| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5212216090 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5408229060 | Doc | 69.9% | CN | US | 2025-05-12 |

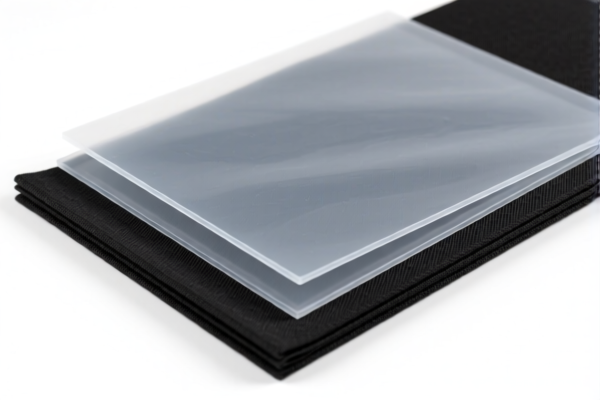

Here is the structured classification and tariff analysis for the Heavy Duty Textile Plastic Sheets based on the provided HS codes and tax details:

✅ HS CODE: 3921902550

Description:

Other plastic sheets, plates, films, foils and strips combined with textile materials, with a weight exceeding 1.492 kg/m², where the textile component contains man-made fibers in greater weight than any other single textile fiber, and the plastic content exceeds 70%.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code applies if the product is primarily plastic (over 70%) and combined with textile materials (mainly man-made fibers). - Ensure the product meets the weight and fiber composition criteria.

✅ HS CODE: 3921902900

Description:

Plastic sheets, plates, films, foils and strips combined with other materials, especially with textile materials, with a weight exceeding 1.492 kg/m².

Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

Key Notes: - This code is for general plastic-textile composites with a weight over 1.492 kg/m². - Less specific than 3921902550, so ensure the product does not meet the more specific criteria of that code.

✅ HS CODE: 5903903090

Description:

Textile fabrics impregnated, coated, covered or laminated with plastic, excluding those in Chapter 5902.

Tariff Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes: - This code applies to textile fabrics that are coated or laminated with plastic. - Ensure the product is not classified under Chapter 5902 (e.g., impregnated or coated fabrics with paper or other materials).

✅ HS CODE: 5212216090

Description:

Cotton woven fabrics, weighing over 200 g/m², unbleached.

Tariff Breakdown:

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

Key Notes: - This code is for cotton fabrics, not for plastic-textile composites. - Likely not applicable unless the product is a cotton fabric with no plastic content.

✅ HS CODE: 5408229060

Description:

Man-made fiber products, where polypropylene is a synthetic fiber, and the fabric is a woven fabric used for packaging, with over 85% synthetic fiber by weight.

Tariff Breakdown:

- Base Tariff Rate: 14.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

Key Notes: - This code applies to synthetic fiber woven fabrics (e.g., packaging fabric). - Not suitable for products with significant plastic content.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of plastic and textile content in the product.

- Check Weight: Ensure the product meets the weight threshold (1.492 kg/m²) for textile-plastic composites.

- Review Certification Requirements: Some products may require specific certifications (e.g., REACH, RoHS) for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so plan accordingly.

- Consult a Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help determining which HS code best fits your specific product. Here is the structured classification and tariff analysis for the Heavy Duty Textile Plastic Sheets based on the provided HS codes and tax details:

✅ HS CODE: 3921902550

Description:

Other plastic sheets, plates, films, foils and strips combined with textile materials, with a weight exceeding 1.492 kg/m², where the textile component contains man-made fibers in greater weight than any other single textile fiber, and the plastic content exceeds 70%.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This code applies if the product is primarily plastic (over 70%) and combined with textile materials (mainly man-made fibers). - Ensure the product meets the weight and fiber composition criteria.

✅ HS CODE: 3921902900

Description:

Plastic sheets, plates, films, foils and strips combined with other materials, especially with textile materials, with a weight exceeding 1.492 kg/m².

Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

Key Notes: - This code is for general plastic-textile composites with a weight over 1.492 kg/m². - Less specific than 3921902550, so ensure the product does not meet the more specific criteria of that code.

✅ HS CODE: 5903903090

Description:

Textile fabrics impregnated, coated, covered or laminated with plastic, excluding those in Chapter 5902.

Tariff Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes: - This code applies to textile fabrics that are coated or laminated with plastic. - Ensure the product is not classified under Chapter 5902 (e.g., impregnated or coated fabrics with paper or other materials).

✅ HS CODE: 5212216090

Description:

Cotton woven fabrics, weighing over 200 g/m², unbleached.

Tariff Breakdown:

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

Key Notes: - This code is for cotton fabrics, not for plastic-textile composites. - Likely not applicable unless the product is a cotton fabric with no plastic content.

✅ HS CODE: 5408229060

Description:

Man-made fiber products, where polypropylene is a synthetic fiber, and the fabric is a woven fabric used for packaging, with over 85% synthetic fiber by weight.

Tariff Breakdown:

- Base Tariff Rate: 14.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

Key Notes: - This code applies to synthetic fiber woven fabrics (e.g., packaging fabric). - Not suitable for products with significant plastic content.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of plastic and textile content in the product.

- Check Weight: Ensure the product meets the weight threshold (1.492 kg/m²) for textile-plastic composites.

- Review Certification Requirements: Some products may require specific certifications (e.g., REACH, RoHS) for import.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so plan accordingly.

- Consult a Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help determining which HS code best fits your specific product.

Customer Reviews

No reviews yet.