| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8536700000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8536698000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8308100000 | Doc | 1.1¢/kg + 2.9%+55.0% | CN | US | 2025-05-12 |

| 7318152095 | Doc | 80.0% | CN | US | 2025-05-12 |

| 7318190000 | Doc | 85.7% | CN | US | 2025-05-12 |

| 7415390000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

Okay, let's break down these HS codes for your "HARDWARE CONNECTOR" declaration. I'll provide a structured analysis, focusing on understanding the classifications and potential tax implications.

Important Note: Tax rates are subject to change. The information below is based on the data you provided and current understanding as of today, but always verify with the latest customs regulations. The "2025.4.2" dates refer to potential future tariff changes.

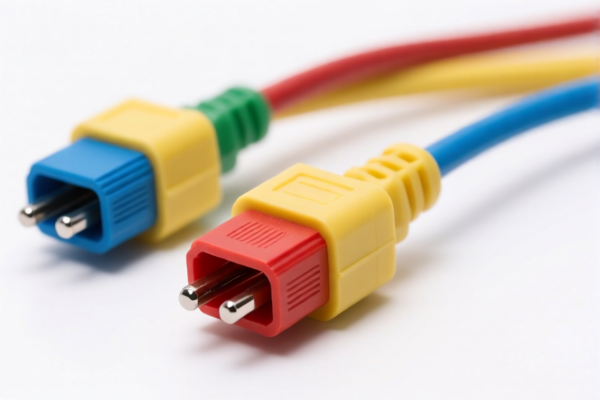

1. 8536.70.00.00: Electrical Connectors (Voltage ≤ 1,000V) - Specifically for Optical Fibers

- 85: Electrical machinery and equipment and parts thereof; sound recording or reproducing apparatus, television-image multiplier tubes.

- 36: Switchgear, relays, fuses, circuit breakers and other electrical switchgear apparatus; connectors, switches, plugs and other connection elements for circuits.

- 70: Connectors for optical fibers, optical fiber bundles or cables.

- Tax: Base Rate: 0.0%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%. Total: 55.0%

- Notes: This code is very specific to connectors used in optical fiber systems.

2. 8536.69.80.00: Electrical Connectors (Voltage ≤ 1,000V) - Lamp-holders, Plugs & Sockets (Other)

- 85: Electrical machinery and equipment and parts thereof; sound recording or reproducing apparatus, television-image multiplier tubes.

- 36: Switchgear, relays, fuses, circuit breakers and other electrical switchgear apparatus; connectors, switches, plugs and other connection elements for circuits.

- 69: Connectors for a voltage not exceeding 1,000 V.

- 80: Lamp-holders, plugs and sockets: Other.

- Tax: Base Rate: 2.7%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%. Total: 57.7%

- Notes: This covers standard electrical connectors like lamp holders, plugs and sockets.

3. 8308.10.00.00: Clasps, Frames with Clasps, Buckles, Hooks, Eyes, Eyelets (Base Metal)

- 83: Miscellaneous articles of base metal.

- 08: Clasps, frames with clasps, buckles, buckle-clasps, hooks, eyes, eyelets and the like, of base metal.

- 10: Hooks, eyes and eyelets.

- Tax: Base Rate: 1.1¢/kg + 2.9%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%. Total: 1.1¢/kg + 2.9% + 55.0%

- Notes: This is for metal hardware used in clothing, footwear, or accessories. The tax is calculated based on weight.

4. 7318.15.20.95: Screws, Bolts, Nuts (Iron or Steel) - Threaded, ≥ 6mm, Other

- 73: Articles of iron or steel.

- 18: Screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers and similar articles.

- 15: Threaded articles.

- 20: Other screws and bolts, whether or not with their nuts or washers.

- 95: Bolts and bolts and their nuts or washers entered or exported in the same shipment Having shanks or threads with a diameter of

6 mm or more: Other: Other. - Tax: Base Rate: 0.0%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%. Total: 80.0%

- Notes: This is for iron or steel screws and bolts with a diameter of 6mm or more.

5. 7318.19.00.00: Screws, Bolts, Nuts (Iron or Steel) - Threaded, Other

- 73: Articles of iron or steel.

- 18: Screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers and similar articles.

- 19: Other threaded articles.

- Tax: Base Rate: 5.7%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%. Total: 85.7%

- Notes: This covers iron or steel screws and bolts not specifically covered in 7318.15.

6. 7415.39.00.00: Nails, Tacks, Screws, Nuts (Copper) - Threaded, Other

- 74: Articles of copper.

- 15: Nails, tacks, drawing pins, staples (other than those of heading 8305) and similar articles; screws, bolts, nuts, screw hooks, rivets, cotters, cotter pins, washers (including spring washers) and similar articles.

- 39: Other threaded articles.

- Tax: Base Rate: 3.0%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%. Total: 58.0%

- Notes: This is for copper screws, bolts, and nuts.

7. 3926.90.99.89: Other Plastics Articles - Other, Other

- 39: Plastics and articles thereof.

- 26: Other articles of plastics and articles of other materials of headings 3901 to 3914.

- 90: Other.

- 99: Other Other.

- Tax: Base Rate: 5.3%, Additional Tariff: 7.5%, Post-April 2, 2025: 30.0%. Total: 42.8%

- Notes: This is a catch-all for plastic hardware.

Recommendations:

- Material Verification: Double-check the exact material composition of each item. The tax rates vary significantly between iron/steel, copper, and plastics.

- Dimensions: For screws and bolts, confirm the shank/thread diameter. This is crucial for correct classification.

- Single Shipment: If you're importing a mix of screws/bolts with and without nuts/washers, clarify if they are entered in the same shipment.

- Certification: Depending on the end-use of the hardware, you may need specific certifications (e.g., RoHS, REACH).

- Future Tariff Changes: Be aware of the potential tariff increases on April 2, 2025.

- Consult a Broker: For complex declarations, it's always best to consult a licensed customs broker. They can provide expert guidance and ensure compliance.

I hope this detailed breakdown is helpful! Let me know if you have any other questions.

Customer Reviews

The 8308100000 HS code for metal clasps was a bit confusing at first, but the mention of the 1.1¢/kg tax rate helped me understand the cost structure.

The 3926909989 HS code for plastic hardware was helpful, and the 42.8% tariff rate made sense now. I’ll be sure to include this in my export planning.

The 7318152095 HS code for iron screws was well explained, but I would have liked more clarification on the 80% tariff rate and its impact on shipping costs.

The detailed breakdown of the 8536700000 HS code for optical fiber connectors was exactly what I needed. The 55% tariff rate is now clear to me.

The 7318190000 HS code section for iron screws was very informative. The 85.7% tax rate is a key point for me to consider when planning my product shipments.