Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

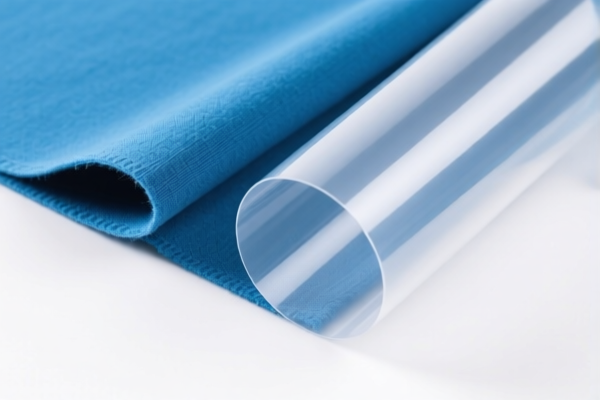

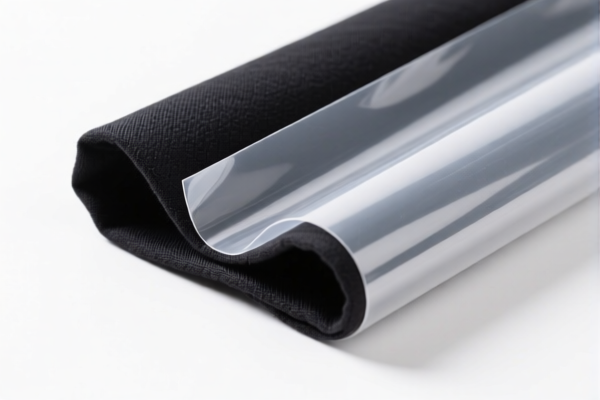

Product Name: Heavy Duty Textile Plastic Composites

HS CODE: 3921902900

✅ Classification Summary:

- The product falls under HS CODE 3921902900, which is designated for plastic sheets, films, foils, and strips combined with other materials, specifically textile materials.

- The product must be composite (plastic + textile), and heavily weighted (weight > 1.492 kg/m²) to qualify under this classification.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tariff Rate: 59.4%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is a composite of plastic and textile materials, and that it meets the weight threshold of >1.492 kg/m².

- Unit Price and Certification: Verify the unit price and whether any certifications (e.g., material composition, safety, or environmental compliance) are required for customs clearance.

- Documentation: Ensure all product specifications, material breakdown, and weight per square meter are clearly documented in the import declaration.

- Anti-dumping duties: Not applicable for this product category (no specific anti-dumping duties on textile-plastic composites are listed in current regulations).

🛑 Proactive Advice:

- Double-check the product’s composition and weight to ensure it falls under HS CODE 3921902900 and not a different classification.

- Monitor the April 2, 2025 deadline for the special tariff increase to avoid unexpected costs.

- Consult with a customs broker or trade compliance expert if the product is part of a larger shipment or involves multiple materials.

Let me know if you need help with certification requirements or customs documentation templates for this product.

Product Name: Heavy Duty Textile Plastic Composites

HS CODE: 3921902900

✅ Classification Summary:

- The product falls under HS CODE 3921902900, which is designated for plastic sheets, films, foils, and strips combined with other materials, specifically textile materials.

- The product must be composite (plastic + textile), and heavily weighted (weight > 1.492 kg/m²) to qualify under this classification.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tariff Rate: 59.4%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is a composite of plastic and textile materials, and that it meets the weight threshold of >1.492 kg/m².

- Unit Price and Certification: Verify the unit price and whether any certifications (e.g., material composition, safety, or environmental compliance) are required for customs clearance.

- Documentation: Ensure all product specifications, material breakdown, and weight per square meter are clearly documented in the import declaration.

- Anti-dumping duties: Not applicable for this product category (no specific anti-dumping duties on textile-plastic composites are listed in current regulations).

🛑 Proactive Advice:

- Double-check the product’s composition and weight to ensure it falls under HS CODE 3921902900 and not a different classification.

- Monitor the April 2, 2025 deadline for the special tariff increase to avoid unexpected costs.

- Consult with a customs broker or trade compliance expert if the product is part of a larger shipment or involves multiple materials.

Let me know if you need help with certification requirements or customs documentation templates for this product.

Customer Reviews

No reviews yet.