| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

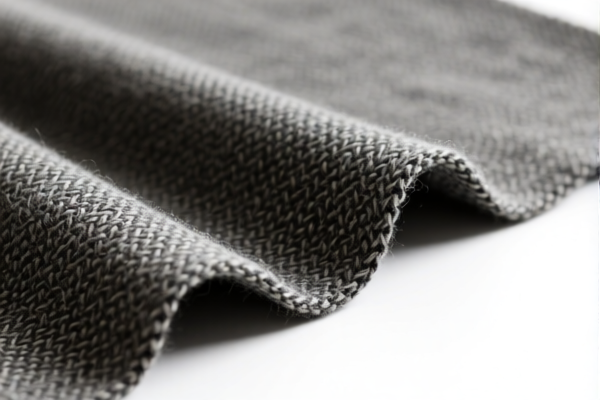

Product Name: Heavy Weight Combed Wool Blend Woven Fabrics

HS CODEs and Tax Information:

- HS CODE: 5112203000

- Description: Mixed combed wool heavy weight woven fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5112303000

- Description: Mixed combed wool heavy weight grade woven fabric / high-density woven fabric / high-count combed wool blend fabric

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. This is a significant increase and may impact cost calculations for imports after this date.

-

Uniform Tax Rates:

-

All listed HS codes have the same total tax rate of 80.0%, which includes base, additional, and the upcoming special tariff.

-

Material Verification:

-

Ensure the fabric is truly a wool blend and not misclassified as pure wool or synthetic blends, as this could lead to incorrect HS code application and penalties.

-

Certifications and Documentation:

-

Confirm if certifications (e.g., origin, composition, or sustainability) are required for import. Some countries may require documentation to verify the fabric’s composition and origin.

-

Unit Price and Composition:

-

Verify the exact composition (e.g., wool percentage, type of blend) and unit price to ensure proper classification and avoid overpayment of duties.

-

Customs Clearance Preparation:

- Provide detailed product descriptions, including fabric weight, weave type, and blend percentages, to customs authorities to avoid classification disputes.

✅ Proactive Advice:

- Check the exact HS code based on the fabric’s weight, weave, and composition to ensure compliance.

- Monitor the April 11, 2025 deadline for the special tariff to adjust import timelines or pricing accordingly.

-

Consult with a customs broker or trade compliance expert if the product is being imported in large quantities or to a country with complex tariff rules. Product Name: Heavy Weight Combed Wool Blend Woven Fabrics

HS CODEs and Tax Information: -

HS CODE: 5112203000

- Description: Mixed combed wool heavy weight woven fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5112303000

- Description: Mixed combed wool heavy weight grade woven fabric / high-density woven fabric / high-count combed wool blend fabric

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. This is a significant increase and may impact cost calculations for imports after this date.

-

Uniform Tax Rates:

-

All listed HS codes have the same total tax rate of 80.0%, which includes base, additional, and the upcoming special tariff.

-

Material Verification:

-

Ensure the fabric is truly a wool blend and not misclassified as pure wool or synthetic blends, as this could lead to incorrect HS code application and penalties.

-

Certifications and Documentation:

-

Confirm if certifications (e.g., origin, composition, or sustainability) are required for import. Some countries may require documentation to verify the fabric’s composition and origin.

-

Unit Price and Composition:

-

Verify the exact composition (e.g., wool percentage, type of blend) and unit price to ensure proper classification and avoid overpayment of duties.

-

Customs Clearance Preparation:

- Provide detailed product descriptions, including fabric weight, weave type, and blend percentages, to customs authorities to avoid classification disputes.

✅ Proactive Advice:

- Check the exact HS code based on the fabric’s weight, weave, and composition to ensure compliance.

- Monitor the April 11, 2025 deadline for the special tariff to adjust import timelines or pricing accordingly.

- Consult with a customs broker or trade compliance expert if the product is being imported in large quantities or to a country with complex tariff rules.

Customer Reviews

No reviews yet.