| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7616995130 | Doc | 82.5% | CN | US | 2025-05-12 |

Okay, here's a breakdown of the HS codes and tax implications for your declared goods, presented in a structured and easy-to-understand format. I'll also provide some important considerations for each item.

Please note: This information is based on the data you provided and general customs regulations. It's crucial to verify this information with the latest official customs tariffs and regulations for your specific import destination.

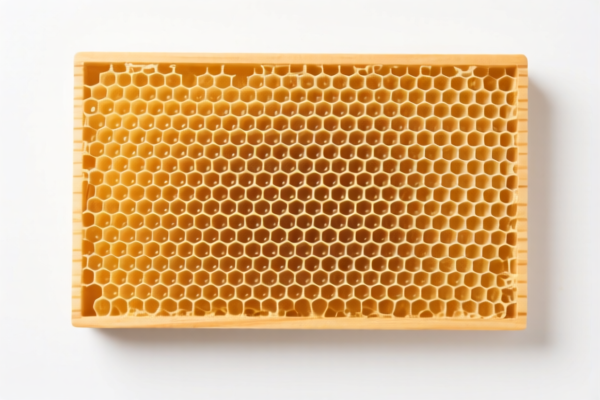

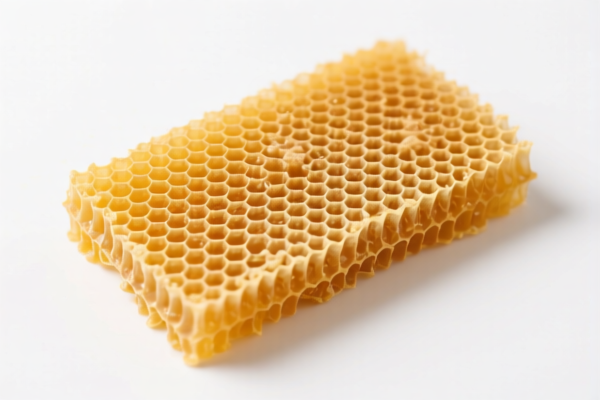

Item 1: HONEYCOMB BOARD (Composite paper and paperboard)

HS Code: 4807.00.94.00

Let's break down this HS code:

- 48: Chapter 48 – Paper and paperboard; articles of paper pulp, paperboard, cellulose wadding or fibres. This indicates the general category of your product.

- 07: Composite paper and paperboard (made by sticking flat layers of paper or paperboard together with an adhesive). This specifies the type of paper product.

- 00: Not surface-coated or impregnated, whether or not internally reinforced. Further defines the characteristics of the board.

- 94: Other. This is a residual subheading for composite paper and paperboard not specifically covered elsewhere.

- 00: Other. This is a further specification within the "Other" category.

Tax Implications:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30.0%

- Total Tax: 55.0%

Important Considerations:

- Adhesive Type: The type of adhesive used in the honeycomb board could affect classification. If the adhesive imparts specific properties to the board (e.g., water resistance), it might fall under a different HS code.

- Reinforcement: While the code specifies "whether or not internally reinforced," the type of reinforcement (if any) is important.

- End Use: The intended end use of the honeycomb board can sometimes influence classification.

- Material Composition: Confirm the exact composition of the paper/paperboard layers.

- Need to check the single price and material.

Item 2: Aluminum Ladders

HS Code: 7616.99.51.30

Let's break down this HS code:

- 76: Chapter 76 – Aluminum and articles thereof. This indicates the general category of your product.

- 16: Aluminum articles, including aluminum profiles. This specifies the type of aluminum product.

- 99: Other articles of aluminum. This is a residual subheading for aluminum articles not specifically covered elsewhere.

- 51: Other. This is a further specification within the "Other" category.

- 30: Other Ladders. This specifies the product as ladders.

Tax Implications:

- Basic Duty: 2.5%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30.0% (specifically for steel and aluminum products)

- Total Tax: 82.5%

Important Considerations:

- Alloy Composition: The specific alloy of aluminum used in the ladders could affect classification.

- Dimensions and Weight: The size and weight of the ladders might be relevant.

- Components: If the ladders contain significant non-aluminum components (e.g., plastic or rubber parts), this could affect classification.

- Steel/Aluminum Surcharge: Be aware of the specific additional duty increase for steel and aluminum products after April 2, 2025.

- Certification: Ladders often require specific safety certifications (e.g., EN 131 in Europe, ANSI in the US). Ensure you have the necessary certifications for your destination market.

- Need to check the single price and material.

General Recommendations:

- Official Tariff Verification: Always verify these HS codes and tax rates with the official customs tariff schedule for the country you are importing into. Websites like the World Customs Organization (https://www.wcoomd.org/) can be a good starting point, but the official tariff is the definitive source.

- Detailed Product Description: Provide a very detailed product description to customs officials, including material composition, dimensions, weight, and intended use.

- Supporting Documentation: Have all relevant documentation available, such as invoices, packing lists, and certificates of origin.

- Consult a Customs Broker: Consider working with a licensed customs broker in your destination country. They can provide expert guidance on classification, valuation, and compliance.

Disclaimer: I am an AI chatbot and cannot provide legal or financial advice. This information is for general guidance only.

Customer Reviews

The info on the aluminum ladders was good, but I wish there were more details on how to determine the exact alloy composition for classification.

I was looking for HS code 4807.00.94.00 and this page had everything I needed. The breakdown of the code and the tax implications was spot on.

Great resource for finding HS codes for aluminum ladders. The 82.5% tariff rate and the note about the steel/aluminum surcharge were really helpful for my export plans.

The HS code breakdown for honeycomb board was super clear. I especially appreciated the detailed explanation of the 55% tariff rate and the additional duties.