| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112301000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112301000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5509910000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5311002000 | Doc | 69.5% | CN | US | 2025-05-12 |

| 5509910000 | Doc | 67.0% | CN | US | 2025-05-12 |

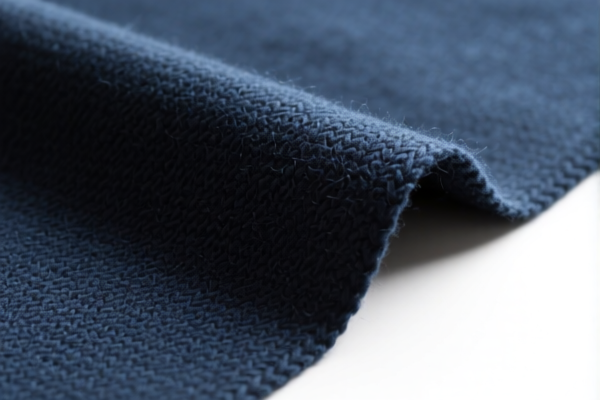

Product Name: Heavyweight Combed Wool/Fine Animal Hair Apparel Fabric

Classification HS Code: 5112.30.10.00 (Primary Code)

Other Possible Codes: 5509.91.00.00, 5311.00.20.00

🔍 HS Code Breakdown and Tax Details

- HS CODE: 5112.30.10.00

- Description: Heavyweight combed fine animal hair mixed fabric for decorative use

-

Total Tax Rate: 62.0%

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5509.91.00.00

- Description: Fine animal hair mixed yarn (coarse-spun)

-

Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5311.00.20.00

- Description: Plant fiber mixed fine animal hair fabric

- Total Tax Rate: 69.5%

- Base Tariff: 14.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and must be considered in your customs planning.

-

Anti-dumping duties:

- Not applicable for this product category (no specific anti-dumping duties on wool or animal hair fabrics are currently in effect).

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Ensure the fabric is indeed a combed wool/fine animal hair mix and not a different blend (e.g., with synthetic fibers), as this could change the HS code.

-

Check Unit Price and Certification:

-

Confirm the unit price and whether certifications (e.g., origin, sustainability, or textile standards) are required for import compliance.

-

Review Tariff Dates:

-

If your shipment is scheduled after April 11, 2025, be prepared for the 30.0% additional tariff. Consider adjusting pricing or seeking duty relief options.

-

Consult with Customs Broker:

- For complex classifications or large volumes, it is advisable to work with a licensed customs broker to ensure accurate classification and compliance.

Let me know if you need help with certification requirements or duty calculation tools.

Product Name: Heavyweight Combed Wool/Fine Animal Hair Apparel Fabric

Classification HS Code: 5112.30.10.00 (Primary Code)

Other Possible Codes: 5509.91.00.00, 5311.00.20.00

🔍 HS Code Breakdown and Tax Details

- HS CODE: 5112.30.10.00

- Description: Heavyweight combed fine animal hair mixed fabric for decorative use

-

Total Tax Rate: 62.0%

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5509.91.00.00

- Description: Fine animal hair mixed yarn (coarse-spun)

-

Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 5311.00.20.00

- Description: Plant fiber mixed fine animal hair fabric

- Total Tax Rate: 69.5%

- Base Tariff: 14.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and must be considered in your customs planning.

-

Anti-dumping duties:

- Not applicable for this product category (no specific anti-dumping duties on wool or animal hair fabrics are currently in effect).

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Ensure the fabric is indeed a combed wool/fine animal hair mix and not a different blend (e.g., with synthetic fibers), as this could change the HS code.

-

Check Unit Price and Certification:

-

Confirm the unit price and whether certifications (e.g., origin, sustainability, or textile standards) are required for import compliance.

-

Review Tariff Dates:

-

If your shipment is scheduled after April 11, 2025, be prepared for the 30.0% additional tariff. Consider adjusting pricing or seeking duty relief options.

-

Consult with Customs Broker:

- For complex classifications or large volumes, it is advisable to work with a licensed customs broker to ensure accurate classification and compliance.

Let me know if you need help with certification requirements or duty calculation tools.

Customer Reviews

No reviews yet.