| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112199560 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112116030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5113000000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5516320510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5407910510 | Doc | 80.0% | CN | US | 2025-05-12 |

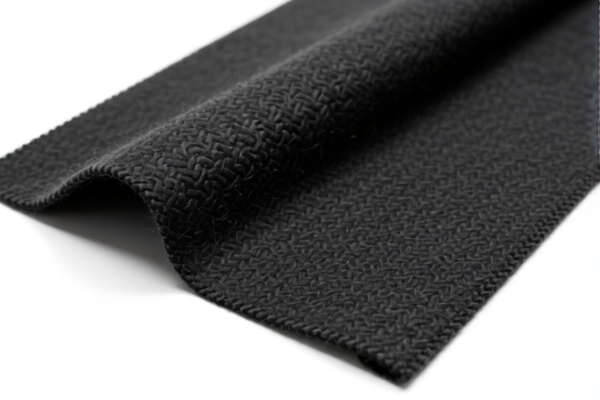

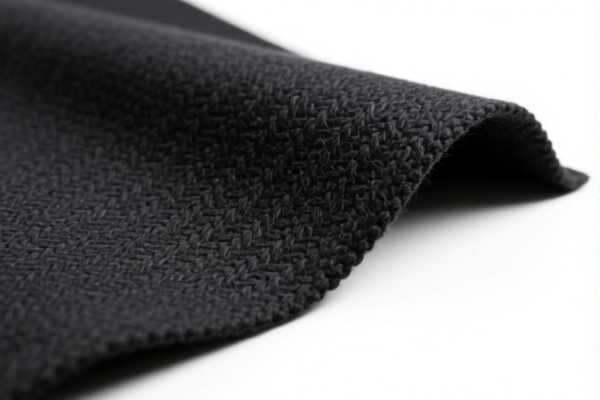

Product Name: Heavyweight Combed Wool/Fine Animal Hair Automotive Interior Fabric

Classification HS Code Analysis:

✅ HS CODE: 5112199560

Description: Combed fine animal hair automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5112116030

Description: Combed fine animal hair automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5113000000

Description: Coarse animal hair automotive fabric

Total Tax Rate: 57.7%

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5516320510

Description: Dyed fine animal hair blended automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5407910510

Description: Fine animal hair blended automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm the exact composition of the fabric (e.g., percentage of animal hair, type of wool, and whether it is blended with other fibers) to ensure correct HS code classification.

- Certifications: Check if any specific certifications (e.g., textile standards, environmental compliance) are required for import into the target market.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric is accurately described in terms of fiber content and processing (e.g., combed, dyed, blended).

- Check Unit Price: The tax rate may affect the final cost, so consider the unit price and total volume for import.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a classification expert to avoid delays or penalties.

Let me know if you need help with HS code selection or tariff calculation for a specific shipment.

Product Name: Heavyweight Combed Wool/Fine Animal Hair Automotive Interior Fabric

Classification HS Code Analysis:

✅ HS CODE: 5112199560

Description: Combed fine animal hair automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5112116030

Description: Combed fine animal hair automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5113000000

Description: Coarse animal hair automotive fabric

Total Tax Rate: 57.7%

Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5516320510

Description: Dyed fine animal hair blended automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5407910510

Description: Fine animal hair blended automotive interior fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm the exact composition of the fabric (e.g., percentage of animal hair, type of wool, and whether it is blended with other fibers) to ensure correct HS code classification.

- Certifications: Check if any specific certifications (e.g., textile standards, environmental compliance) are required for import into the target market.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric is accurately described in terms of fiber content and processing (e.g., combed, dyed, blended).

- Check Unit Price: The tax rate may affect the final cost, so consider the unit price and total volume for import.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a classification expert to avoid delays or penalties.

Let me know if you need help with HS code selection or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.