| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3923290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923300090 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the detailed customs compliance analysis for Food Grade PET Plastic Sheet and related products, based on the provided HS codes and tax information:

📌 Product Classification Overview

The product "Food Grade PET Plastic Sheet" falls under several HS codes depending on its specific form and use. Below are the classifications and associated tax details:

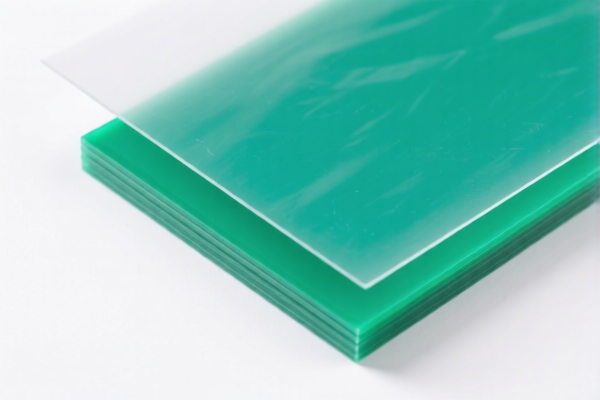

🔢 HS Code: 3920620090

Product Description: PET Plastic Food-Grade Film

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 4.2% + 25.0% + 30.0% = 59.2%

🔢 HS Code: 3921904090

Product Description: Plastic Food-Grade Film

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 4.2% + 0.0% + 30.0% = 34.2%

🔢 HS Code: 3923290000

Product Description: Food-Grade Plastic Bags

Total Tax Rate: 58.0%

Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 3.0% + 25.0% + 30.0% = 58.0%

🔢 HS Code: 3923300090

Product Description: Food-Grade Plastic Bottles

Total Tax Rate: 58.0%

Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 3.0% + 25.0% + 30.0% = 58.0%

🔢 HS Code: 3903190000

Product Description: Food-Grade Polystyrene Granules

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 6.5% + 25.0% + 30.0% = 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these products. However, it is advisable to confirm with customs or a trade compliance expert if the product is subject to any ongoing anti-dumping investigations.

📌 Proactive Advice for Importers

-

Verify Material and Unit Price:

Ensure the product is indeed food-grade PET and not a different polymer (e.g., polystyrene or polyethylene), as this can affect the correct HS code. -

Check Required Certifications:

Food-grade products may require food safety certifications (e.g., FDA, GB standards) for import compliance. -

Review Tariff Changes:

Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider engaging a customs broker to ensure accurate classification and compliance.

Let me know if you need help determining the correct HS code for a specific product variant or packaging. Here is the detailed customs compliance analysis for Food Grade PET Plastic Sheet and related products, based on the provided HS codes and tax information:

📌 Product Classification Overview

The product "Food Grade PET Plastic Sheet" falls under several HS codes depending on its specific form and use. Below are the classifications and associated tax details:

🔢 HS Code: 3920620090

Product Description: PET Plastic Food-Grade Film

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 4.2% + 25.0% + 30.0% = 59.2%

🔢 HS Code: 3921904090

Product Description: Plastic Food-Grade Film

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 4.2% + 0.0% + 30.0% = 34.2%

🔢 HS Code: 3923290000

Product Description: Food-Grade Plastic Bags

Total Tax Rate: 58.0%

Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 3.0% + 25.0% + 30.0% = 58.0%

🔢 HS Code: 3923300090

Product Description: Food-Grade Plastic Bottles

Total Tax Rate: 58.0%

Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 3.0% + 25.0% + 30.0% = 58.0%

🔢 HS Code: 3903190000

Product Description: Food-Grade Polystyrene Granules

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total: 6.5% + 25.0% + 30.0% = 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these products. However, it is advisable to confirm with customs or a trade compliance expert if the product is subject to any ongoing anti-dumping investigations.

📌 Proactive Advice for Importers

-

Verify Material and Unit Price:

Ensure the product is indeed food-grade PET and not a different polymer (e.g., polystyrene or polyethylene), as this can affect the correct HS code. -

Check Required Certifications:

Food-grade products may require food safety certifications (e.g., FDA, GB standards) for import compliance. -

Review Tariff Changes:

Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider engaging a customs broker to ensure accurate classification and compliance.

Let me know if you need help determining the correct HS code for a specific product variant or packaging.

Customer Reviews

No reviews yet.