| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7317000000 | Doc | Error | CN | US | 2025-05-12 |

| 7415100000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 7616101000 | Doc | 60.7% | CN | US | 2025-05-12 |

| 8302416080 | Doc | 83.9% | CN | US | 2025-05-12 |

| 8302498090 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8467895090 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8548000000 | Doc | 55.0% | CN | US | 2025-05-12 |

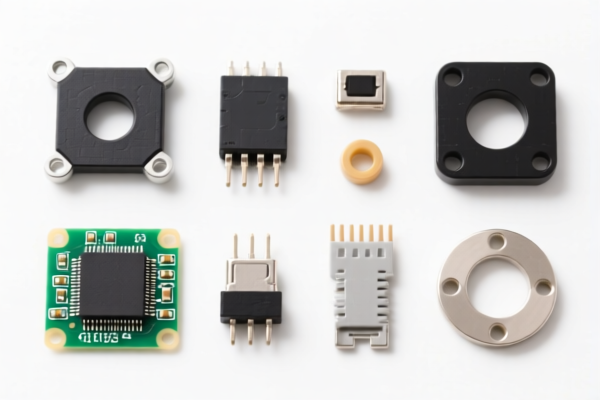

Hardware Goods HS Code Classification & Duty Analysis

This document provides a breakdown of the HS codes provided for various hardware goods, along with associated duty information. Please review carefully to ensure accurate classification for your import/export activities.

Understanding HS Codes:

HS (Harmonized System) codes are internationally standardized product codes used to classify traded products. The first six digits are generally consistent globally, while additional digits may vary by country. Here's a general breakdown of the structure:

- Chapter (First 2 digits): Broad category of goods (e.g., 73 – Iron or Steel Articles).

- Heading (Next 2 digits): More specific grouping within the chapter (e.g., 7317 – Nails, screws, bolts, etc.).

- Subheading (Next 2 digits): Further refinement of the product (e.g., 7317.00 – Nails, screws, bolts, etc. of iron or steel).

- Additional Digits: Country-specific codes for even greater detail.

Detailed HS Code Analysis:

1. 7317.00.00.00 – Nails, tacks, drawing pins, corrugated nails, staples (other than those of heading 8305) and similar articles, of iron or steel

- Chapter 73: Iron or Steel Articles.

- Heading 7317: Nails, screws, bolts, nuts, screw hooks, rivets, cotters, cotter pins, washers and similar articles.

- Subheading 7317.00: Nails, tacks, drawing pins, staples (other than those of heading 8305) and similar articles, of iron or steel.

- Duty: Tax information retrieval failed. Please double-check the specific material composition and intended use.

2. 7415.10.00.00 – Nails, tacks, drawing pins, staples (other than those of heading 8305) and similar articles, of copper or of iron or steel with heads of copper

- Chapter 74: Copper and articles thereof.

- Heading 7415: Nails, screws, bolts, nuts, screw hooks, rivets, cotters, cotter pins, washers and similar articles.

- Subheading 7415.10: Nails and tacks, drawing pins, staples and similar articles.

- Duty:

- Basic Duty: 2.5%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty: 30.0%

- Total Duty: 57.5%

3. 7616.10.10.00 – Other articles of aluminum: Nails, tacks, staples (other than those of heading 8305), screws, bolts, nuts, screw hooks, rivets, cotters, cotter pins, washers and similar articles: Nails, tacks and staples

- Chapter 76: Aluminum and articles thereof.

- Heading 7616: Other articles of aluminum.

- Subheading 7616.10: Nails, screws, bolts, nuts, screw hooks, rivets, cotters, cotter pins, washers and similar articles.

- Duty:

- Basic Duty: 5.7%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty: 30.0%

- Total Duty: 60.7%

4. 8302.41.60.80 – Base metal mountings, fittings and similar articles suitable for furniture, doors, staircases, windows, blinds, coachwork, saddlery, trunks, chests, caskets or the like; base metal hat racks, hat-pegs, brackets and similar fixtures; castors with mountings of base metal; automatic door closers of base metal; and base metal parts thereof: Other mountings, fittings and similar articles, and parts thereof: Suitable for buildings: Other: Of iron or steel, of aluminum or of zinc

- Chapter 83: Miscellaneous articles of base metal.

- Heading 8302: Base metal mountings, fittings and similar articles.

- Subheading 8302.41: Other mountings, fittings and similar articles, and parts thereof.

- Duty:

- Basic Duty: 3.9%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty: 30.0%

- Total Duty: 83.9%

5. 8302.49.80.90 – Base metal mountings, fittings and similar articles suitable for furniture, doors, staircases, windows, blinds, coachwork, saddlery, trunks, chests, caskets or the like; base metal hat racks, hat-pegs, brackets and similar fixtures; castors with mountings of base metal; automatic door closers of base metal; and base metal parts thereof: Other mountings, fittings and similar articles, and parts thereof: Other: Other Other

- Chapter 83: Miscellaneous articles of base metal.

- Heading 8302: Base metal mountings, fittings and similar articles.

- Subheading 8302.49: Other mountings, fittings and similar articles, and parts thereof.

- Duty:

- Basic Duty: 3.5%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty: 30.0%

- Total Duty: 58.5%

6. 8467.89.50.90 – Tools for working in the hand, pneumatic, hydraulic or with self-contained electric or nonelectric motor, and parts thereof: Other tools: Other: Other Other

- Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances.

- Heading 8467: Tools for working in the hand, pneumatic, hydraulic or with self-contained electric or nonelectric motor.

- Subheading 8467.89: Other tools.

- Duty:

- Basic Duty: 0.0%

- Additional Duty: 7.5%

- Post April 2, 2025: Additional Duty: 30.0%

- Total Duty: 37.5%

7. 8548.00.00.00 – Electrical parts of machinery or apparatus, not specified or included elsewhere in this chapter

- Chapter 85: Electrical machinery and equipment.

- Heading 8548: Electrical parts of machinery or apparatus.

- Subheading 8548.00: Electrical parts of machinery or apparatus.

- Duty:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty: 30.0%

- Total Duty: 55.0%

Important Considerations & Recommendations:

- Material Composition: The duty rates can vary significantly based on the material (iron, steel, aluminum, copper, etc.). Please verify the exact composition of each item.

- Intended Use: The specific application of the hardware goods can influence the correct HS code classification.

- Valuation: The declared value of the goods is crucial for duty calculation.

- Certifications: Depending on the product and destination country, you may need specific certifications (e.g., CE marking, RoHS compliance).

- Post April 2, 2025 Duty Changes: Be aware of the upcoming duty changes and factor them into your cost calculations.

- Consult with a Customs Broker: For complex classifications or large shipments, it is highly recommended to consult with a licensed customs broker in the destination country. They can provide expert guidance and ensure compliance with all applicable regulations.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Duty rates and regulations are subject to change. Always verify the latest information with the relevant customs authorities.

Customer Reviews

The table with all the HS codes and tariff rates was easy to use, but I wish the 7317.00.00.00 entry had more details since the tax info was missing. Still, it was a good start.

I was impressed with the clarity of the HS Code 8302.41.60.80 analysis. The information helped me avoid a potential classification error for my iron door fittings.

The detailed explanation of the 7415.10.00.00 HS code and the 57.5% tariff rate was exactly what I needed for my copper hardware export. The additional duty breakdown was a nice touch.

The breakdown of HS Code 7317.00.00.00 was super helpful. I was able to identify the correct classification for my steel nails and understand the duty implications.