| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4005990000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

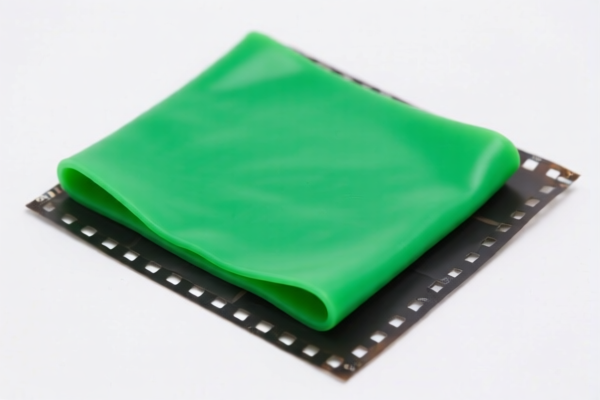

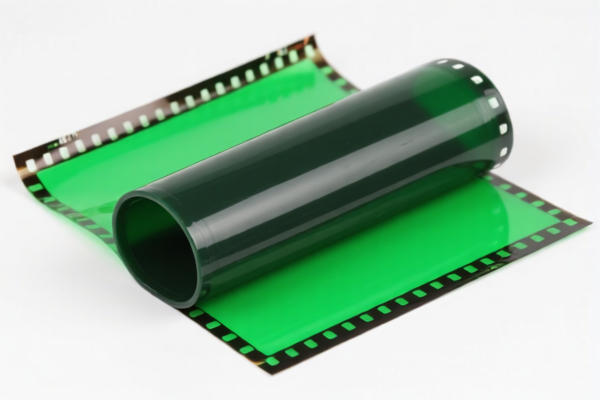

Product Classification: Fluororubber Raw Material for Film Forming

HS CODE: 4002600000, 3904691000, 4005990000 (multiple applicable codes based on specific product form)

🔍 Classification Summary

- Fluororubber raw material is classified under HS CODE 4002600000 (synthetic rubber in primary form) or 4005990000 (unvulcanized rubber compounds) depending on the form (e.g., granules, sheets).

- Fluororubber film or coating is classified under HS CODE 3904691000 (fluorinated ethylene propylene copolymer, as an elastomer).

📊 Tariff Overview

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025, and is likely related to trade policy adjustments or import restrictions.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact form of the fluororubber (e.g., raw granules, sheets, or coated films) to ensure correct HS code classification.

- Unit Price: Provide detailed pricing to support the classification and avoid disputes.

- Certifications: Check if technical specifications, material safety data sheets (MSDS), or customs declarations are required for fluororubber imports.

- Anti-dumping duties: Not applicable for fluororubber unless specific anti-dumping measures are in place (not indicated in this case).

- Documentation: Ensure proper commercial invoice, packing list, and product description align with the HS code and tariff classification.

✅ Proactive Advice

- Double-check the product form (raw material, film, coating) to ensure the correct HS code is used.

- Monitor policy updates after April 11, 2025, as the 30.0% additional tariff may affect cost and compliance.

- Consult a customs broker or import compliance expert if the product is part of a complex supply chain or subject to special regulations.

Let me know if you need help with customs documentation templates or tariff calculation tools.

Product Classification: Fluororubber Raw Material for Film Forming

HS CODE: 4002600000, 3904691000, 4005990000 (multiple applicable codes based on specific product form)

🔍 Classification Summary

- Fluororubber raw material is classified under HS CODE 4002600000 (synthetic rubber in primary form) or 4005990000 (unvulcanized rubber compounds) depending on the form (e.g., granules, sheets).

- Fluororubber film or coating is classified under HS CODE 3904691000 (fluorinated ethylene propylene copolymer, as an elastomer).

📊 Tariff Overview

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025, and is likely related to trade policy adjustments or import restrictions.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact form of the fluororubber (e.g., raw granules, sheets, or coated films) to ensure correct HS code classification.

- Unit Price: Provide detailed pricing to support the classification and avoid disputes.

- Certifications: Check if technical specifications, material safety data sheets (MSDS), or customs declarations are required for fluororubber imports.

- Anti-dumping duties: Not applicable for fluororubber unless specific anti-dumping measures are in place (not indicated in this case).

- Documentation: Ensure proper commercial invoice, packing list, and product description align with the HS code and tariff classification.

✅ Proactive Advice

- Double-check the product form (raw material, film, coating) to ensure the correct HS code is used.

- Monitor policy updates after April 11, 2025, as the 30.0% additional tariff may affect cost and compliance.

- Consult a customs broker or import compliance expert if the product is part of a complex supply chain or subject to special regulations.

Let me know if you need help with customs documentation templates or tariff calculation tools.

Customer Reviews

No reviews yet.