| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4016935050 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4008292000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3926904510 | Doc | 58.5% | CN | US | 2025-05-12 |

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4016935010 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Classification: Fluororubber Raw Material for O Rings

HS CODE: 3904691000, 3904695000, 4008292000, 4008294000, 4016935010, 4016935050, 3926904510

🔍 Classification Overview

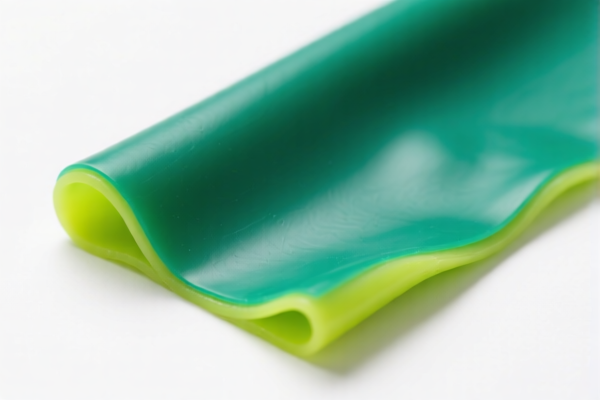

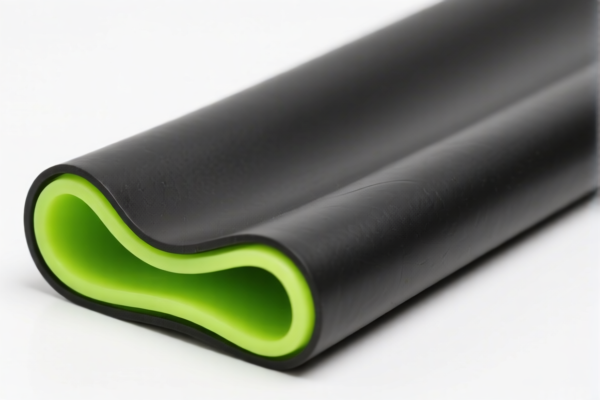

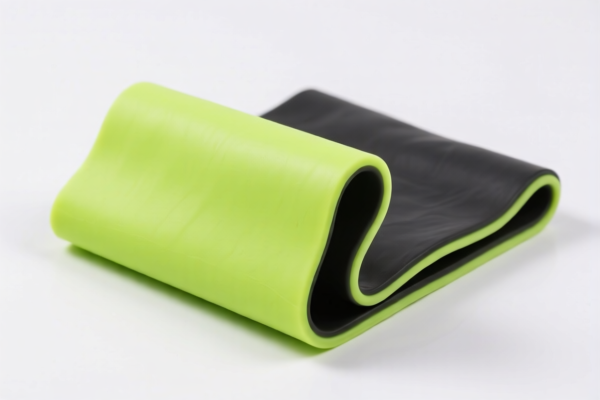

Fluororubber raw material for O rings is typically classified under HS codes 3904691000 or 3904695000 if it is in its original polymer form (e.g., fluoropolymer elastomers). If it is processed into finished O rings, it may fall under HS codes 4016935010 or 4016935050, which are for sulfurized rubber products such as O rings and seals.

📊 Tariff Summary (as of now)

- Base Tariff Rate: Varies from 0.0% to 6.5% depending on the HS code.

- Additional Tariff (General): 25.0% applied to all listed HS codes.

- Special Tariff (April 11, 2025 onwards): 30.0% added to the base and general tariffs.

- Total Tax Rate: Ranges from 55.0% to 61.5%, depending on the specific HS code.

