| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the "Glass Bead Reflective Self Adhesive Plastic Sheets" based on the provided HS codes and tax details:

✅ HS CODE: 3919901000

Product Description:

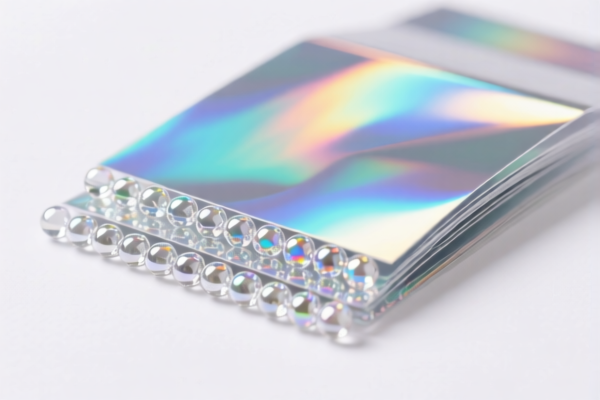

Self-adhesive plastic products with a reflective surface produced entirely or partially by glass beads (glass sand).

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning. -

Anti-dumping duties:

Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods. -

Material and Certification:

Ensure the product is glass bead reflective and self-adhesive, as this is critical for correct classification under HS 3919901000.

Confirm if any certifications (e.g., safety, reflective performance) are required for import or use in specific markets.

🛠️ Proactive Advice:

-

Verify Product Specifications:

Confirm that the product is self-adhesive, reflective, and made with glass beads to ensure it falls under HS 3919901000 and not a different category (e.g., 3919101010 or 3919102055). -

Check Unit Price and Material Composition:

If the product is a sheet or film, ensure the width is not more than 20 cm (which would fall under 3919101050). This is a critical detail for accurate classification. -

Import Documentation:

Prepare all necessary documentation, including product specifications, certifications, and origin information, to avoid delays at customs.

📌 Other Relevant HS Codes (for comparison):

- HS 3919101010 – Road marking tapes (not reflective, not glass bead-based)

- HS 3919102055 – Self-adhesive plastic film (lower base tariff of 5.8%)

- HS 3919101050 – Self-adhesive plastic sheets (up to 20 cm width)

These codes may be applicable if the product lacks the glass bead reflective feature or has different dimensions.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for the "Glass Bead Reflective Self Adhesive Plastic Sheets" based on the provided HS codes and tax details:

✅ HS CODE: 3919901000

Product Description:

Self-adhesive plastic products with a reflective surface produced entirely or partially by glass beads (glass sand).

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning. -

Anti-dumping duties:

Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods. -

Material and Certification:

Ensure the product is glass bead reflective and self-adhesive, as this is critical for correct classification under HS 3919901000.

Confirm if any certifications (e.g., safety, reflective performance) are required for import or use in specific markets.

🛠️ Proactive Advice:

-

Verify Product Specifications:

Confirm that the product is self-adhesive, reflective, and made with glass beads to ensure it falls under HS 3919901000 and not a different category (e.g., 3919101010 or 3919102055). -

Check Unit Price and Material Composition:

If the product is a sheet or film, ensure the width is not more than 20 cm (which would fall under 3919101050). This is a critical detail for accurate classification. -

Import Documentation:

Prepare all necessary documentation, including product specifications, certifications, and origin information, to avoid delays at customs.

📌 Other Relevant HS Codes (for comparison):

- HS 3919101010 – Road marking tapes (not reflective, not glass bead-based)

- HS 3919102055 – Self-adhesive plastic film (lower base tariff of 5.8%)

- HS 3919101050 – Self-adhesive plastic sheets (up to 20 cm width)

These codes may be applicable if the product lacks the glass bead reflective feature or has different dimensions.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.