| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 6005901000 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5112196020 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516330510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111904000 | Doc | 62.0% | CN | US | 2025-05-12 |

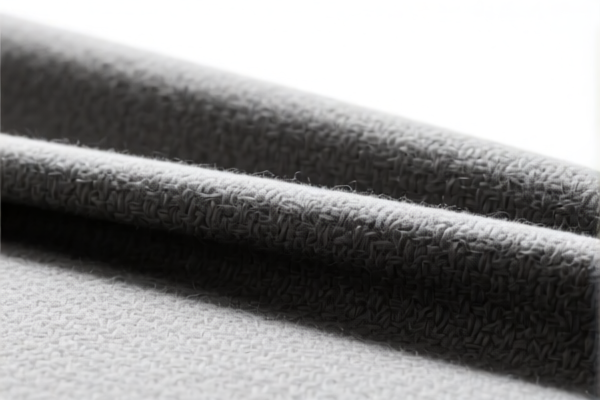

Product Classification: High Content Wool Sofa Fabric

HS CODE: 5112196060 (Primary Code)

Alternative HS CODEs:

- 6005901000 (Wool Knitted Fabric)

- 5112196020 (High-count Wool Fabric)

- 5516330510 (Synthetic Blended Fabric with Wool)

- 5111904000 (Carded Wool for Upholstery)

🔍 Key Classification Notes:

- Material Composition: The fabric is made of high content wool (≥85% wool or fine animal hair), with ultra-fine fibers (≤18.5 microns in diameter), and high weight (>340 g/m²).

- Usage: Designed for sofa upholstery, which may fall under decorative or heavy-duty woven fabrics.

- HS Code Selection:

- 5112196060 is the most accurate for woven wool fabric with high wool content, ultra-fine fibers, and high weight.

- 5111904000 may apply if the fabric is carded wool used for upholstery (e.g., heavy-weight decorative fabric).

- 6005901000 applies if the fabric is knitted (not woven).

- 5516330510 applies if the fabric is a blended synthetic short fiber with wool (≤85% synthetic).

📊 Tariff Overview (as of now):

- Base Tariff Rate: 25.0% (for 5112196060, 5112196020, 5516330510)

- 7.0% (for 5111904000)

- Additional Tariff (General): 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate:

- 80.0% (for 5112196060, 5112196020, 5516330510)

- 65.0% (for 6005901000)

- 62.0% (for 5111904000)

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

- An additional 30.0% tariff will be imposed after April 11, 2025 on the listed HS codes.

- This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties (if applicable):

- Not applicable for wool products (unlike iron or aluminum).

- However, always verify if the product is subject to anti-dumping or countervailing duties based on the country of origin and product specifics.

✅ Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact wool content, fiber diameter, and fabric weight to ensure correct HS code classification.

- Check Unit Price: High-value goods may be subject to additional import duties or licensing requirements.

- Certifications Required: Some countries may require textile certifications (e.g., origin, composition, or environmental compliance).

- Plan for April 11, 2025: If importing after this date, budget for the 30.0% additional tariff.

- Consult Customs Broker: For complex classifications or high-value imports, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: High Content Wool Sofa Fabric

HS CODE: 5112196060 (Primary Code)

Alternative HS CODEs:

- 6005901000 (Wool Knitted Fabric)

- 5112196020 (High-count Wool Fabric)

- 5516330510 (Synthetic Blended Fabric with Wool)

- 5111904000 (Carded Wool for Upholstery)

🔍 Key Classification Notes:

- Material Composition: The fabric is made of high content wool (≥85% wool or fine animal hair), with ultra-fine fibers (≤18.5 microns in diameter), and high weight (>340 g/m²).

- Usage: Designed for sofa upholstery, which may fall under decorative or heavy-duty woven fabrics.

- HS Code Selection:

- 5112196060 is the most accurate for woven wool fabric with high wool content, ultra-fine fibers, and high weight.

- 5111904000 may apply if the fabric is carded wool used for upholstery (e.g., heavy-weight decorative fabric).

- 6005901000 applies if the fabric is knitted (not woven).

- 5516330510 applies if the fabric is a blended synthetic short fiber with wool (≤85% synthetic).

📊 Tariff Overview (as of now):

- Base Tariff Rate: 25.0% (for 5112196060, 5112196020, 5516330510)

- 7.0% (for 5111904000)

- Additional Tariff (General): 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate:

- 80.0% (for 5112196060, 5112196020, 5516330510)

- 65.0% (for 6005901000)

- 62.0% (for 5111904000)

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

- An additional 30.0% tariff will be imposed after April 11, 2025 on the listed HS codes.

- This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties (if applicable):

- Not applicable for wool products (unlike iron or aluminum).

- However, always verify if the product is subject to anti-dumping or countervailing duties based on the country of origin and product specifics.

✅ Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact wool content, fiber diameter, and fabric weight to ensure correct HS code classification.

- Check Unit Price: High-value goods may be subject to additional import duties or licensing requirements.

- Certifications Required: Some countries may require textile certifications (e.g., origin, composition, or environmental compliance).

- Plan for April 11, 2025: If importing after this date, budget for the 30.0% additional tariff.

- Consult Customs Broker: For complex classifications or high-value imports, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.