📌 Key HS Codes and Tax Rates

| HS CODE | Description | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3904691000 | Fluoropolymer elastomers (raw material) | 0.0% | 25.0% | 30.0% | 55.0% |

| 3904695000 | Fluoropolymer (raw material) | 6.5% | 25.0% | 30.0% | 61.5% |

| 4008292000 | Rubber profiles (non-cellular) | 2.9% | 25.0% | 30.0% | 57.9% |

| 4008294000 | Other rubber profiles (includes fluor) | 2.9% | 25.0% | 30.0% | 57.9% |

| 4016935010 | O-rings made of fluororubber | 2.5% | 25.0% | 30.0% | 57.5% |

| 4016935050 | Other sulfurized rubber seals | 2.5% | 25.0% | 30.0% | 57.5% |

| 3926904510 | Seals, gaskets, O-rings (processed) | 3.5% | 25.0% | 30.0% | 58.5% |

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify with customs or a compliance expert if importing from specific countries.

- Material Verification: Confirm whether the product is in raw polymer form (e.g., fluoropolymer) or processed into O rings (sulfurized rubber), as this will determine the correct HS code.

- Certifications: Some HS codes may require technical documentation, material specifications, or certifications (e.g., RoHS, REACH) depending on the importing country.

✅ Proactive Advice for Importers

- Verify the exact material composition (e.g., fluororubber, fluoropolymer, sulfurized rubber).

- Check the unit of measurement (e.g., kg, piece) to ensure correct classification.

- Review the product’s end use (e.g., industrial, automotive) to determine if any special regulations apply.

- Consult a customs broker or compliance expert for HS code confirmation and documentation requirements.

Let me know if you need help with HS code selection or customs documentation!

Product Classification: Fluororubber Raw Material for O Rings

HS CODE: 3904691000, 3904695000, 4008292000, 4008294000, 4016935010, 4016935050, 3926904510

🔍 Classification Overview

Fluororubber raw material for O rings is typically classified under HS codes 3904691000 or 3904695000 if it is in its original polymer form (e.g., fluoropolymer elastomers). If it is processed into finished O rings, it may fall under HS codes 4016935010 or 4016935050, which are for sulfurized rubber products such as O rings and seals.

📊 Tariff Summary (as of now)

- Base Tariff Rate: Varies from 0.0% to 6.5% depending on the HS code.

- Additional Tariff (General): 25.0% applied to all listed HS codes.

- Special Tariff (April 11, 2025 onwards): 30.0% added to the base and general tariffs.

- Total Tax Rate: Ranges from 55.0% to 61.5%, depending on the specific HS code.

📌 Key HS Codes and Tax Rates

| HS CODE | Description | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3904691000 | Fluoropolymer elastomers (raw material) | 0.0% | 25.0% | 30.0% | 55.0% |

| 3904695000 | Fluoropolymer (raw material) | 6.5% | 25.0% | 30.0% | 61.5% |

| 4008292000 | Rubber profiles (non-cellular) | 2.9% | 25.0% | 30.0% | 57.9% |

| 4008294000 | Other rubber profiles (includes fluor) | 2.9% | 25.0% | 30.0% | 57.9% |

| 4016935010 | O-rings made of fluororubber | 2.5% | 25.0% | 30.0% | 57.5% |

| 4016935050 | Other sulfurized rubber seals | 2.5% | 25.0% | 30.0% | 57.5% |

| 3926904510 | Seals, gaskets, O-rings (processed) | 3.5% | 25.0% | 30.0% | 58.5% |

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify with customs or a compliance expert if importing from specific countries.

- Material Verification: Confirm whether the product is in raw polymer form (e.g., fluoropolymer) or processed into O rings (sulfurized rubber), as this will determine the correct HS code.

- Certifications: Some HS codes may require technical documentation, material specifications, or certifications (e.g., RoHS, REACH) depending on the importing country.

✅ Proactive Advice for Importers

- Verify the exact material composition (e.g., fluororubber, fluoropolymer, sulfurized rubber).

- Check the unit of measurement (e.g., kg, piece) to ensure correct classification.

- Review the product’s end use (e.g., industrial, automotive) to determine if any special regulations apply.

- Consult a customs broker or compliance expert for HS code confirmation and documentation requirements.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.