| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926904510 | Doc | 58.5% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

Here is the structured and professional analysis of the HS codes and tariff rates for Fluororubber Raw Material for Gaskets, based on your input:

✅ HS CODE: 4002600000

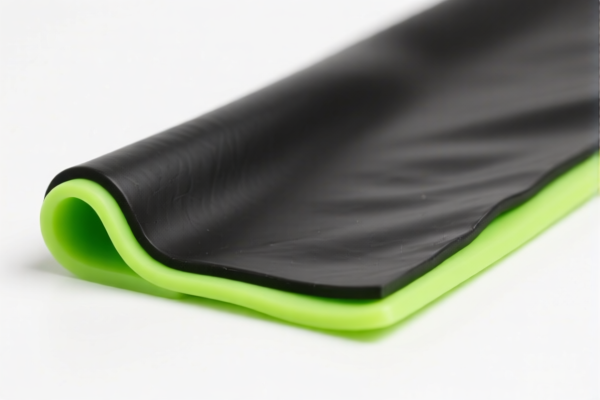

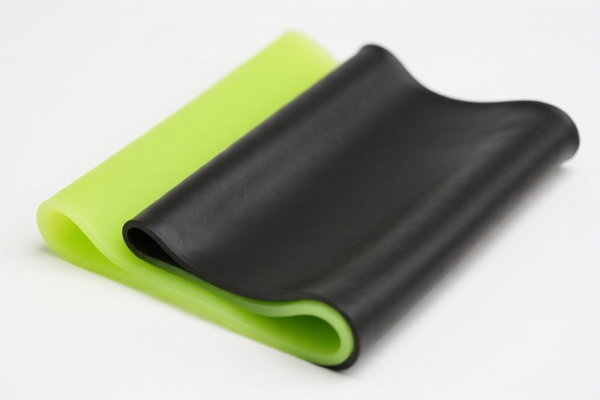

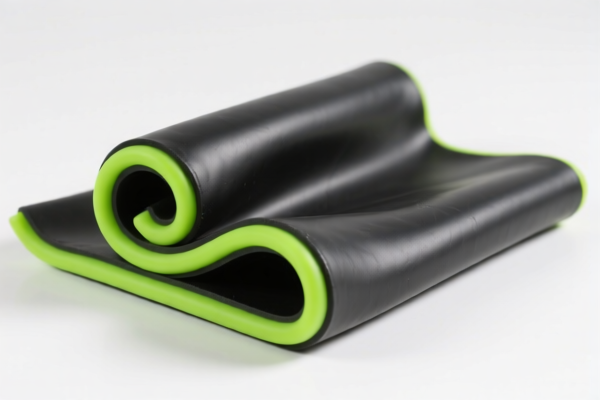

Product Description: Fluororubber raw material (synthetic rubber raw material)

Summary: Matches the product description.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- No anti-dumping duties or special tariffs on iron/aluminum apply.

- Proactive Advice: Confirm the material is indeed raw fluororubber and not a finished product.

✅ HS CODE: 3904695000

Product Description: Fluororubber gaskets (fluoropolymer)

Summary: Matches the description of fluoropolymer under HS 3904.

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Higher base tariff compared to raw materials.

- Proactive Advice: Verify if the product is a finished gasket or raw fluoropolymer.

✅ HS CODE: 3926904510

Product Description: Fluororubber gaskets (seals, O-rings, etc.)

Summary: Matches the description of seals and gaskets under HS 3926.

Total Tax Rate: 58.5%

Tax Breakdown:

- Base Tariff: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Lower base tariff than 3904695000.

- Proactive Advice: Ensure the product is classified as a seal or gasket and not a raw material.

✅ HS CODE: 3904691000

Product Description: Fluororubber gaskets (fluoropolymer)

Summary: Matches the description of fluoropolymer under HS 3904.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- No base tariff, but subject to additional and special tariffs.

- Proactive Advice: Confirm the product is a finished fluoropolymer gasket.

✅ HS CODE: 4008294000

Product Description: Fluororubber gasket assembly (rubber product)

Summary: Matches the description of vulcanized rubber products under HS 4008.

Total Tax Rate: 57.9%

Tax Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly higher base tariff than 4002600000.

- Proactive Advice: Confirm if the product is a complete assembly or individual gasket.

📌 General Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for fluororubber or rubber products.

- Certifications: Ensure compliance with any required certifications (e.g., RoHS, REACH, or customs documentation).

- Material Verification: Confirm whether the product is raw fluororubber or a finished gasket, as this significantly affects classification and tax rates.

- Unit Price: Verify the unit price and quantity for accurate customs valuation.

If you need further clarification on any of the HS codes or their application, feel free to ask. Here is the structured and professional analysis of the HS codes and tariff rates for Fluororubber Raw Material for Gaskets, based on your input:

✅ HS CODE: 4002600000

Product Description: Fluororubber raw material (synthetic rubber raw material)

Summary: Matches the product description.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- No anti-dumping duties or special tariffs on iron/aluminum apply.

- Proactive Advice: Confirm the material is indeed raw fluororubber and not a finished product.

✅ HS CODE: 3904695000

Product Description: Fluororubber gaskets (fluoropolymer)

Summary: Matches the description of fluoropolymer under HS 3904.

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Higher base tariff compared to raw materials.

- Proactive Advice: Verify if the product is a finished gasket or raw fluoropolymer.

✅ HS CODE: 3926904510

Product Description: Fluororubber gaskets (seals, O-rings, etc.)

Summary: Matches the description of seals and gaskets under HS 3926.

Total Tax Rate: 58.5%

Tax Breakdown:

- Base Tariff: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Lower base tariff than 3904695000.

- Proactive Advice: Ensure the product is classified as a seal or gasket and not a raw material.

✅ HS CODE: 3904691000

Product Description: Fluororubber gaskets (fluoropolymer)

Summary: Matches the description of fluoropolymer under HS 3904.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- No base tariff, but subject to additional and special tariffs.

- Proactive Advice: Confirm the product is a finished fluoropolymer gasket.

✅ HS CODE: 4008294000

Product Description: Fluororubber gasket assembly (rubber product)

Summary: Matches the description of vulcanized rubber products under HS 4008.

Total Tax Rate: 57.9%

Tax Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly higher base tariff than 4002600000.

- Proactive Advice: Confirm if the product is a complete assembly or individual gasket.

📌 General Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for fluororubber or rubber products.

- Certifications: Ensure compliance with any required certifications (e.g., RoHS, REACH, or customs documentation).

- Material Verification: Confirm whether the product is raw fluororubber or a finished gasket, as this significantly affects classification and tax rates.

- Unit Price: Verify the unit price and quantity for accurate customs valuation.

If you need further clarification on any of the HS codes or their application, feel free to ask.

Customer Reviews

No reviews yet.