Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4009110000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4006905000 | Doc | 57.7% | CN | US | 2025-05-12 |

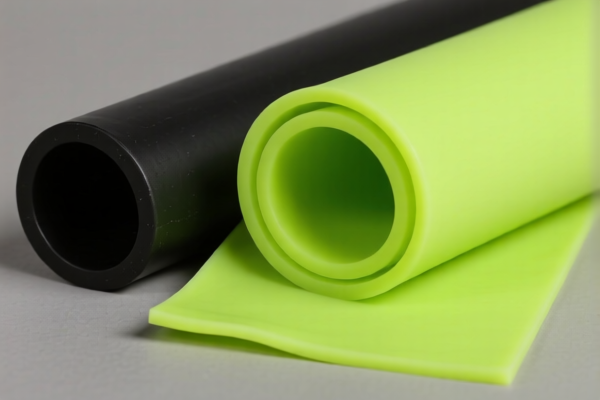

Product Classification: Fluororubber Raw Material for Tubing Extrusion

HS CODE: 3904691000, 4002600000, 3904695000, 4009110000, 4006905000

🔍 Classification Overview

The product "Fluororubber Raw Material for Tubing Extrusion" can be classified under several HS codes depending on its form and intended use. Below is a breakdown of the relevant classifications and their associated tariffs:

📌 HS Code 3904691000

- Description: Fluororubber extrusion profiles, in the primary form of halogenated olefin polymers, classified as elastomers.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is suitable for fluororubber in its raw, unprocessed form intended for extrusion.

📌 HS Code 4002600000

- Description: Fluororubber raw material, classified as synthetic rubber raw material.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general classification for fluororubber as a raw material for synthetic rubber production.

📌 HS Code 3904695000

- Description: Fluororubber tubes, in the primary form of polyvinyl chloride or other halogenated olefins.

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to fluororubber tubes in their primary (unprocessed) form.

📌 HS Code 4009110000

- Description: Fluororubber tubes, classified as rubber tubes or hoses, vulcanized rubber.

- Total Tax Rate: 57.5%

- Tariff Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for fluororubber tubes that have been vulcanized (processed).

📌 HS Code 4006905000

- Description: Fluororubber tubes, classified as other forms and products of unvulcanized rubber.

- Total Tax Rate: 57.7%

- Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to fluororubber tubes that are unvulcanized and in a semi-finished state.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All classifications are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Material Verification: Confirm the exact chemical composition and processing stage of the fluororubber (e.g., raw, unvulcanized, vulcanized) to ensure correct HS code selection.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Unit Price: Verify the unit price and whether it includes processing or finishing, as this may affect classification.

✅ Proactive Advice

- Consult a customs broker or HS code expert for confirmation, especially if the product is in a transitional or ambiguous classification.

- Keep records of material specifications, processing steps, and supplier documentation to support customs declarations.

Product Classification: Fluororubber Raw Material for Tubing Extrusion

HS CODE: 3904691000, 4002600000, 3904695000, 4009110000, 4006905000

🔍 Classification Overview

The product "Fluororubber Raw Material for Tubing Extrusion" can be classified under several HS codes depending on its form and intended use. Below is a breakdown of the relevant classifications and their associated tariffs:

📌 HS Code 3904691000

- Description: Fluororubber extrusion profiles, in the primary form of halogenated olefin polymers, classified as elastomers.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is suitable for fluororubber in its raw, unprocessed form intended for extrusion.

📌 HS Code 4002600000

- Description: Fluororubber raw material, classified as synthetic rubber raw material.

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general classification for fluororubber as a raw material for synthetic rubber production.

📌 HS Code 3904695000

- Description: Fluororubber tubes, in the primary form of polyvinyl chloride or other halogenated olefins.

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to fluororubber tubes in their primary (unprocessed) form.

📌 HS Code 4009110000

- Description: Fluororubber tubes, classified as rubber tubes or hoses, vulcanized rubber.

- Total Tax Rate: 57.5%

- Tariff Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for fluororubber tubes that have been vulcanized (processed).

📌 HS Code 4006905000

- Description: Fluororubber tubes, classified as other forms and products of unvulcanized rubber.

- Total Tax Rate: 57.7%

- Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies to fluororubber tubes that are unvulcanized and in a semi-finished state.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All classifications are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Material Verification: Confirm the exact chemical composition and processing stage of the fluororubber (e.g., raw, unvulcanized, vulcanized) to ensure correct HS code selection.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Unit Price: Verify the unit price and whether it includes processing or finishing, as this may affect classification.

✅ Proactive Advice

- Consult a customs broker or HS code expert for confirmation, especially if the product is in a transitional or ambiguous classification.

- Keep records of material specifications, processing steps, and supplier documentation to support customs declarations.

Customer Reviews

No reviews yet.