| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

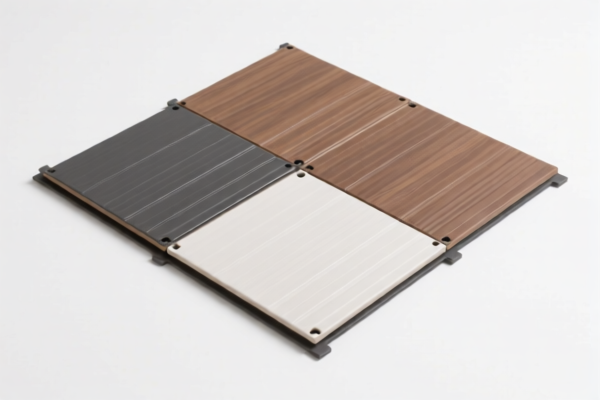

Product Classification: Foamed PVC Floor Tiles

HS CODEs and Tax Details:

- HS CODE: 3918101020

- Product Description: Anti-slip PVC floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101030

- Product Description: Anti-slip PVC floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101040

- Product Description: Waterproof PVC floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918901000

- Product Description: Foam floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Product Description: PVC foam board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PVC floor tiles or foam boards in the provided data. However, it is advisable to confirm with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Material and Certification Requirements:

Verify the material composition (e.g., PVC content, additives, foam density) and unit price to ensure correct classification. Some HS codes may require certifications (e.g., fire resistance, environmental standards) depending on the end-use or import country regulations.

✅ Proactive Advice:

- Double-check the product description to ensure it matches the HS code used (e.g., "foam" vs. "anti-slip" vs. "waterproof").

- Consult with customs or a compliance expert if your product includes additives or is used in specific applications (e.g., commercial vs. residential).

-

Plan for the April 11, 2025 tariff increase to avoid unexpected costs in your import budget. Product Classification: Foamed PVC Floor Tiles

HS CODEs and Tax Details: -

HS CODE: 3918101020

- Product Description: Anti-slip PVC floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101030

- Product Description: Anti-slip PVC floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101040

- Product Description: Waterproof PVC floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918901000

- Product Description: Foam floor tiles

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Product Description: PVC foam board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PVC floor tiles or foam boards in the provided data. However, it is advisable to confirm with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Material and Certification Requirements:

Verify the material composition (e.g., PVC content, additives, foam density) and unit price to ensure correct classification. Some HS codes may require certifications (e.g., fire resistance, environmental standards) depending on the end-use or import country regulations.

✅ Proactive Advice:

- Double-check the product description to ensure it matches the HS code used (e.g., "foam" vs. "anti-slip" vs. "waterproof").

- Consult with customs or a compliance expert if your product includes additives or is used in specific applications (e.g., commercial vs. residential).

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs in your import budget.

Customer Reviews

No reviews yet.