| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4004000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4005910000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4006905000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Classification: Fluororubber Raw Material

HS CODE: 4002600000, 4004000000, 4005910000, 4006905000, 3904691000

🔍 Classification Overview

Fluororubber raw materials and related products fall under several HS codes depending on their form and processing stage. Below is a breakdown of the classifications and associated tariffs:

📌 HS Code 4002600000 – Fluororubber Raw Material (Synthetic Rubber)

- Description: Fluororubber raw material, classified as synthetic rubber.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is for raw fluororubber before any processing or compounding.

📌 HS Code 4004000000 – Fluororubber Powder (Rubber Waste, Powder, Granules)

- Description: Fluororubber powder, classified as rubber waste, powder, or granules (excluding hard rubber).

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Applicable to processed fluororubber in powder or granular form.

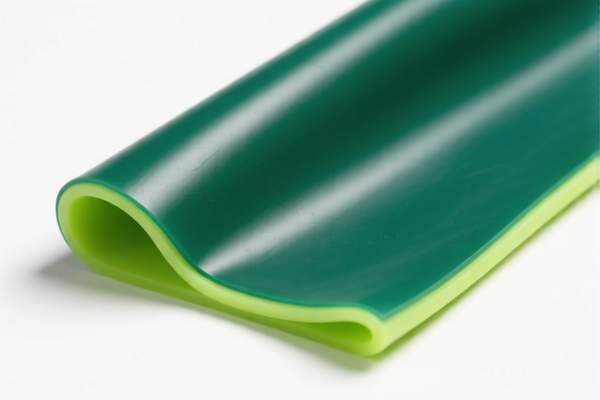

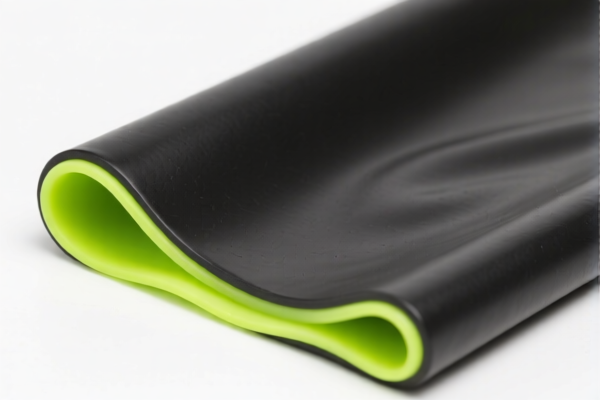

📌 HS Code 4005910000 – Fluororubber Sheets (Unvulcanized Composite Rubber Sheets)

- Description: Fluororubber sheets, classified as unvulcanized composite rubber sheets.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to semi-finished fluororubber sheets used in further manufacturing.

📌 HS Code 4006905000 – Fluororubber Profiles (Unvulcanized Rubber Products)

- Description: Fluororubber profiles, classified as unvulcanized rubber products in other forms (e.g., profiles).

- Total Tax Rate: 57.7%

- Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Higher base tariff compared to raw materials, due to semi-manufactured form.

📌 HS Code 3904691000 – Fluororubber Silicone Rubber (Halogenated Olefin Polymers)

- Description: Fluororubber silicone rubber, classified as halogenated olefin polymers (e.g., polyvinyl chloride).

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is for fluororubber in a different chemical form, such as silicone-based.

⚠️ Important Policy Alerts

- April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- Anti-dumping duties: Not applicable for fluororubber raw materials, but always verify for any new anti-dumping measures.

- Customs Compliance: Ensure the product is correctly classified based on its form (raw, powder, sheet, profile, etc.).

✅ Proactive Advice for Importers

- Verify Material Specifications: Confirm the exact chemical composition and form of the fluororubber (e.g., raw, powder, sheet, profile).

- Check Unit Price and Certification: Some fluororubber products may require specific certifications (e.g., RoHS, REACH).

- Monitor Tariff Updates: Stay informed about any changes in customs policies, especially after April 11, 2025.

- Consult a Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with a specific product description or customs documentation.

Product Classification: Fluororubber Raw Material

HS CODE: 4002600000, 4004000000, 4005910000, 4006905000, 3904691000

🔍 Classification Overview

Fluororubber raw materials and related products fall under several HS codes depending on their form and processing stage. Below is a breakdown of the classifications and associated tariffs:

📌 HS Code 4002600000 – Fluororubber Raw Material (Synthetic Rubber)

- Description: Fluororubber raw material, classified as synthetic rubber.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is for raw fluororubber before any processing or compounding.

📌 HS Code 4004000000 – Fluororubber Powder (Rubber Waste, Powder, Granules)

- Description: Fluororubber powder, classified as rubber waste, powder, or granules (excluding hard rubber).

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Applicable to processed fluororubber in powder or granular form.

📌 HS Code 4005910000 – Fluororubber Sheets (Unvulcanized Composite Rubber Sheets)

- Description: Fluororubber sheets, classified as unvulcanized composite rubber sheets.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to semi-finished fluororubber sheets used in further manufacturing.

📌 HS Code 4006905000 – Fluororubber Profiles (Unvulcanized Rubber Products)

- Description: Fluororubber profiles, classified as unvulcanized rubber products in other forms (e.g., profiles).

- Total Tax Rate: 57.7%

- Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Higher base tariff compared to raw materials, due to semi-manufactured form.

📌 HS Code 3904691000 – Fluororubber Silicone Rubber (Halogenated Olefin Polymers)

- Description: Fluororubber silicone rubber, classified as halogenated olefin polymers (e.g., polyvinyl chloride).

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification is for fluororubber in a different chemical form, such as silicone-based.

⚠️ Important Policy Alerts

- April 11, 2025 Special Tariff: All the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- Anti-dumping duties: Not applicable for fluororubber raw materials, but always verify for any new anti-dumping measures.

- Customs Compliance: Ensure the product is correctly classified based on its form (raw, powder, sheet, profile, etc.).

✅ Proactive Advice for Importers

- Verify Material Specifications: Confirm the exact chemical composition and form of the fluororubber (e.g., raw, powder, sheet, profile).

- Check Unit Price and Certification: Some fluororubber products may require specific certifications (e.g., RoHS, REACH).

- Monitor Tariff Updates: Stay informed about any changes in customs policies, especially after April 11, 2025.

- Consult a Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.