Found 11 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5101116060 | Doc | 18.7¢/clean kg+55.0% | CN | US | 2025-05-12 |

| 5101214060 | Doc | 20.6¢/clean kg+55.0% | CN | US | 2025-05-12 |

| 5903203010 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903903010 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5602210000 | Doc | 49.5¢/kg + 7.5%+55.0% | CN | US | 2025-05-12 |

| 5602101000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 6003101000 | Doc | 69.1% | CN | US | 2025-05-12 |

| 6003109000 | Doc | 61.6% | CN | US | 2025-05-12 |

| 6005901000 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6005909000 | Doc | 65.0% | CN | US | 2025-05-12 |

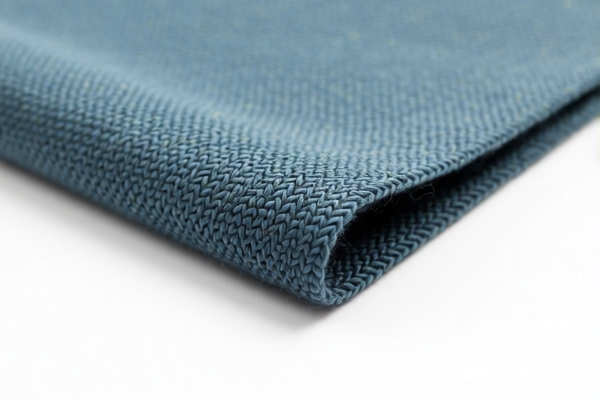

✅ Product Classification and Customs Tariff Analysis for High Count Combed Wool Woven Fabrics (≥85% Wool, ≤18.5μm, >340g/m²)

🔍 HS CODE: 5112196060

📌 Product Description:

- Woven fabrics of combed wool or combed fine animal hair

- Containing ≥85% by weight of wool or fine animal hair

- Average fiber diameter ≤18.5 microns

- Weight >340 g/m²

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff: 80.0%

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to all imports after this date. This increases the total tariff by 5% (from 75% to 80%).

📌 Key Considerations:

- Material Verification: Confirm that the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Weight Check: Ensure the fabric weighs more than 340 g/m² to qualify for this HS code.

- Certifications: May require material composition certificates or fiber diameter test reports for customs compliance.

- Tariff Impact: The 80% total tariff is among the highest for textile imports, so accurate classification is critical to avoid overpayment or delays.

📌 Alternative HS Codes (for comparison):

| HS Code | Description | Total Tariff | Notes |

|---|---|---|---|

| 5101116060 | Combed wool yarns (clean kg basis) | 18.7¢ + 55% | Lower for yarns |

| 5101214060 | Combed fine animal hair yarns | 20.6¢ + 55% | Similar to above |

| 5903203010 | Plastic-coated wool fabrics | 57.7% | Higher than 5112 |

| 5903903010 | Other plastic-coated wool fabrics | 57.7% | Same as above |

| 5602210000 | Wool felt (not coated) | 49.5¢ + 55% | For felt products |

| 5602101000 | Laminated needleloom felt | 67.0% | Higher than 5112 |

| 6003101000 | Knitted wool fabrics (other) | 69.1% | For knitted goods |

| 6003109000 | Other knitted wool fabrics | 61.6% | Lower than 5112 |

| 6005901000 | Warp-knitted wool fabrics | 65.0% | For warp-knitted goods |

| 6005909000 | Other warp-knitted fabrics | 65.0% | Similar to above |

🛑 Proactive Advice:

- Verify Material Composition: Ensure the fabric meets the 85% wool/fine animal hair and ≤18.5μm fiber diameter criteria.

- Check Weight: Confirm the fabric exceeds 340 g/m² to avoid misclassification.

- Document Compliance: Maintain fiber test reports, material composition certificates, and weight measurements for customs.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consider Alternatives: If the high tariff is a concern, explore alternative fabric constructions or material blends that may qualify for lower rates.

