| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3923290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 4811514000 | Doc | 55.0% | CN | US | 2025-05-12 |

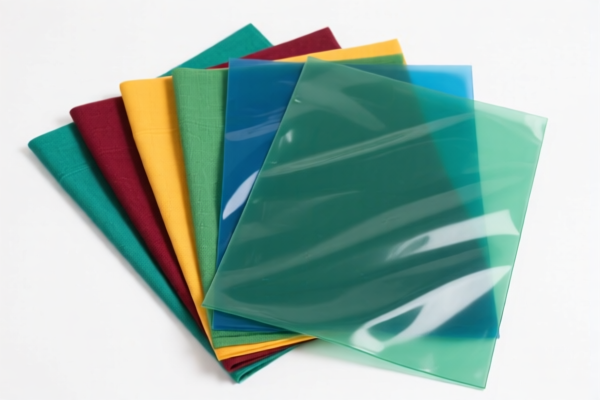

Here is the structured classification and tariff information for Food Grade Textile Plastic Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3921902550

Product Description: Food-grade textile plastic sheets, where the plastic content exceeds 70%, and the textile component contains synthetic fibers in greater weight than any other single fiber type, with a weight of more than 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This classification applies to composite materials with a significant plastic component.

- Ensure the product meets the weight and fiber composition criteria for this HS code.

- Verify if any anti-dumping duties apply (not specified here, but always check for specific product origin).

✅ HS CODE: 3921904090

Product Description: Food-grade plastic film, classified under "Other plastic sheets, plates, films, foils and strips" (flexible plastic film), without specific reinforcement materials.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Key Notes:

- This code is suitable for thin, flexible plastic films used in food packaging.

- No additional tariffs are currently applied (as of now).

- Confirm the product is not reinforced with other materials, as that may change the classification.

✅ HS CODE: 3923290000

Product Description: Food-grade plastic bags, used for packaging or transporting goods, made of plastic that meets food safety standards.

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

- Key Notes:

- This code is for general-purpose plastic bags, including those used in food packaging.

- Ensure the product is not classified under a more specific HS code (e.g., 3921 for composite materials).

- Confirm compliance with food safety regulations and certifications (e.g., FDA, GB standards).

✅ HS CODE: 3921902900

Product Description: Plastic-textile composite sheets, which are a combination of plastic and textile materials.

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.4%

- Key Notes:

- This code is for composite materials where the plastic content is significant but not as high as in 3921902550.

- Ensure the product is not classified under a more specific code (e.g., 3921902550 for higher plastic content).

- Verify the material composition and weight ratio to avoid misclassification.

✅ HS CODE: 4811514000

Product Description: Food-grade plastic-coated paper, which is paper or paperboard coated with plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code is for paper products with a plastic coating, suitable for food packaging.

- Ensure the product is not classified as a plastic film or composite material.

- Confirm the coating thickness and material composition to avoid misclassification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product meets the specific HS code criteria (e.g., weight, fiber content, plastic percentage).

- Check Certifications: Confirm that the product complies with food safety standards (e.g., FDA, GB, etc.).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs.

- Consult Customs Authorities: For complex or borderline cases, seek clarification from local customs or a customs broker.

- Document Everything: Keep records of product specifications, certifications, and tariff calculations for customs audits.

Let me know if you need help with a specific product or further clarification on any of these HS codes. Here is the structured classification and tariff information for Food Grade Textile Plastic Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3921902550

Product Description: Food-grade textile plastic sheets, where the plastic content exceeds 70%, and the textile component contains synthetic fibers in greater weight than any other single fiber type, with a weight of more than 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This classification applies to composite materials with a significant plastic component.

- Ensure the product meets the weight and fiber composition criteria for this HS code.

- Verify if any anti-dumping duties apply (not specified here, but always check for specific product origin).

✅ HS CODE: 3921904090

Product Description: Food-grade plastic film, classified under "Other plastic sheets, plates, films, foils and strips" (flexible plastic film), without specific reinforcement materials.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Key Notes:

- This code is suitable for thin, flexible plastic films used in food packaging.

- No additional tariffs are currently applied (as of now).

- Confirm the product is not reinforced with other materials, as that may change the classification.

✅ HS CODE: 3923290000

Product Description: Food-grade plastic bags, used for packaging or transporting goods, made of plastic that meets food safety standards.

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

- Key Notes:

- This code is for general-purpose plastic bags, including those used in food packaging.

- Ensure the product is not classified under a more specific HS code (e.g., 3921 for composite materials).

- Confirm compliance with food safety regulations and certifications (e.g., FDA, GB standards).

✅ HS CODE: 3921902900

Product Description: Plastic-textile composite sheets, which are a combination of plastic and textile materials.

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.4%

- Key Notes:

- This code is for composite materials where the plastic content is significant but not as high as in 3921902550.

- Ensure the product is not classified under a more specific code (e.g., 3921902550 for higher plastic content).

- Verify the material composition and weight ratio to avoid misclassification.

✅ HS CODE: 4811514000

Product Description: Food-grade plastic-coated paper, which is paper or paperboard coated with plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code is for paper products with a plastic coating, suitable for food packaging.

- Ensure the product is not classified as a plastic film or composite material.

- Confirm the coating thickness and material composition to avoid misclassification.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product meets the specific HS code criteria (e.g., weight, fiber content, plastic percentage).

- Check Certifications: Confirm that the product complies with food safety standards (e.g., FDA, GB, etc.).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs.

- Consult Customs Authorities: For complex or borderline cases, seek clarification from local customs or a customs broker.

- Document Everything: Keep records of product specifications, certifications, and tariff calculations for customs audits.

Let me know if you need help with a specific product or further clarification on any of these HS codes.

Customer Reviews

No reviews yet.