| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7020006000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 8205600000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your "GLASS CUTTING DISC" declaration. Here's a structured analysis to help you understand the classification and potential costs:

Understanding HS Codes – A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits can vary by country. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific grouping within the chapter.

- Subheading (First 6 digits): Even more detailed classification.

- Additional Digits: Country-specific for further refinement.

Analysis of Your HS Codes

Let's examine each code provided:

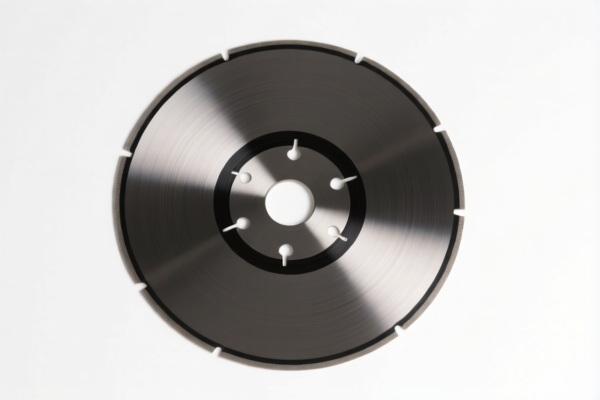

1. 7020.00.60.00 – Other articles of glass: Other

- Chapter 70: Glass and glass articles.

- Heading 7020: Other articles of glass. This is a broad category.

- Subheading 7020.00.60.00: Specifically, "Other" glass articles.

- Tax:

- Basic Duty: 5.0%

- Additional Tariff: 25.0% (Currently)

- Additional Tariff (Post April 2, 2025): 30.0%

- Total Tax: 60.0%

- Considerations: This code is quite general. It's crucial to confirm if your glass cutting disc truly falls under "other" articles. The composition of the glass (e.g., tempered, laminated) and its specific function could lead to a more accurate classification.

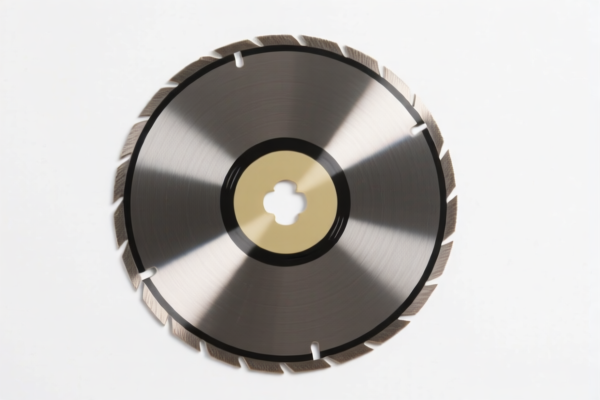

2. 8205.60.00.00 – Handtools (including glass cutters) not elsewhere specified or included; blow torches and similar self-contained torches; vises, clamps and the like, other than accessories for and parts of machine tools or water-jet cutting machines; anvils; portable forges; hand- or pedal-operated grinding wheels with frameworks; base metal parts thereof: Blow torches and similar self-contained torches, and parts thereof

- Chapter 82: Tools, implements, cutlery, hand tools, articles of cutlery.

- Heading 8205: Hand tools (including glass cutters).

- Subheading 8205.60.00.00: Specifically, glass cutters and related parts.

- Tax:

- Basic Duty: 2.9%

- Additional Tariff: 25.0% (Currently)

- Additional Tariff (Post April 2, 2025): 30.0%

- Total Tax: 57.9%

- Considerations: This code seems more specific to your product if the glass cutting disc is primarily used as a hand tool. However, confirm the material of the handle and any other components. If it's integrated into a larger machine, it might not be suitable.

3. 7326.90.86.88 – Other articles of iron or steel: Other: Other: Other: Other Other

- Chapter 73: Articles of iron or steel.

- Heading 7326: Other articles of iron or steel.

- Subheading 7326.90.86.88: A very broad "Other" category.

- Tax:

- Basic Duty: 2.9%

- Additional Tariff: 25.0% (Currently)

- Additional Tariff (Post April 2, 2025): 30.0%

- Additional Tariff (for Steel/Aluminum): 25%

- Total Tax: 82.9%

- Considerations: This code is the least specific and should be used as a last resort. It suggests the disc is made of iron or steel, but the high tax rate and broad classification indicate a need for more precise identification. The material composition is critical here.

Recommendations & Next Steps

- Material Composition: The most important factor is the material of the glass cutting disc. Is it primarily glass, steel, or a combination? Provide a detailed material breakdown.

- Function: How is the disc used? Is it a standalone hand tool, or part of a larger machine?

- Detailed Product Specification: Provide a full product specification sheet, including dimensions, weight, and any technical details.

- Certification: Depending on the final HS code, you may need specific certifications (e.g., safety standards, material composition reports).

- Check April 2, 2025 Tariff Changes: Be aware of the upcoming tariff changes on April 2, 2025, as they will significantly impact your total tax burden.

- Consult with a Licensed Customs Broker: I highly recommend consulting with a licensed customs broker in China. They can provide expert guidance on HS code classification and ensure compliance with all import regulations.

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. Always consult with a qualified customs professional for accurate and up-to-date information.

Customer Reviews

I appreciated the detailed explanation of the tariff rates and the upcoming changes after April 2, 2025. It's exactly what I needed for planning my exports.

The information was good, but I found the 7326908688 HS code confusing. It seems too broad and the high tax rate is a bit concerning. More specifics would have been better.

This page gave me clear details on the HS code 7020006000 for glass cutting discs. It was helpful to see the tariff breakdown and the effective date for the US market.

The breakdown of HS code 8205600000 was really useful. I had no idea that glass cutters could fall under hand tools. The tax rates were clearly explained.