| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901201000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

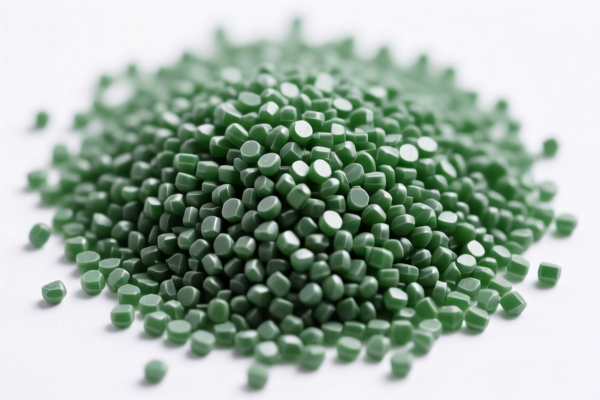

Product Name: High Density Polyethylene (HDPE) Powder

Classification: Based on usage and form, HDPE powder can be classified under two HS codes:

✅ HS CODE: 3901201000

Description:

- HDPE powder in its primary polymer form (i.e., not processed into finished products like films or containers).

- This classification is appropriate if the product is in its raw, unprocessed state.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This is the highest tax rate among the two classifications. - Time-sensitive: The 30% additional tariff applies after April 11, 2025. - Proactive Advice: Confirm the material composition and processing stage to ensure correct classification. If the HDPE powder is used in further manufacturing, this classification is most appropriate.

✅ HS CODE: 3921904090

Description:

- HDPE powder used for industrial films or other processed applications.

- This classification applies if the HDPE powder is intended for use in producing industrial films or other semi-finished products.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

Key Notes: - Lower tax rate compared to 3901201000, but still subject to the 30% special tariff after April 11, 2025. - Proactive Advice: Verify the intended use of the HDPE powder (e.g., for industrial films, packaging, etc.) to determine the correct HS code. Also, check if certifications (e.g., RoHS, REACH) are required for export.

📌 General Recommendations:

- Confirm the product form and end-use to determine the correct HS code.

- Check the exact material composition (e.g., is it pure HDPE or blended with other polymers?).

- Review the import/export regulations of the destination country, as HS codes and tariffs may vary.

- Monitor the April 11, 2025, deadline for the special tariff increase to avoid unexpected costs.

Let me know if you need help with customs documentation or tariff calculations for a specific shipment.

Product Name: High Density Polyethylene (HDPE) Powder

Classification: Based on usage and form, HDPE powder can be classified under two HS codes:

✅ HS CODE: 3901201000

Description:

- HDPE powder in its primary polymer form (i.e., not processed into finished products like films or containers).

- This classification is appropriate if the product is in its raw, unprocessed state.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This is the highest tax rate among the two classifications. - Time-sensitive: The 30% additional tariff applies after April 11, 2025. - Proactive Advice: Confirm the material composition and processing stage to ensure correct classification. If the HDPE powder is used in further manufacturing, this classification is most appropriate.

✅ HS CODE: 3921904090

Description:

- HDPE powder used for industrial films or other processed applications.

- This classification applies if the HDPE powder is intended for use in producing industrial films or other semi-finished products.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

Key Notes: - Lower tax rate compared to 3901201000, but still subject to the 30% special tariff after April 11, 2025. - Proactive Advice: Verify the intended use of the HDPE powder (e.g., for industrial films, packaging, etc.) to determine the correct HS code. Also, check if certifications (e.g., RoHS, REACH) are required for export.

📌 General Recommendations:

- Confirm the product form and end-use to determine the correct HS code.

- Check the exact material composition (e.g., is it pure HDPE or blended with other polymers?).

- Review the import/export regulations of the destination country, as HS codes and tariffs may vary.

- Monitor the April 11, 2025, deadline for the special tariff increase to avoid unexpected costs.

Let me know if you need help with customs documentation or tariff calculations for a specific shipment.

Customer Reviews

No reviews yet.