| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4002600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4004000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4005910000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance guidance for Fluororubber Sheet Raw Material, based on the provided HS codes and tax details:

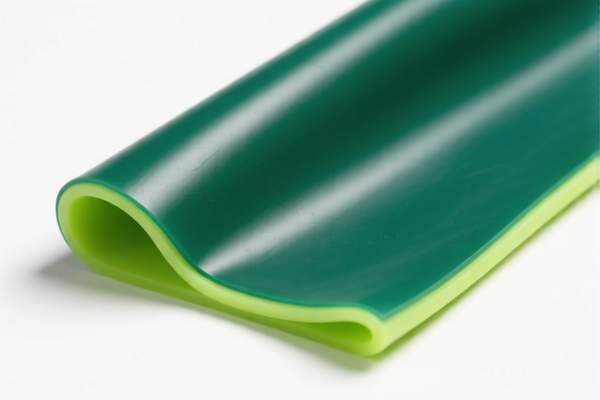

✅ Product Classification Overview: Fluororubber Sheet Raw Material

The product is classified under several HS codes depending on its form and processing stage. Below are the key classifications and associated customs duties:

🔢 HS Code Breakdown and Tax Rates

1. HS Code: 4002600000

- Description: Fluororubber raw material (synthetic rubber raw material)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This is the most appropriate classification for fluororubber raw material.

2. HS Code: 4004000000

- Description: Fluororubber powder (rubber waste, scraps, and trimmings, excluding hard rubber, and derived powders and granules)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies if the product is in powder or granular form.

3. HS Code: 4005910000

- Description: Fluororubber sheets (unvulcanized composite rubber sheets)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies to unvulcanized fluororubber sheets.

4. HS Code: 3904691000

- Description: Fluororubber sheets (original form of halogenated olefins polymer, classified as elastomers)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies to fluoropolymer elastomers in original form.

5. HS Code: 3904695000

- Description: Fluororubber sheets (primary form of polyvinyl chloride or other halogenated olefins polymer)

- Total Tax Rate: 61.5%

- Tax Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies to fluororubber sheets made from PVC or other halogenated olefins.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for fluororubber in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin.

📌 Proactive Compliance Advice

-

Verify Material and Unit Price:

Confirm the exact chemical composition and processing stage of the fluororubber (e.g., raw material, powder, unvulcanized sheet, or finished product) to ensure correct HS code classification. -

Check Required Certifications:

Some fluororubber products may require technical specifications, safety data sheets (SDS), or customs declarations for hazardous materials, depending on the country of import. -

Consult with Customs Broker:

For high-value or complex fluororubber products, it is recommended to engage a customs broker to ensure compliance with all import regulations and avoid delays or penalties.

Let me know if you need help with HS code selection based on specific product details or documentation. Here is the structured analysis and customs compliance guidance for Fluororubber Sheet Raw Material, based on the provided HS codes and tax details:

✅ Product Classification Overview: Fluororubber Sheet Raw Material

The product is classified under several HS codes depending on its form and processing stage. Below are the key classifications and associated customs duties:

🔢 HS Code Breakdown and Tax Rates

1. HS Code: 4002600000

- Description: Fluororubber raw material (synthetic rubber raw material)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This is the most appropriate classification for fluororubber raw material.

2. HS Code: 4004000000

- Description: Fluororubber powder (rubber waste, scraps, and trimmings, excluding hard rubber, and derived powders and granules)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies if the product is in powder or granular form.

3. HS Code: 4005910000

- Description: Fluororubber sheets (unvulcanized composite rubber sheets)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies to unvulcanized fluororubber sheets.

4. HS Code: 3904691000

- Description: Fluororubber sheets (original form of halogenated olefins polymer, classified as elastomers)

- Total Tax Rate: 55.0%

- Tax Details:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies to fluoropolymer elastomers in original form.

5. HS Code: 3904695000

- Description: Fluororubber sheets (primary form of polyvinyl chloride or other halogenated olefins polymer)

- Total Tax Rate: 61.5%

- Tax Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This applies to fluororubber sheets made from PVC or other halogenated olefins.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for fluororubber in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin.

📌 Proactive Compliance Advice

-

Verify Material and Unit Price:

Confirm the exact chemical composition and processing stage of the fluororubber (e.g., raw material, powder, unvulcanized sheet, or finished product) to ensure correct HS code classification. -

Check Required Certifications:

Some fluororubber products may require technical specifications, safety data sheets (SDS), or customs declarations for hazardous materials, depending on the country of import. -

Consult with Customs Broker:

For high-value or complex fluororubber products, it is recommended to engage a customs broker to ensure compliance with all import regulations and avoid delays or penalties.

Let me know if you need help with HS code selection based on specific product details or documentation.

Customer Reviews

No reviews yet.