| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5803003000 | Doc | 71.5% | CN | US | 2025-05-12 |

| 5407910510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5509910000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5408310510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112301000 | Doc | 62.0% | CN | US | 2025-05-12 |

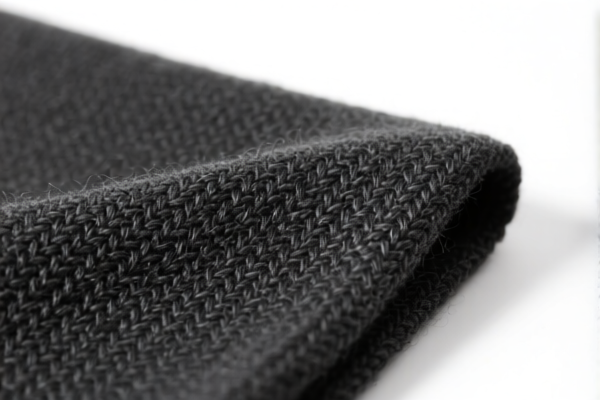

Here is the structured classification and tariff analysis for the "High Density Combed Wool/Fine Animal Hair Woven Cloth" based on the provided HS codes and tax details:

✅ HS CODE: 5803003000

Product Description: Animal Hair High-Density Gauze

Total Tax Rate: 71.5%

- Base Tariff: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant code for animal hair high-density woven cloth, especially if it's used for decorative or specialized purposes.

✅ HS CODE: 5407910510

Product Description: High-Strength Fine Animal Hair Blended Machine-Woven Fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to blended fabrics with high-strength properties, possibly more suitable for industrial or technical applications.

✅ HS CODE: 5509910000

Product Description: Fine Animal Hair Blended High-Strength Yarn

Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for yarn, not fabric. If your product is in fabric form, this may not be the correct classification.

✅ HS CODE: 5408310510

Product Description: High-Content Fine Animal Hair Blended Machine-Woven Fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for blended fabrics with a high content of fine animal hair, likely for textile or fashion use.

✅ HS CODE: 5112301000

Product Description: Combed Fine Animal Hair Blended High-Density Decorative Fabric

Total Tax Rate: 62.0%

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a decorative fabric, possibly used in interior design or luxury goods. It may be suitable if the product is intended for decorative or ornamental use.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so importers must plan accordingly.

🛑 Important Reminders:

- Verify the material composition (e.g., percentage of animal hair vs. other fibers) to ensure correct classification.

- Check the unit price and intended use (e.g., decorative, industrial, or fashion) to determine the most accurate HS code.

- Certifications may be required (e.g., origin, fiber content, or environmental compliance).

- Consult a customs broker or expert for final classification, especially if the product is complex or blends multiple materials.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff analysis for the "High Density Combed Wool/Fine Animal Hair Woven Cloth" based on the provided HS codes and tax details:

✅ HS CODE: 5803003000

Product Description: Animal Hair High-Density Gauze

Total Tax Rate: 71.5%

- Base Tariff: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant code for animal hair high-density woven cloth, especially if it's used for decorative or specialized purposes.

✅ HS CODE: 5407910510

Product Description: High-Strength Fine Animal Hair Blended Machine-Woven Fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to blended fabrics with high-strength properties, possibly more suitable for industrial or technical applications.

✅ HS CODE: 5509910000

Product Description: Fine Animal Hair Blended High-Strength Yarn

Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for yarn, not fabric. If your product is in fabric form, this may not be the correct classification.

✅ HS CODE: 5408310510

Product Description: High-Content Fine Animal Hair Blended Machine-Woven Fabric

Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for blended fabrics with a high content of fine animal hair, likely for textile or fashion use.

✅ HS CODE: 5112301000

Product Description: Combed Fine Animal Hair Blended High-Density Decorative Fabric

Total Tax Rate: 62.0%

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a decorative fabric, possibly used in interior design or luxury goods. It may be suitable if the product is intended for decorative or ornamental use.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so importers must plan accordingly.

🛑 Important Reminders:

- Verify the material composition (e.g., percentage of animal hair vs. other fibers) to ensure correct classification.

- Check the unit price and intended use (e.g., decorative, industrial, or fashion) to determine the most accurate HS code.

- Certifications may be required (e.g., origin, fiber content, or environmental compliance).

- Consult a customs broker or expert for final classification, especially if the product is complex or blends multiple materials.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.