✅ Conclusion:

The HS Code 5112196060 is the correct classification for high-count combed wool woven fabrics with the specified characteristics. However, due to the 80% total tariff, it is essential to double-check classification criteria and prepare all necessary documentation to ensure smooth customs clearance.

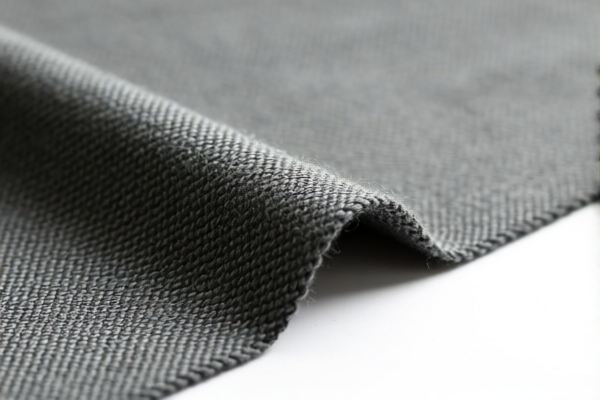

✅ Product Classification and Customs Tariff Analysis for High Count Combed Wool Woven Fabrics (≥85% Wool, ≤18.5μm, >340g/m²)

🔍 HS CODE: 5112196060

📌 Product Description:

- Woven fabrics of combed wool or combed fine animal hair

- Containing ≥85% by weight of wool or fine animal hair

- Average fiber diameter ≤18.5 microns

- Weight >340 g/m²

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff: 80.0%

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: Applies to all imports after this date. This increases the total tariff by 5% (from 75% to 80%).

📌 Key Considerations:

- Material Verification: Confirm that the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Weight Check: Ensure the fabric weighs more than 340 g/m² to qualify for this HS code.

- Certifications: May require material composition certificates or fiber diameter test reports for customs compliance.

- Tariff Impact: The 80% total tariff is among the highest for textile imports, so accurate classification is critical to avoid overpayment or delays.

📌 Alternative HS Codes (for comparison):

| HS Code | Description | Total Tariff | Notes |

|---|---|---|---|

| 5101116060 | Combed wool yarns (clean kg basis) | 18.7¢ + 55% | Lower for yarns |

| 5101214060 | Combed fine animal hair yarns | 20.6¢ + 55% | Similar to above |

| 5903203010 | Plastic-coated wool fabrics | 57.7% | Higher than 5112 |

| 5903903010 | Other plastic-coated wool fabrics | 57.7% | Same as above |

| 5602210000 | Wool felt (not coated) | 49.5¢ + 55% | For felt products |

| 5602101000 | Laminated needleloom felt | 67.0% | Higher than 5112 |

| 6003101000 | Knitted wool fabrics (other) | 69.1% | For knitted goods |

| 6003109000 | Other knitted wool fabrics | 61.6% | Lower than 5112 |

| 6005901000 | Warp-knitted wool fabrics | 65.0% | For warp-knitted goods |

| 6005909000 | Other warp-knitted fabrics | 65.0% | Similar to above |

🛑 Proactive Advice:

- Verify Material Composition: Ensure the fabric meets the 85% wool/fine animal hair and ≤18.5μm fiber diameter criteria.

- Check Weight: Confirm the fabric exceeds 340 g/m² to avoid misclassification.

- Document Compliance: Maintain fiber test reports, material composition certificates, and weight measurements for customs.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consider Alternatives: If the high tariff is a concern, explore alternative fabric constructions or material blends that may qualify for lower rates.

✅ Conclusion:

The HS Code 5112196060 is the correct classification for high-count combed wool woven fabrics with the specified characteristics. However, due to the 80% total tariff, it is essential to double-check classification criteria and prepare all necessary documentation to ensure smooth customs clearance.

Customer Reviews

No reviews yet.