| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

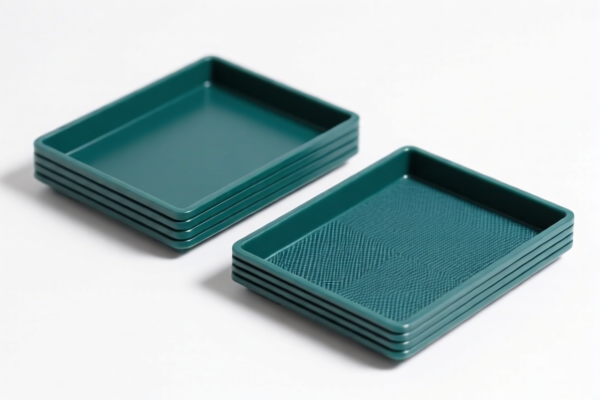

Product Name: Heavy Duty Textile Reinforced Plastic Plates

Classification HS Code: Based on the provided data, the most likely applicable HS codes are:

✅ HS CODE: 3921902510

Description:

- Applies to other plastic plates, sheets, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m².

- The textile component is predominant by weight, and no single textile fiber weighs more than synthetic fiber.

- Plastic content exceeds 70% by weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Time-Sensitive Policy Alert:

- April 11 Special Tariff: If the product is subject to additional tariffs after April 11, 2025, the total tax rate may increase further. Confirm with customs or a trade compliance expert.

📌 Other Possible HS Codes:

HS CODE: 3921902550

- Applies to textile-reinforced plastic plates with synthetic fiber content higher than any other single textile fiber.

- Plastic content >70%.

- Total Tax Rate: 61.5% (same as 3921902510)

- Note: This code is not recommended unless the product specifically meets the synthetic fiber dominance criteria.

HS CODE: 3921902900

- Applies to plastic plates combined with other materials, with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

- Note: This code is not recommended unless the product does not meet the textile fiber dominance criteria.

📌 Proactive Advice:

- Verify Material Composition: Confirm the weight percentages of plastic and textile components to ensure correct HS code classification.

- Check Unit Price: Tariff rates may vary based on value or origin (e.g., preferential trade agreements).

- Certifications Required: Ensure compliance with import certifications (e.g., CE, RoHS, or other relevant standards).

- Consult Customs Authority: For final confirmation, especially if the product is close to the boundary of multiple HS codes.

📊 Summary of Tax Rates:

| HS Code | Base Tariff | Additional Tariff | April 2, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921902510 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

If you provide more details on the material composition and intended use, I can help further refine the classification and tax implications.

Product Name: Heavy Duty Textile Reinforced Plastic Plates

Classification HS Code: Based on the provided data, the most likely applicable HS codes are:

✅ HS CODE: 3921902510

Description:

- Applies to other plastic plates, sheets, films, foils, and strips combined with textile materials, with a weight exceeding 1.492 kg/m².

- The textile component is predominant by weight, and no single textile fiber weighs more than synthetic fiber.

- Plastic content exceeds 70% by weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Time-Sensitive Policy Alert:

- April 11 Special Tariff: If the product is subject to additional tariffs after April 11, 2025, the total tax rate may increase further. Confirm with customs or a trade compliance expert.

📌 Other Possible HS Codes:

HS CODE: 3921902550

- Applies to textile-reinforced plastic plates with synthetic fiber content higher than any other single textile fiber.

- Plastic content >70%.

- Total Tax Rate: 61.5% (same as 3921902510)

- Note: This code is not recommended unless the product specifically meets the synthetic fiber dominance criteria.

HS CODE: 3921902900

- Applies to plastic plates combined with other materials, with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

- Note: This code is not recommended unless the product does not meet the textile fiber dominance criteria.

📌 Proactive Advice:

- Verify Material Composition: Confirm the weight percentages of plastic and textile components to ensure correct HS code classification.

- Check Unit Price: Tariff rates may vary based on value or origin (e.g., preferential trade agreements).

- Certifications Required: Ensure compliance with import certifications (e.g., CE, RoHS, or other relevant standards).

- Consult Customs Authority: For final confirmation, especially if the product is close to the boundary of multiple HS codes.

📊 Summary of Tax Rates:

| HS Code | Base Tariff | Additional Tariff | April 2, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921902510 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

If you provide more details on the material composition and intended use, I can help further refine the classification and tax implications.

Customer Reviews

No reviews yet.