| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

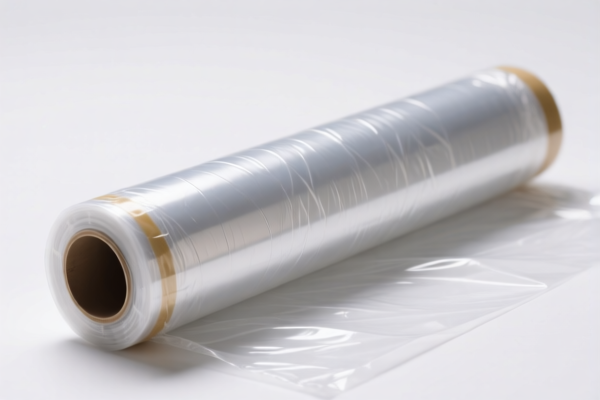

Here is the structured analysis and classification for Food Grade Plastic Film based on the provided HS codes and tariff details:

📦 Product Classification Overview: Food Grade Plastic Film

Below are the HS codes and associated tariff details for various types of plastic films, including food-grade films:

🔢 HS Code: 3921904090

Description: Other plastic sheets, plates, films, foils and strips, flexible plastic films, not specially reinforced

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for general flexible plastic films, not specifically for food-grade materials.

- Action Required: Verify if the film is food-grade and whether it requires specific certifications (e.g., FDA, ISO 22000).

🔢 HS Code: 3920620090

Description: Plastic films made of polyethylene terephthalate (PET), non-cellular and not reinforced

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: PET films are commonly used in food packaging.

- Action Required: Confirm if the film is used for food contact and ensure compliance with food safety regulations.

🔢 HS Code: 3920690000

Description: Non-cellular and not reinforced plastic sheets, plates, films, foils and strips, polyester materials

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: This includes polyester-based films, which may be used in food packaging.

- Action Required: Ensure the film is suitable for food contact and meets relevant standards.

🔢 HS Code: 3920100000

Description: Plastic films made of polyethylene

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: Polyethylene films are widely used in food packaging.

- Action Required: Confirm if the film is food-grade and whether it requires specific certifications.

🔢 HS Code: 3920991000

Description: Other plastics, polypropylene films

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: Polypropylene films are often used in food packaging due to their heat resistance.

- Action Required: Verify if the film is food-grade and ensure compliance with food safety regulations.

📌 Proactive Advice for Users:

- Material Verification: Confirm the exact material (e.g., PET, PE, PP) and whether it is food-grade.

- Certifications: Ensure the product meets food safety standards (e.g., FDA, ISO 22000, GB 9685).

- Tariff Changes: Be aware of the April 11, 2025 special tariff increase of 30.0% for all listed HS codes.

- Documentation: Prepare proper documentation (e.g., material safety data sheets, certifications) for customs clearance.

- Consultation: If unsure, consult a customs broker or regulatory expert for accurate classification and compliance.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured analysis and classification for Food Grade Plastic Film based on the provided HS codes and tariff details:

📦 Product Classification Overview: Food Grade Plastic Film

Below are the HS codes and associated tariff details for various types of plastic films, including food-grade films:

🔢 HS Code: 3921904090

Description: Other plastic sheets, plates, films, foils and strips, flexible plastic films, not specially reinforced

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: This code is for general flexible plastic films, not specifically for food-grade materials.

- Action Required: Verify if the film is food-grade and whether it requires specific certifications (e.g., FDA, ISO 22000).

🔢 HS Code: 3920620090

Description: Plastic films made of polyethylene terephthalate (PET), non-cellular and not reinforced

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: PET films are commonly used in food packaging.

- Action Required: Confirm if the film is used for food contact and ensure compliance with food safety regulations.

🔢 HS Code: 3920690000

Description: Non-cellular and not reinforced plastic sheets, plates, films, foils and strips, polyester materials

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: This includes polyester-based films, which may be used in food packaging.

- Action Required: Ensure the film is suitable for food contact and meets relevant standards.

🔢 HS Code: 3920100000

Description: Plastic films made of polyethylene

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: Polyethylene films are widely used in food packaging.

- Action Required: Confirm if the film is food-grade and whether it requires specific certifications.

🔢 HS Code: 3920991000

Description: Other plastics, polypropylene films

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Anti-dumping duties: Not applicable

- Note: Polypropylene films are often used in food packaging due to their heat resistance.

- Action Required: Verify if the film is food-grade and ensure compliance with food safety regulations.

📌 Proactive Advice for Users:

- Material Verification: Confirm the exact material (e.g., PET, PE, PP) and whether it is food-grade.

- Certifications: Ensure the product meets food safety standards (e.g., FDA, ISO 22000, GB 9685).

- Tariff Changes: Be aware of the April 11, 2025 special tariff increase of 30.0% for all listed HS codes.

- Documentation: Prepare proper documentation (e.g., material safety data sheets, certifications) for customs clearance.

- Consultation: If unsure, consult a customs broker or regulatory expert for accurate classification and compliance.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.