| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5407410060 | Doc | 68.6% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance guidance for the High Corrosion Resistant Grade Polyamide Raw Material based on the provided HS codes and tax details:

✅ HS CODE: 3908902000

Product Description: Polyamide in primary form (including "Double (4-Amino-3-Methylcyclohexyl) Methane - Isophthalic Acid - Lauric Lactam Copolymer")

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 55.0% (0.0% + 25.0% + 30.0%)

✅ HS CODE: 5407410060

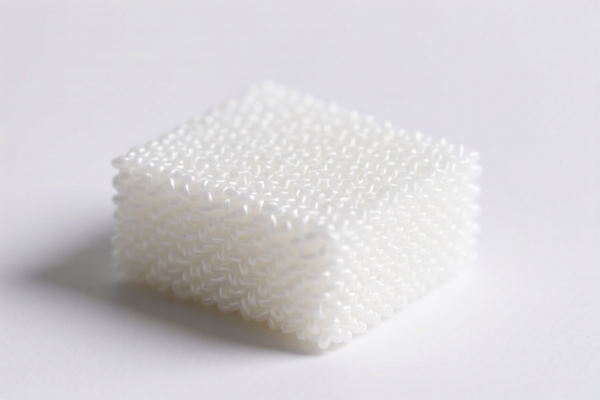

Product Description: Woven fabrics containing 85% or more by weight of nylon or other polyamide fibers

Total Tax Rate: 68.6%

Tax Breakdown:

- Base Tariff: 13.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 68.6% (13.6% + 25.0% + 30.0%)

✅ HS CODE: 3908907000

Product Description: Other polyamide in primary form

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 61.5% (6.5% + 25.0% + 30.0%)

✅ HS CODE: 3920920000

Product Description: Sheets made of polyamide

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polyamide raw materials in the provided data. However, it is advisable to check the latest anti-dumping duty lists from customs authorities for any applicable duties. -

Certifications and Documentation:

Ensure that the product is correctly classified under the appropriate HS code. Verify the material composition, unit price, and certifications (e.g., REACH, RoHS, or other relevant standards) required for import. -

Customs Declaration Accuracy:

For customs clearance, provide detailed product specifications, including chemical structure, application, and technical data sheets if available.

📌 Proactive Advice:

- Confirm the exact chemical name and molecular structure of the polyamide to ensure correct HS code classification.

- If the product is used in specialized industries (e.g., aerospace, chemical processing), check for special import permits or regulatory approvals.

- Consider tariff planning and cost estimation well in advance of the April 11, 2025 deadline to avoid unexpected increases in import costs.

Let me know if you need help with HS code verification or customs documentation. Here is the structured analysis and customs compliance guidance for the High Corrosion Resistant Grade Polyamide Raw Material based on the provided HS codes and tax details:

✅ HS CODE: 3908902000

Product Description: Polyamide in primary form (including "Double (4-Amino-3-Methylcyclohexyl) Methane - Isophthalic Acid - Lauric Lactam Copolymer")

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 55.0% (0.0% + 25.0% + 30.0%)

✅ HS CODE: 5407410060

Product Description: Woven fabrics containing 85% or more by weight of nylon or other polyamide fibers

Total Tax Rate: 68.6%

Tax Breakdown:

- Base Tariff: 13.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 68.6% (13.6% + 25.0% + 30.0%)

✅ HS CODE: 3908907000

Product Description: Other polyamide in primary form

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 61.5% (6.5% + 25.0% + 30.0%)

✅ HS CODE: 3920920000

Product Description: Sheets made of polyamide

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polyamide raw materials in the provided data. However, it is advisable to check the latest anti-dumping duty lists from customs authorities for any applicable duties. -

Certifications and Documentation:

Ensure that the product is correctly classified under the appropriate HS code. Verify the material composition, unit price, and certifications (e.g., REACH, RoHS, or other relevant standards) required for import. -

Customs Declaration Accuracy:

For customs clearance, provide detailed product specifications, including chemical structure, application, and technical data sheets if available.

📌 Proactive Advice:

- Confirm the exact chemical name and molecular structure of the polyamide to ensure correct HS code classification.

- If the product is used in specialized industries (e.g., aerospace, chemical processing), check for special import permits or regulatory approvals.

- Consider tariff planning and cost estimation well in advance of the April 11, 2025 deadline to avoid unexpected increases in import costs.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.