| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112301000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5113000000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5113000000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5311002000 | Doc | 69.5% | CN | US | 2025-05-12 |

| 5509910000 | Doc | 67.0% | CN | US | 2025-05-12 |

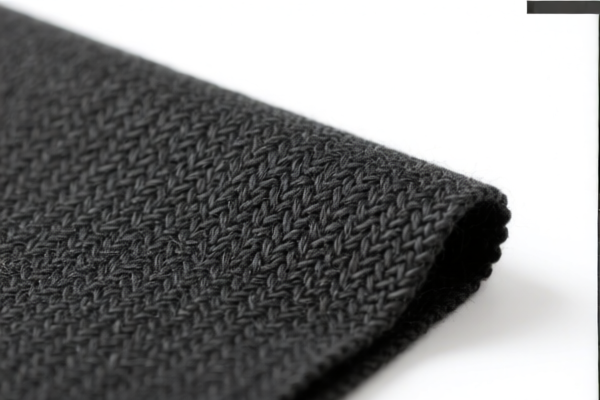

Here is the structured classification and tariff information for the "Heavyweight Combed Wool/Fine Animal Hair Woven Fabrics" product, based on the provided HS codes and tax details:

✅ HS CODE: 5112301000

Product Description: Heavyweight combed fine animal hair woven decorative fabrics

Total Tax Rate: 62.0%

- Base Tariff Rate: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for decorative woven fabrics made from combed fine animal hair.

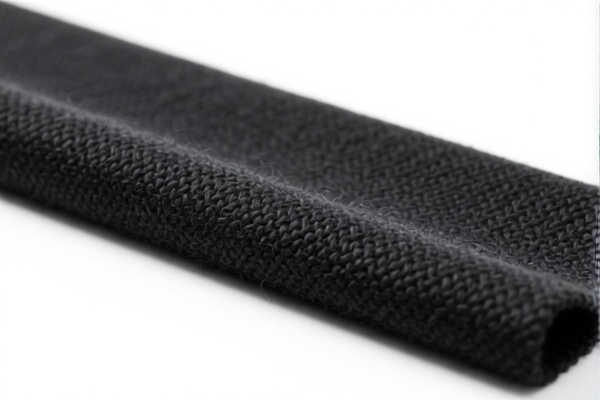

✅ HS CODE: 5113000000

Product Description: Animal hair coarse woven fabrics / Heavy animal hair felt fabrics

Total Tax Rate: 57.7%

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to coarse woven fabrics or thick felt fabrics made from animal hair.

- Important: If the fabric is not decorative and is used for general purposes, this code may be more appropriate.

✅ HS CODE: 5311002000

Product Description: Plant fiber blended fine animal hair woven fabrics

Total Tax Rate: 69.5%

- Base Tariff Rate: 14.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for woven fabrics made from a blend of plant fibers and fine animal hair.

- Important: Ensure the blend ratio is clearly defined, as this may affect classification.

✅ HS CODE: 5509910000

Product Description: Fine animal hair blended coarse yarn

Total Tax Rate: 67.0%

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to coarse yarn made from a blend of fine animal hair.

- Important: This is for yarn, not finished fabric. If your product is fabric, this code may not be applicable.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of animal hair and other fibers in the fabric. This is crucial for accurate classification.

- Check Fabric Use: Determine if the fabric is for decorative purposes or general use, as this can influence the correct HS code.

- Unit Price and Certification: Ensure you have certifications (e.g., origin, fiber content) and accurate unit pricing for customs compliance.

- April 11, 2025 Deadline: Be aware that additional tariffs will increase after this date. Plan your import schedule accordingly.

- Anti-Dumping Duties: While not listed here, be cautious of anti-dumping duties if the product is subject to such measures (common for certain textile imports).

Let me know if you need help determining the most accurate HS code based on your specific product details. Here is the structured classification and tariff information for the "Heavyweight Combed Wool/Fine Animal Hair Woven Fabrics" product, based on the provided HS codes and tax details:

✅ HS CODE: 5112301000

Product Description: Heavyweight combed fine animal hair woven decorative fabrics

Total Tax Rate: 62.0%

- Base Tariff Rate: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for decorative woven fabrics made from combed fine animal hair.

✅ HS CODE: 5113000000

Product Description: Animal hair coarse woven fabrics / Heavy animal hair felt fabrics

Total Tax Rate: 57.7%

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to coarse woven fabrics or thick felt fabrics made from animal hair.

- Important: If the fabric is not decorative and is used for general purposes, this code may be more appropriate.

✅ HS CODE: 5311002000

Product Description: Plant fiber blended fine animal hair woven fabrics

Total Tax Rate: 69.5%

- Base Tariff Rate: 14.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for woven fabrics made from a blend of plant fibers and fine animal hair.

- Important: Ensure the blend ratio is clearly defined, as this may affect classification.

✅ HS CODE: 5509910000

Product Description: Fine animal hair blended coarse yarn

Total Tax Rate: 67.0%

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to coarse yarn made from a blend of fine animal hair.

- Important: This is for yarn, not finished fabric. If your product is fabric, this code may not be applicable.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of animal hair and other fibers in the fabric. This is crucial for accurate classification.

- Check Fabric Use: Determine if the fabric is for decorative purposes or general use, as this can influence the correct HS code.

- Unit Price and Certification: Ensure you have certifications (e.g., origin, fiber content) and accurate unit pricing for customs compliance.

- April 11, 2025 Deadline: Be aware that additional tariffs will increase after this date. Plan your import schedule accordingly.

- Anti-Dumping Duties: While not listed here, be cautious of anti-dumping duties if the product is subject to such measures (common for certain textile imports).

Let me know if you need help determining the most accurate HS code based on your specific product details.

Customer Reviews

No reviews yet.