| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4821902000 | Doc | 55.0% | CN | US | 2025-05-12 |

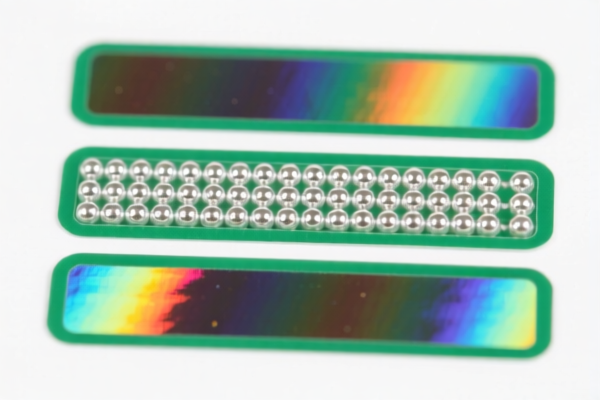

Here is the structured classification and tariff information for the "Glass Bead Reflective Self Adhesive Safety Labels" product, based on the provided HS codes and tax details:

✅ HS CODE: 3919101050

Description:

Self-adhesive plastic sheets, plates, films, foils, strips, and other flat shapes, whether or not wound in rolls, with a reflective surface produced entirely or partially by glass beads (glass beads), with a width not exceeding 20 cm.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

✅ HS CODE: 3919901000

Description:

Self-adhesive plastic products with a reflective surface produced entirely or partially by glass beads (glass sand).

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

✅ HS CODE: 4821902000

Description:

Various types of paper and paperboard labels, including self-adhesive labels, where the term "self-adhesive" in the product name matches the description in the HS code.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

⚠️ Important Notes and Recommendations:

- Material Verification: Confirm whether the product is made of plastic or paper to determine the correct HS code. This will directly affect the applicable tax rate.

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., safety, reflective performance) are required for import.

- April 11, 2025, Special Tariff: Be aware that an additional 30% tariff will be applied after this date. Plan your import schedule accordingly.

- Anti-Dumping Duties: Not applicable for this product category (no mention of anti-dumping duties on glass beads or plastic).

- Customs Declaration: Ensure that the product description on the customs declaration matches the HS code and the actual product characteristics (e.g., reflective surface, self-adhesive, material type).

📌 Proactive Advice:

- If the product is plastic-based, use HS CODE 3919101050 or 3919901000.

- If the product is paper-based, use HS CODE 4821902000.

- Always verify the material composition and reflective properties to ensure correct classification.

- Keep updated on tariff changes, especially the April 11, 2025 deadline.

Let me know if you need help with customs documentation or further classification clarification. Here is the structured classification and tariff information for the "Glass Bead Reflective Self Adhesive Safety Labels" product, based on the provided HS codes and tax details:

✅ HS CODE: 3919101050

Description:

Self-adhesive plastic sheets, plates, films, foils, strips, and other flat shapes, whether or not wound in rolls, with a reflective surface produced entirely or partially by glass beads (glass beads), with a width not exceeding 20 cm.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

✅ HS CODE: 3919901000

Description:

Self-adhesive plastic products with a reflective surface produced entirely or partially by glass beads (glass sand).

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

✅ HS CODE: 4821902000

Description:

Various types of paper and paperboard labels, including self-adhesive labels, where the term "self-adhesive" in the product name matches the description in the HS code.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

⚠️ Important Notes and Recommendations:

- Material Verification: Confirm whether the product is made of plastic or paper to determine the correct HS code. This will directly affect the applicable tax rate.

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., safety, reflective performance) are required for import.

- April 11, 2025, Special Tariff: Be aware that an additional 30% tariff will be applied after this date. Plan your import schedule accordingly.

- Anti-Dumping Duties: Not applicable for this product category (no mention of anti-dumping duties on glass beads or plastic).

- Customs Declaration: Ensure that the product description on the customs declaration matches the HS code and the actual product characteristics (e.g., reflective surface, self-adhesive, material type).

📌 Proactive Advice:

- If the product is plastic-based, use HS CODE 3919101050 or 3919901000.

- If the product is paper-based, use HS CODE 4821902000.

- Always verify the material composition and reflective properties to ensure correct classification.

- Keep updated on tariff changes, especially the April 11, 2025 deadline.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.