| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926904510 | Doc | 58.5% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008292000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 4016996050 | Doc | 57.5% | CN | US | 2025-05-12 |

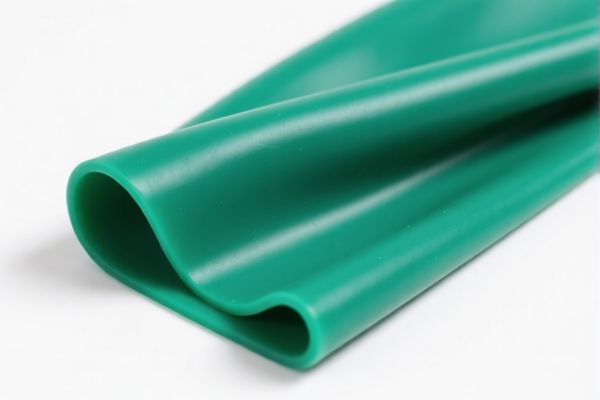

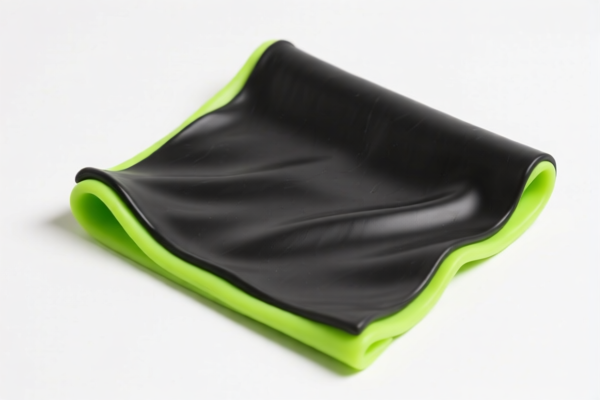

Product Name: Fluororubber Raw Material for Seals

Classification: Based on the provided HS codes and summaries, fluororubber raw material for seals can be classified under several HS codes depending on the specific application (e.g., industrial, building, chemical, or valve seals). Below is a structured breakdown of the relevant HS codes and their associated tax rates.

🔍 HS Code Classification Overview

- HS Code 3904.69.50.00

- Description: Fluororubber seals classified under halogenated olefins polymer (Chapter 3904).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff compared to other codes.

-

HS Code 3926.90.45.10

- Description: Fluororubber seals classified under plastic products (Chapter 3926).

- Total Tax Rate: 58.5%

- Breakdown:

- Base Tariff: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff than 3904.69.50.00.

-

HS Code 3904.69.10.00

- Description: Fluororubber industrial or building seals (Chapter 3904).

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Zero base tariff, but still subject to additional and special tariffs.

-

HS Code 4008.29.20.00

- Description: Fluororubber seals for chemical equipment (Chapter 4008).

- Total Tax Rate: 57.9%

- Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff than 3904.69.10.00.

-

HS Code 4016.99.60.50

- Description: Fluororubber seals for valves (Chapter 4016).

- Total Tax Rate: 57.5%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff than 4008.29.20.00.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for fluororubber raw materials in the provided data. However, it is advisable to verify if any anti-dumping measures apply based on the country of origin and product specifics. -

Certifications and Documentation:

- Ensure the product is correctly classified under the appropriate HS code based on its end-use (e.g., industrial, building, chemical, or valve seals).

- Verify material composition and unit price for accurate customs valuation.

- Confirm if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

✅ Proactive Advice

- Double-check the HS code based on the specific application of the fluororubber seals (e.g., industrial vs. building vs. chemical).

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult with customs brokers or legal advisors if the product is subject to anti-dumping or countervailing duties.

- Maintain detailed documentation on the product’s material, origin, and intended use to support customs compliance.

Let me know if you need help determining the most suitable HS code for your specific fluororubber seal application.

Product Name: Fluororubber Raw Material for Seals

Classification: Based on the provided HS codes and summaries, fluororubber raw material for seals can be classified under several HS codes depending on the specific application (e.g., industrial, building, chemical, or valve seals). Below is a structured breakdown of the relevant HS codes and their associated tax rates.

🔍 HS Code Classification Overview

- HS Code 3904.69.50.00

- Description: Fluororubber seals classified under halogenated olefins polymer (Chapter 3904).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff compared to other codes.

-

HS Code 3926.90.45.10

- Description: Fluororubber seals classified under plastic products (Chapter 3926).

- Total Tax Rate: 58.5%

- Breakdown:

- Base Tariff: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff than 3904.69.50.00.

-

HS Code 3904.69.10.00

- Description: Fluororubber industrial or building seals (Chapter 3904).

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Zero base tariff, but still subject to additional and special tariffs.

-

HS Code 4008.29.20.00

- Description: Fluororubber seals for chemical equipment (Chapter 4008).

- Total Tax Rate: 57.9%

- Breakdown:

- Base Tariff: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff than 3904.69.10.00.

-

HS Code 4016.99.60.50

- Description: Fluororubber seals for valves (Chapter 4016).

- Total Tax Rate: 57.5%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff than 4008.29.20.00.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for fluororubber raw materials in the provided data. However, it is advisable to verify if any anti-dumping measures apply based on the country of origin and product specifics. -

Certifications and Documentation:

- Ensure the product is correctly classified under the appropriate HS code based on its end-use (e.g., industrial, building, chemical, or valve seals).

- Verify material composition and unit price for accurate customs valuation.

- Confirm if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

✅ Proactive Advice

- Double-check the HS code based on the specific application of the fluororubber seals (e.g., industrial vs. building vs. chemical).

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult with customs brokers or legal advisors if the product is subject to anti-dumping or countervailing duties.

- Maintain detailed documentation on the product’s material, origin, and intended use to support customs compliance.

Let me know if you need help determining the most suitable HS code for your specific fluororubber seal application.

Customer Reviews

No reviews yet.