropolymer, sulfurized rubber, or finished O ring).

- Check the HS CODE with customs or a classification expert to avoid misclassification penalties.

- Monitor the April 11, 2025 deadline for tariff changes and plan accordingly.

- Review import documentation to ensure compliance with all customs regulations.

Customer Reviews

No reviews yet.